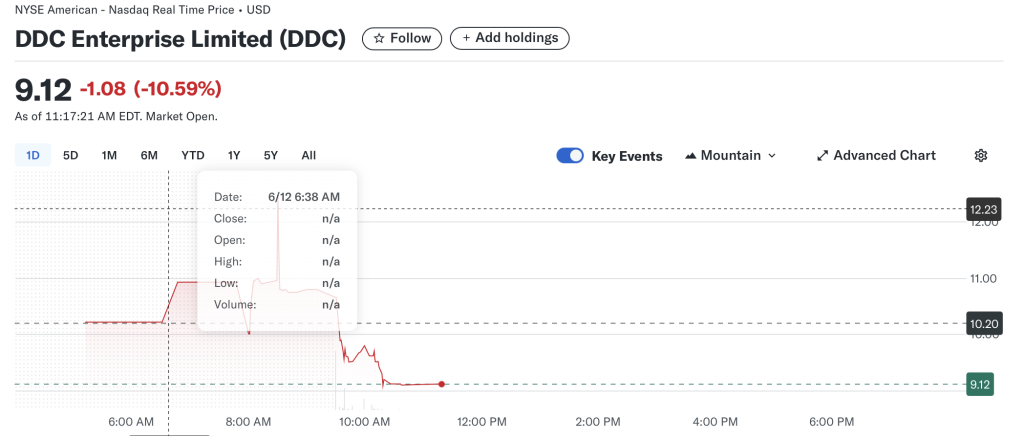

DDC Enterprise Shares Plunge 10.5% Following Bold 38 Bitcoin Purchase – Bet Gone Wrong?

Wall Street meets crypto chaos as DDC Enterprise''s stock tanks after doubling down on Bitcoin.

Market tremors: The 10.5% nosedive comes just hours after the company disclosed its latest crypto shopping spree—adding 38 BTC to its treasury. Traders clearly aren''t buying the ''digital gold'' narrative today.

Timing is everything: With Bitcoin still licking its wounds from last month''s 20% correction, the acquisition raises eyebrows. Either DDC knows something we don''t, or they''ve perfected the art of buying high.

The big question: Is this a strategic accumulation or another corporate FOMO play? One thing''s certain—shareholders are paying the price for management''s crypto conviction.

Bonus jab: Nothing says ''financial prudence'' like chasing volatile assets with shareholder money—but hey, at least their balance sheet is blockchain-verified.

Positioning Bitcoin as a Core Asset

While most companies remain cautious in their approach to digital assets, DDC Enterprise said it has aggressively positioned Bitcoin as a long-term financial hedge and store of value.

The company said it has structured its treasury strategy around this conviction, acquiring BTC at what it considers optimal market entry points. Its BTC-per-share metric—now sitting at 0.029679 per 1,000 shares—is touted as a novel value proposition for shareholders interested in digital asset exposure through traditional equity markets.

The acquisition is also reflective of a growing trend among listed companies that use Bitcoin not merely as an investment, but as a strategic balance sheet tool. DDC’s MOVE indicates confidence in Bitcoin’s long-term upside, despite market volatility and regulatory uncertainty in some jurisdictions.

DDC Enterprise said it is using BitGo as its official custodian. The firm said that by using BitGo’s custody solutions, DDC seeks to support its growing digital asset strategy with scalable and secure infrastructure designed to meet the demands of institutional investors.

Institutional grade execution + institutional grade security![]()

Thank you @mikebelshe I’m excited to build a significant and long term partnership with @BitGo![]()

![]()

![]() https://t.co/fTrFSDbQKd

https://t.co/fTrFSDbQKd

Market Reaction: DDC Down 10.5% Despite BTC Buy

Despite the announcement, DDC shares were down 10.5% in trading, indicating investor caution or profit-taking.

However, the company remains steadfast in its dual focus: growing its global Asian food business through brands like DayDayCook, Nona Lim, and Yai’s Thai, while simultaneously leading the charge on Bitcoin treasury adoption.