Exposed: How the Trump Family Raked in Massive Crypto Profits

The Trump clan's crypto windfall just leaked—and the numbers are staggering.

Political dynasties meet digital gold rush.

While Main Street investors got rekt in the last bear market, one family kept stacking sats. Now we know how much.

Behind the scenes of Washington's most unlikely crypto whales.

Another reminder that in finance, the house always wins—especially when the house is a gilded Fifth Avenue penthouse.

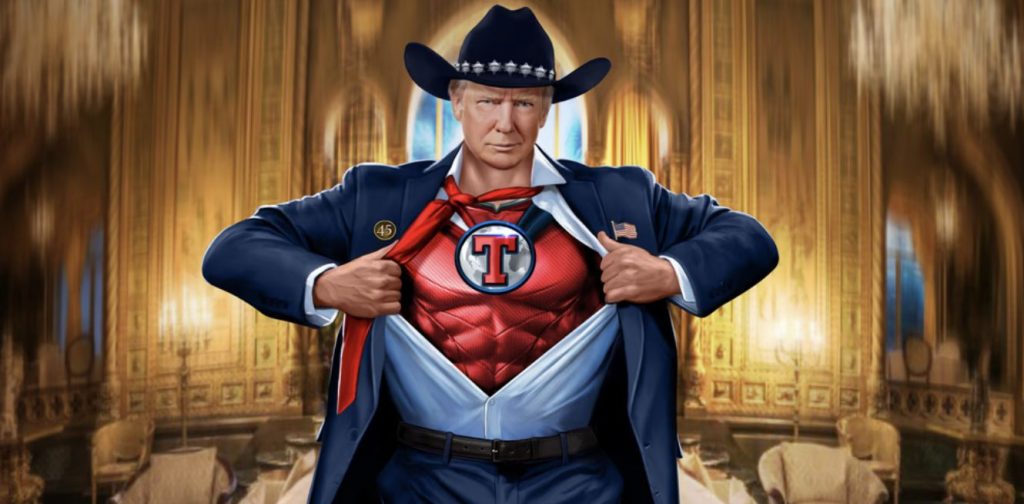

Less lucrative, over the past 12 months at least, have been the many collections of non-fungible tokens he’s released — depicting TRUMP as everything from a cowboy to a superhero. That brought in income of a mere $1.16 million, illustrating how interest in digital collectibles has dissipated substantially.

There are important caveats worth bearing in mind here. For one, all of this crypto activity is a drop in the bucket compared with the overall income of over $600 million reported in this financial disclosure. A lot of this is linked to his interests in real estate and golf — as well as his private members’ club in Mar-a-Lago.

And the other one is this: it looks like this filing doesn’t take into account the vast amount of fees generated through the $TRUMP token. His businesses have an 80% stake in this meme coin. There was a trading frenzy when it was unveiled just before his inauguration, and another when he unveiled a dinner for top holders.

As a result, you could argue that this disclosure isn’t an accurate snapshot of the president’s varied crypto interests, which come at a time where he is playing an instrumental role in regulating the space.

What’s more, a lot may change by the time the next filing is published. A recent Forbes report revealed that one of Trump’s entities has been actively reducing its stake in World Liberty Financial — a sign “backroom deals” are being conducted while he’s in office, and money is being taken off the table.

It’s a Family Thing

Concerns about the conflicts of interest posed by Donald Trump’s exposure to the crypto market are well-documented — but it’s also fascinating to examine how members of his immediate family are profiting in the current bull run.

Whereas the 79-year-old once described Bitcoin as a “scam against the dollar,” others saw incredible amounts of opportunity. Chiefly, his youngest son Barron. The president alluded to this during a news conference last year, saying:

“Barron knows so much about this. Barron’s a young guy, but he knows — he talks about his wallet, he’s got four wallets or something, and I’ll say ‘what is a wallet?’ But he knows it inside out.”

Estimates have recently suggested that the 19-year-old could be worth a cool $40 million — that’s $25 million after taxes are taken into account — because of his role in making his father’s crypto businesses a reality. That’s substantially more than his siblings were worth at that age, with Barron described as a “Web3 ambassador” in the “gold paper” published by World Liberty Financial.

A flurry of announcements surrounding the Trump family’s crypto ambitions show they’re determined to milk this bull run for all it’s got. A new stablecoin has been recently launched — USD1 — which will undoubtedly benefit from the GENIUS Act winding its way through Congress. And inspired by Michael Saylor’s Strategy, $2.5 billion is now being raised in order to launch a “Bitcoin treasury.”

The Citizens for Responsibility and Ethics in Washington has described the president’s DEEP ties to crypto, which involves partnerships with foreign business, as “unprecedented,” adding:

“During Trump’s last term, CREW tracked over 3,700 conflicts of interest between his presidency and businesses. With the expansion of his foreign developments and his foray into cryptocurrency, among other ventures, he seems poised to rack up more conflicts than ever, with even less transparency than last time.”

This vocal criticism — spanning campaign groups and Democratic politicians — seems to be falling on deaf ears. As 2025 progresses, expect the Trump family to play an even bigger role in the crypto space… for better or worse.