Senate Greenlights GENIUS Act—Yet Stablecoin Hurdles Loom Large

Washington just handed crypto a win—but the real battle starts now.

The GENIUS Act sailed through the Senate this week, marking a rare bipartisan moment for blockchain legislation. Yet anyone popping champagne hasn't read the fine print.

Stablecoins remain the elephant in the room. While lawmakers high-five over progress, Tether's shadow still stretches across half the market cap. No amount of political theater changes that.

Three key roadblocks ahead:

1. Regulatory whack-a-mole: State-by-state approvals won't cut it when USDT operates like a decentralized central bank.

2. The transparency trap: 'Backed 1:1' claims keep getting audited—by Twitter sleuths, not accountants.

3. The yield paradox: Why hold a 'stable' coin when your grandma's money market fund pays 5%?

Wall Street's watching with popcorn ready. As one VC whispered: 'They'll regulate the hell out of this—right after they finish 'regulating' Citadel's order flow.'

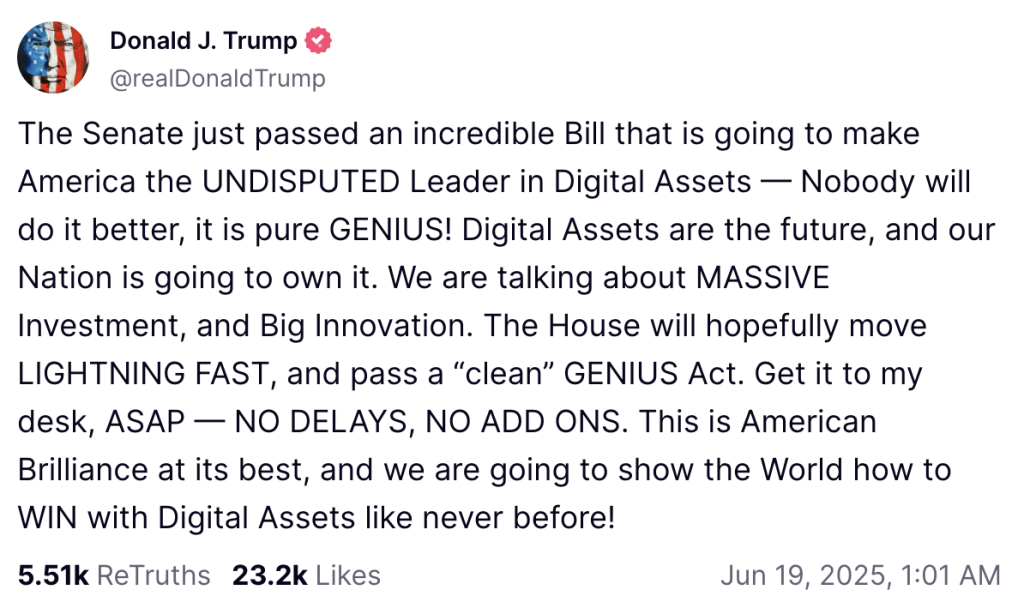

But hurdles remain for the GENIUS Act. It’s still got to be passed by the House of Representatives — and a long summer recess is looming.

Bitpace CEO Anil Oncu told Cryptonews that this bill could drive stablecoin growth and have a significant positive impact on financial inclusion, adding:

“With stablecoin supply now at $239 billion, up from under $10 billion five years ago, regulation is essential. Many US institutions remain cautious due to unclear rules, however, a unified framework removes that barrier and will unlock pent-up institutional demand.”

Stablecoins have become a dominant theme of 2025. Circle, the issuer of USDC, listed on the stock market earlier this month — and has been on a tear ever since.

Whereas the company’s IPO was priced at a mere $31, it’s currently changing hands for just shy of $200 — that’s a 545% increase in a matter of weeks.

U.S. politicians regard stablecoins as a way of cementing dollar dominance in the 21st century, and now, attention is turning to adoption among consumers.

“Coinbase Payments” was unveiled this week, which aims to help businesses “offer crypto-native payments without needing crypto-native teams.”

A collaboration with Shopify means that millions of e-tailers can now accept stablecoins, reducing transaction fees for businesses with razor-thin margins.

And over on the institutional side, JPMorgan has announced that it’s launching a “permissioned token” called JPMD, which has the qualities of a stablecoin.

All of these bullish developments have led some in the space to argue that stablecoins are safer than the deposits held at commercial banks.

That’s a bit of a stretch. For one, consumers have deposit protections in the event that a financial institution goes out of business — meaning they can receive generous levels of compensation for any losses.

There are safeguards in place if they forget their password or PIN, too. Contrast that with a self-custodial wallet, where funds are lost forever if they are transferred to the wrong address, or the private key is lost.

And despite Tether insisting that it is ramping up efforts to be more transparent — and prove that all of the USDT in circulation is fully backed by fiat — this issuer is yet to embark on a full and independent audit.

This has set alarm bells ringing in some circles. Last year, Cyber Capital founder Justin Bons described Tether as a “scam” that has the potential to be “bigger than FTX and Bernie Madoff combined,” meaning it is “one of the biggest existential threats to crypto as a whole.”

But beyond that, some critics fear that astronomical growth in the stablecoin market could have huge ramifications for the global economy, and stability within the financial ecosystem. The Bank for International Settlements delved into this in a recent report, and argued that flows in and out of stablecoins are already having a significant impact on the cost of short-term borrowing for the U.S. government. The authors wrote:

“Their growth blurs the lines between cryptocurrency and traditional finance and carries implications for monetary policy, transparency of stablecoin reserves and financial stability — particularly during periods of market stress.”

Countries around the world are also watching the explosion of stablecoins very closely. The Atlantic Council recently cited figures that show 98% of stablecoins are pegged to the dollar, with 80% of transactions happening outside of America. This could end up weakening local currencies — with Italian finance minister Giancarlo Giorgetti warning they are an “even more dangerous” threat than Trump’s tariffs.

Nascent technologies often come with growing pains — just look at AI. We’re about to see the same with stablecoins. The GENIUS Act is an encouraging step forward when it comes to regulation, but only scratches the surface of the challenges that lie ahead.