WIF Price Prediction: 35% Daily Surge Ignites Breakout – Can It Rocket to $2?

Dogwifhat (WIF) just woke up the crypto market with a jaw-dropping 35% daily pump—finally cracking a stubborn consolidation pattern. Traders are now betting this meme coin’s got enough gas to chase the $2 milestone.

The Breakout Nobody Saw Coming

After weeks of sideways action, WIF’s chart just turned into a fireworks display. The 35% vertical move sliced through resistance like a hot knife through butter, leaving bagholders scrambling to reposition.

$2 or Bust?

With volatility back on the menu, derivatives traders are piling in—though let’s be real, half these positions will get liquidated faster than a Wall Street intern’s coffee run. The real question: does this meme have fundamentals, or is it just another leverage-fueled joyride?

One thing’s certain: in crypto, even the jester’s hat gets its day. Whether WIF sustains this rally or becomes another ‘wen lambo’ gravestone depends on whether buyers can keep the momentum alive. Place your bets—the casino’s open.

WIF Price Analysis: Is the Correction Finally Over?

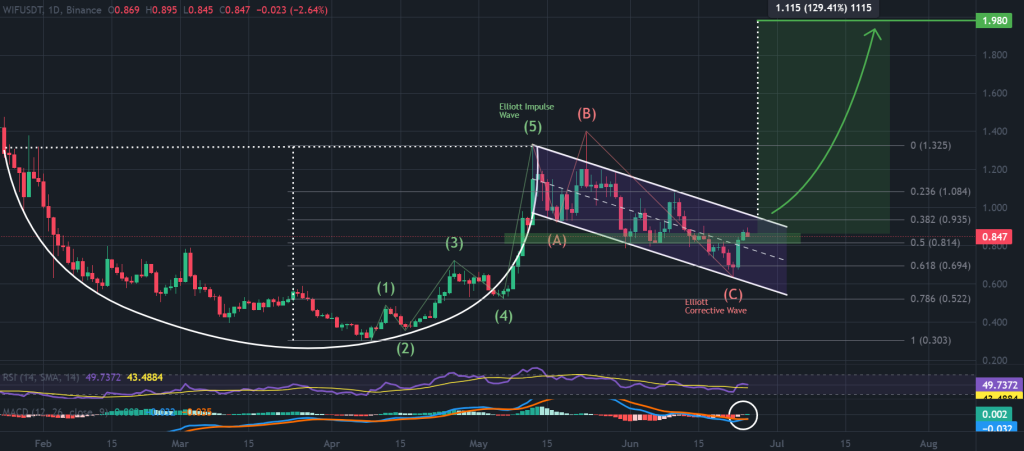

The completion of an Elliott wave—with a 5-wave upward movement starting in April, followed by an A-B-C correction—could mark the end of a wider cup-and-handle.

The structure suggests the May-born downtrend may be exhausted, with wave C extended 1.618 times the length of wave A and support found at the 0.618 Fibonacci retracement of the previous 5-wave move.

The alignment of these technical markers forms a confluence zone, often indicative of high-probability reversals—further supported by key momentum indicators.

On the 1-day timeframe, the MACD line has completed its first golden cross since the corrective wave began, overtaking the signal line in a potential early sign of a new WIF price uptrend.

More so, the RSI has reclaimed neutral territory around 50, suggesting renewed buying pressure after weeks of weakness.

Notably, both the 5-wave impulse and the following A-B-C correction align with the structure of the multi-month cup-and-handle pattern.

Given the correct timing of the Elliott wave, a pattern breakout could be in the cards, targeting key resistance at $0.935 in alignment with the 0.382 Fibonacci level.

A confirmed break above this level WOULD open the door for a bullish continuation toward the cup-and-handle breakout target near $2—representing a potential 130% upside.

That said, holding immediate support at $0.814—in line with the historic accumulation zone and the 0.5 Fibonacci level—is crucial to maintain the bullish outlook and avoid a return to wave C.

It took 5 months to Get Here – Here’s How to See Bigger and Quicker Gains

When it comes to large meme coins like WIF, timing is everything. Breakouts take months to build up and a fraction of that time to unfold—traders spend most of their time waiting.

Meanwhile, low-cap coins making the rounds like Aura are posting 46x gains in a single day.

That’s where Snorter ($SNORT) steps in. Its purpose-built Telegram trading bot is engineered to spot early momentum, helping investors get in before the crowd—where the real gains are made.

While Trading Bots are not a new concept, Snorter has been designed specifically for sniping with limit orders, MEV-resistant token swaps, copy trading, and even rug-pull protection.

It’s one thing to get in first, it’s another thing to know when to sell—Snorter Bot can help.

The project is off to a strong start—$SNORT has already raised over $1.25 million in its first three weeks of presale, likely driven by its high 261% APY on staking to rewards early investors.

You can keep up with Snorter on X, Instagram, or join the presale on the Snorter website.