Michael Saylor Doubles Down: $1.05B Bitcoin Buy Sparks Debate – Genius Move or Reckless Gamble?

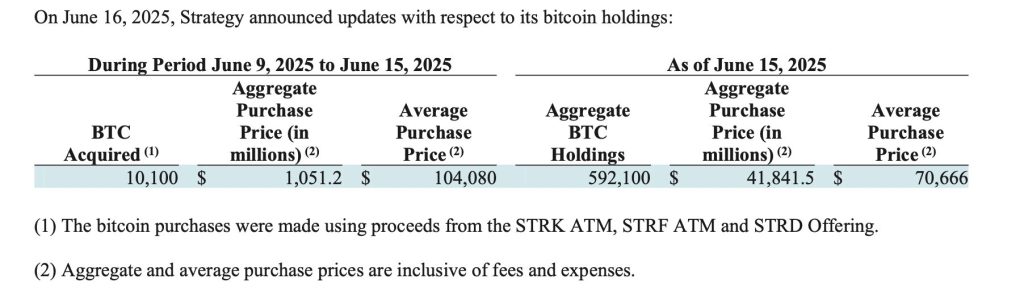

MicroStrategy''s latest power play just shook the crypto world—again. The enterprise software-turned-Bitcoin-hoarder dropped another $1.05 billion into BTC, fueling fresh debates about corporate crypto strategy.

Debt or destiny?

Saylor''s team leveraged convertible notes (again) to fund the purchase, making Wall Street analysts clutch their pearls. ''Leveraging debt to buy volatile assets? What could go wrong?'' quipped one CNBC commentator—between sips of $28 artisanal coffee.

The HODL doctrine

This brings MicroStrategy''s total Bitcoin war chest to a staggering 226,331 BTC (worth ~$15 billion at press time). The move cements Saylor''s reputation as Bitcoin''s ultimate corporate evangelist—or its most reckless high-stakes gambler, depending who you ask.

Market ripple effect

The announcement triggered immediate 3% BTC price bump, proving Saylor''s moves still move markets. Meanwhile, gold bugs quietly sobbed into their safe-haven spreadsheets.

One thing''s certain: in Saylor''s world, there''s no such thing as ''too much'' Bitcoin. Even if it means playing financial Jenga with corporate debt.

Continued Confidence in Bitcoin’s Long-Term Value

In the filing, Strategy’s management stresses its unwavering conviction in Bitcoin’s long-term value proposition, although they acknowledge the volatility and risks associated with such a concentrated treasury allocation.

The filing explicitly warns that the absence of diversification heightens exposure to Bitcoin’s short-term price fluctuations: “The concentration of our assets in Bitcoin limits our ability to mitigate risk that could otherwise be achieved by holding a more diversified portfolio.”

Strategy notes that this strategy “has not been tested over an extended period of time or under different market conditions.”

Financing and Risk Factors

The 8‑K also discloses that Strategy’s Bitcoin acquisitions are financed primarily through debt and equity, making the company dependent on favorable financing conditions to sustain its accumulation trajectory.

Strategy also flags counterparty and custody risks, acknowledging that if custodians were to undergo insolvency, access to stored bitcoin might be impeded.

This purchase follows a recent 10-for-1 stock split in August 2024, ensuring that per-share metrics in the Form 8‑K reflect adjusted, post-split figures.

With Bitcoin hovering around $104k, Strategy’s entry is striking for its size and continued commitment amid a volatile macroeconomic environment.

Michael Saylor Extends Hand to Pakistan’s Crypto Ambition

This weekend, Michael Saylor, the executive chairman of Strategy, reportedly met with top Pakistani officials to explore how crypto could help reshape the country’s financial future.

The talks, described by officials as a “landmark discussion,” brought Saylor together with Finance Minister Muhammad Aurangzeb and Minister of State for Crypto and Blockchain Bilal Bin Saqib.

The agenda focused on how Bitcoin could be used in sovereign reserves and monetary policy. Meanwhile, Pakistan is accelerating efforts to become a digital asset leader in the Global South.

“Pakistan aspires to lead the Global South in the development and adoption of digital assets, setting a benchmark for innovation, regulation, and inclusive growth in the digital economy,” said Aurangzeb, who also chairs the Pakistan Crypto Council.