Solana Price Alert: Descending Triangle Threatens 30% Plunge to $102

Solana's chart flashes red as a classic bearish pattern takes shape. The descending triangle—every trader's favorite nightmare—suggests SOL could be in for a rough ride.

Technical breakdown ahead: When support becomes resistance, things get ugly fast. The $102 target isn't just doomscrolling—it's simple math from the pattern's height. Remember when 'triangle' meant stability? Crypto laughs at geometry.

Market psychology at play: Buyers keep testing the same level, each time with less conviction. Meanwhile, sellers sharpen their knives at lower highs. This isn't FUD—it's pure price action.

Silver lining? Crypto moves fast. Today's death spiral could be tomorrow's 'buy the dip' opportunity. Just ask the hedge funds currently repositioning their shorts (while telling retail to HODL).

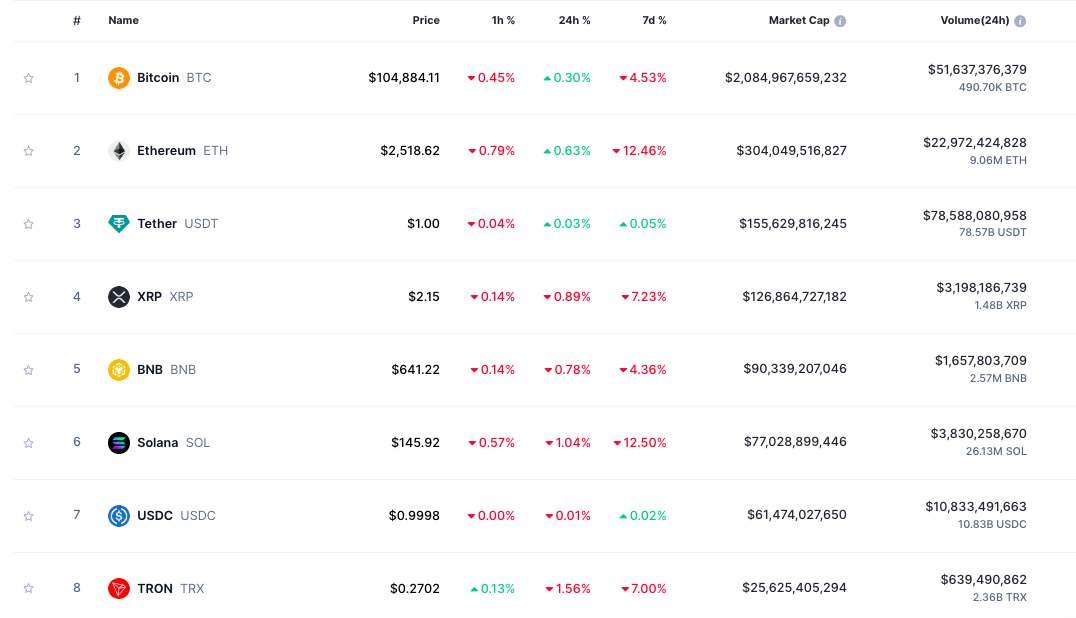

Source: CoinMarketCap

Source: CoinMarketCap

Solana Crushes All Rivals with $4.79M Daily Revenue Despite Price Decline.

Despite this lackluster performance, solana continues to establish itself as one of the most dominant payment networks and an expanding hub for consumer applications.

The platform dominates in user adoption, boasting over 3.25 million active wallet addresses. This far surpasses Ethereum’s and nearly equals Tron’s 2.58 million.

While Solana’s $8.4 billion in DeFi Total Value Locked (TVL) remains well below Ethereum’s $62 billion, it outperforms all major blockchains in revenue generation.

Over the past 24 hours, Solana produced over $4.79 million in revenue, with only Hyperliquid and Binance Smart Chain (BSC) coming close at $3.38 million and $2.41 million, respectively.

These metrics have led many to view $SOL as an undervalued asset at current Solana price levels and market capitalization.

$140-145 Key Support Zone Holds SOL’s Fate Amid VanEck DTCC Filing Hopes

Technical analysts are closely watching Solana’s price action as it tests a key Fibonacci retracement zone between 0.618 and 0.786, a level that has historically indicated potential trend reversals.

![]() Technical Analysis – $SOL/USDT Prime Long Opportunity from a Golden Support Zone

Technical Analysis – $SOL/USDT Prime Long Opportunity from a Golden Support Zone![]() #SOL is currently testing the golden Fibonacci retracement zone between 0.618 and 0.786, which historically acts as a strong reversal area.

#SOL is currently testing the golden Fibonacci retracement zone between 0.618 and 0.786, which historically acts as a strong reversal area.![]() The chart shows a falling wedge… pic.twitter.com/da9zwXvLGN

The chart shows a falling wedge… pic.twitter.com/da9zwXvLGN

![]()

Analyst VipRoseTr identifies a falling wedge pattern (typically bullish) on SOL’s daily charts, though the broader trend remains contested by longer-term bearish structures.

According to this analysis, a successful hold above current support levels could propel SOL toward near-term targets of $204.31, with medium-term potential reaching $229.01 and possibly testing 2021 highs NEAR $258.45.

Many consider these targets achievable given the growing possibility of Solana ETF approval. VanEck’s Solana ETF ($VSOL) was registered with the U.S. Depository Trust & Clearing Corporation (DTCC) on June 18.

While this doesn’t constitute SEC approval, it represents a preparatory measure, similar to the process followed by Bitcoin and ethereum ETFs, as VanEck positions itself for potential regulatory clearance.

The SEC recently postponed its decision on the Franklin Spot Solana ETF. However, Bloomberg analyst Eric Balchunas maintains that approval odds remain at 90%, citing ongoing discussions between the SEC and ETF issuers as an encouraging development.

SOL Tests $140 Support as Triangle Points to $102 Breakdown Target

Solana’s technical setup presents a key inflection point as it forms a descending triangle pattern—a formation that typically indicates bearish continuation.

Over recent months, SOL’s price action has painted a clear picture of successively lower highs along a downward-sloping trendline, while finding consistent support near the $140-145 zone. This pattern now approaches its apex, forcing an imminent resolution.

The most striking aspect is the breakout projection indicated by directional arrows, suggesting a potential downside target near the $102-103 area should the triangle break lower.

The falling wedge (bullish, daily chart) and descending triangle (bearish, weekly chart) reflect conflicting indications. A break above $170 validates the wedge’s upside, while breaking below $140 confirms the triangle’s $102 target.

This scenario represents a 30% decline from current levels, matching the triangle’s measured MOVE calculation.

Should the $140-145 support level fail, accelerated selling pressure could drive prices toward the projected target of around $102.

Conversely, any bullish reversal WOULD require $SOL to break above the descending trendline resistance in the $160-170 area with substantial volume, which would negate the bearish triangle formation.

The highlighted zone appears to indicate the potential breakout area and price target, with resistance levels situated in the $180-$ 220 range, based on historical price structure.