Celestia (TIA) Price Prediction: Will It Defy FUD and Surge Past $2? Founder Bets Big

FUD swirling around Celestia? The project's founder isn't sweating—bullish momentum could push TIA past the $2 resistance.

Modular blockchain's dark horse. While 'experts' waffle on macro trends, Celestia's tech stack keeps builders hooked. No fluff, just scalable data availability.

Price action at a crossroads. A breakout above $2 would silence skeptics—until the next 'crypto winter' narrative drops, of course. Stay sharp.

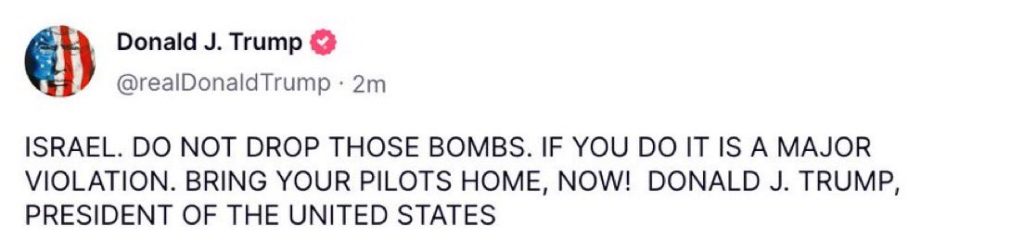

Trump urges Israel to sustain the ceasefire. Source: Truth Social, @realDonaldTrump.

Trump urges Israel to sustain the ceasefire. Source: Truth Social, @realDonaldTrump.

Celestia Has $100 Million “War Chest” Ready for Escalations

In response to building tensions and FUD surrounding a “World War 3” scenario, Al-Bassam affirmed that nothing has changed behind the scenes during a June 23 X post.

He cited the 95% drawdown since early 2024 as a normal part of the industry, adding that Celestia has “$100M+ war chest and a 6+ year runway” ahead of potential geopolitical escalations.

Despite the FUD (which is getting more ridiculous by the day), all Celestia founders, early employees and Core engineers are still here and working as hard as we did when Celestia started 5 years ago.

So say that Celestia did 9/11 for all I care or whatever FUD you want, I've… https://t.co/lvYDO9bqUn

The co-founder stated that “all Celestia founders, early employees, and CORE engineers are still here and working as hard as we did when Celestia started 5 years ago.”

His main talking point, however, appears to address growing criticism from tokenholders and independent researchers over misconduct, insider profit-taking, and community mistrust.

The most notable being an X thread from Startup Anthropologist posted the same day, alleging the Celestia team and insiders used retail traders as exit liquidity to offload large quantities of TIA tokens.

from personal diary: celestia's crime pattern

– all c-suite had unlocks in early oct 24

– team unlocks in late oct

– mustafa sold 25m+ in OTC, moved to dubai

– andy got paid $$$$$$ to shill tia

– nick flew abril to paris

– yaz got fired for sexual harassment, moved out of brypto

Celestia Price Analysis: Does TIA Have the Backing to Reclaim $2?

While Celestia may have the financial backing to weather the next wave of market headwinds, community sentiments put pressure on emerging signs of bullishness.

Following an early-week reversal, TIA has confirmed support at the lower boundary of the falling wedge that has shaped its decline since early March.

Momentum indicators are starting to turn. The RSI has bounced sharply from deeply oversold territory—climbing from 25 to 35 since the weekend—signaling seller exhaustion.

Buyers appear to be stepping in, with a bounce at $1.32 pushing the MACD line toward a potential golden cross above the signal line—a classic reversal indicator.

This marks the second attempt since mid-May. A similar setup in early June failed as buy pressure proved unable to sustain lasting momentum.

Should the bulls capitalise on seller exhaustion, a decisive golden cross could be an early sign of a short-term uptrend, bringing wedge resistance at $2.60 back into play.

This 63% rise could come to pass with assistance from historical support around $2.36. This aligns with the 0.5% Fibonacci level, often seen as a prime accumulation zone for reversals.

A breakout above the pattern’s upper resistance could trigger a 200% move toward the technical Celestia Price target at $4.67, in line with the 1.618 Fibonacci extension level.

Still, the $1.80 resistance—aligned with the 20-day EMA—remains the key immediate hurdle. A rejection here could delay a breakout and risk a potential falling wedge breakdown.

The Solana Ecosystem Could Take the Spotlight

If community concerns weren’t enough, those who picked Celestia over other Layer-1s may be forced to reconsider as the solana ecosystem finally addresses its biggest limitation: scalability.

The narrative has shifted with the arrival of Solaxy ($SOLX), Solana’s first-ever Layer-2 scaling solution.

Solana has long lacked this capability, limiting its DeFi and cross-chain use case—until now.

By processing transactions off-chain and finalizing them on Solana, Solaxy significantly reduces congestion and lowers transaction costs, while offering seamless interoperability across both blockchains.

Since raising $58 million in its presale phase, the token is reaping the demand of decentralized exchanges, hitting a market cap of over $110 million after an expected shakeout of weak hands.

You can keep up with Solaxy on X and Telegram, or top up on $SOLX through the Solaxy website.