Crypto Market Tumbles: What’s Driving the June 20, 2025 Sell-Off?

Crypto bulls got trampled today as digital assets nosedived across the board. Here's why the red dominates the charts.

Macro Mayhem Strikes Again

Traditional markets sneezed—crypto caught pneumonia. Risk assets tanked after the Fed's latest hawkish remarks sent Treasury yields screaming north.

Liquidity Ghost Town

On-chain data shows whales dumping positions faster than a DeFi project after an audit failure. Exchange reserves are swelling while bid support evaporates.

Derivatives Domino Effect

Leverage got liquidated—a cool $500 million in long positions vaporized before lunchtime. Perp funding rates flipped negative as traders scrambled to hedge.

The Silver Lining Playbook

Veterans are whispering 'buy the dip' while retail panics. After all, nothing makes bankers more uncomfortable than crypto winter's fire sale prices.

Crypto Winners & Losers

All the top 10 coins per market cap are down today – but most of them with such a low percentage that they’re practically unchanged.

fell by 0.1%, meaning it hasn’t really changed in a day, now trading at $104,705.

Also,too fell by just 0.1%, therefore also standing unchanged at $2,521. Both BTC and ETH have barely moved over the past two days.

saw the highest decrease in this category of 1.7% to the price of $0.1679. It’s the only one with a change of more than 1%.follows with a fall of 0.8% to $2.14.

As Cryptonews reported, crypto analyst ‘Crypto Beast’ recently opined that XRP has significant upside potential, particularly now that its regulatory headwinds are gone.

XRP is about to explode.

I’m eyeing at least $8, and the market still hasn’t caught up to the fact that the SEC doesn’t consider it a security.$XRP holders are about to PRINT.

I’ll drop the signal to exit right here when the moment is right.

You’ll regret not following. pic.twitter.com/oiE8INoy7F

Moreover, 20 of the top 100 coins saw their prices rise in the same period. The category’s best performer is, which is the only coin with a double-digit rise. It’s up 14.2% to $17.28.is next, having increased by 9.8% to $0.1958.

At the same time,fell the most: 7.4% to $1.01. It’s followed bywith a 6.3% drop to $1.31.

Meanwhile,CEO Linda Yaccarino recently announced that users will soon be able to trade and invest directly on the platform. “And that’s whether I can pay you for the pizza that we shared last night, or make an investment, or a trade. So that’s the future,” she said.

Bitcoin Holds Firm in Face of Geopolitical Chaos

James Toledano, Chief Operating Officer at Unity Wallet, commented that “we have seen over the past week that even with geopolitical chaos—especially in the Middle-East, Bitcoin has proven its resilience—although this will be tested if oil prices begin to rise.”

Similarly, Gadi Chait, Head of Investment at, argues that BTC holds within the six-figure mark, “showing its resilience even with major geopolitical tensions intensifying rapidly.” These include conflict escalation in the Middle East, ongoing trade disputes, and global economic uncertainty.

“But amongst all of that, Bitcoin’s price stability shows just how mature it is among all of this outside noise.”

The US Senate passing the GENIUS Act with bipartisan support reinforces a sense of legitimacy for crypto. “For the crypto industry, this is a key milestone, not just in policy but in the trust of the system,” Chait says.

Meanwhile, Dom Harz, Co-Founder of Layer-2, noted that ETH is consolidating above $2,400, up from a low of $1,400 in April, signaling the return of investor confidence “as many choose to stake rather than sell.”

Also, bitcoin is consolidating above $104,000, says Harz, “still sitting on vast, untapped liquidity.”

“The real opportunity lies in the convergence of these two ecosystems — connecting Bitcoin’s capital with Ethereum’s DeFi infrastructure to unlock the next wave of yield and innovation.”

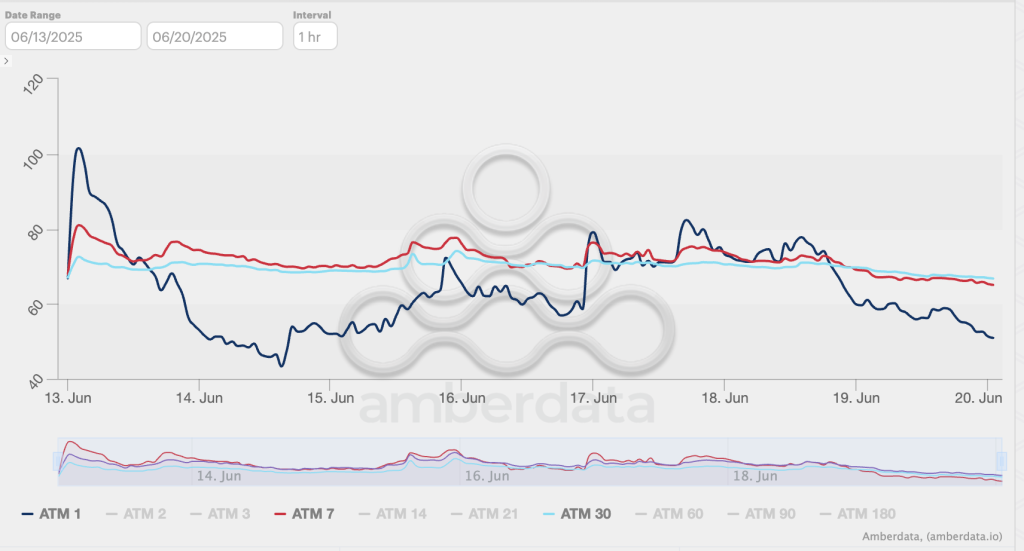

Finally, Nick Forster, Founder of decentralized onchain options AI-powered platform, argues that in the NEAR term, “the dramatic drop in ETH volatility [from around 100% to 60%] could create conditions for a breakout, especially if Middle East tensions ease further.”

In the medium term, investors should keep an eye on the 26 September expiry buildup in BTC. It could trigger volatility as it approaches.

Per Forster, “BTC volatility remained much calmer overall, peaking near 50% (ATM 1 day) before trending down toward 30%. Both ETH and BTC show a typical contango structure, with short-term vols more sensitive to immediate events.”

Levels & Events to Watch Next

At the time of writing, BTC trades at $104,705, unchanged since this time yesterday. It has been trading in this zone for the past two days, unable to hold the $105,000 level. It attempted to surpass it again within the past 24 hours, briefly hitting the highest intraday high of $105,036.

It also nearly fell below the $104,000 mark, reaching the daily low of $104,004, surging up soon after.

At the same time, ethereum is currently trading at $2,521. Like BTC, it has maintained this level for the past two days. It dropped from its intraday high of $2,541 to the intraday low of $2,488, before recovering to the current price.

Moreover, the crypto market sentiment continues unchanged for two days in a row as well. The Fear and Greed Index still stands at 48. The investors are waiting for further signals to make their next move. Standing in neutral, the sentiment can easily move to greed or fear.

Meanwhile, US markets were closed on 19 June for Juneteenth National Independence Day, a bank holiday in that country. Therefore, there will be no information on the performance of US BTC and ETH spot exchange-traded funds (ETFs) until later today.

On 18 June, US BTC ETFs marked eight consecutive days of inflows, with $389.57 million. US ETH spot ETFs recorded net inflows of $19.1 million in that same period.

In South Korea, the(FSC) has submitted a roadmap to the, outlining a potential framework to approve spot crypto exchange-traded funds (ETFs) in the second half of 2025.

This is a notable shift from the FSC’s long-standing position that these products are risks to financial stability.

MASSIVE BREAKING: South Korean presidential election won by Lee Jae-myung who committed to allow South Korea’s $884 billion national pension fund to invest in Bitcoin and cryptocurrency — also promises to launch Bitcoin ETF.

Wild this happened the 2nd day I am in South Korea. pic.twitter.com/NkXfe0AaIy

Healthcare infrastructure firmis planning to accumulate 10,000 Bitcoin this year, as well as 105,000 BTC by 2027. The company has appointed BTC expert Joe Burnett as Director of Bitcoin Strategy. Burnett recently told Cryptonews that BTC is “more scarce and portable than gold.”

$SMLR appoints Joe Burnett @IIICapital as Director of Bitcoin Strategy. Announces three-year plan to own 105,000 #Bitcoins by Year-End 2027. So fired up to have Joe on board to help with this exciting new chapter in Semler's $BTC mission.![]()

Quick FAQ

The crypto market has been red over the last day. The US stock market was closed on Thursday, 19 June, in observance of Juneteenth National Independence Day. Therefore, no new information will be available till the market closes today (US time).

The consolidation may continue in the short term, as the market attempts to find footing for the next leg up. Depending on further geopolitical and economic developments, the prices may decrease further.