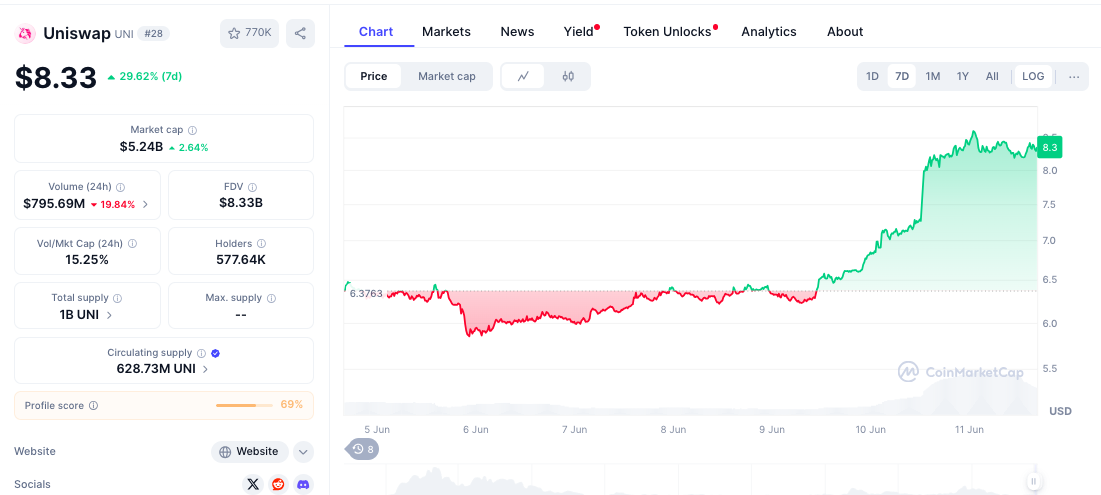

🚀 Uniswap Rockets 30% in 48 Hours: $4.7B On-Chain Tsunami Eyes $15 Breakout

DeFi''s favorite DEX just went supersonic—liquidity pools are overflowing as traders pile into UNI like it''s a free airdrop (spoiler: it''s not).

The $15 moonshot: On-chain volume screams bullish as whales and degens alike front-run what could be Uniswap''s first major breakout since the DAO wars.

Reality check: Sure, $4.7B in volume is impressive—until you remember this is crypto, where ''fundamentals'' means whose Twitter thread went viral last night.

One thing''s certain: When Uniswap sneezes, the whole AMM market catches a cold. Buckle up.

Source: CoinMarketCap

Source: CoinMarketCap

Uniswap Dominates With $2.73B TVL, Surpassing Rival DEXs and Layer-1 Chains

This dominance is supported by DefiLlama data, which shows that Uniswap’s daily volume ($4.7B) and TVL ($2.73B) now eclipse those of rivals like PancakeSwap and even Layer-1 chains such as Avalanche and Sui. Uniswap’s daily volume also exceeds the combined totals of Orca, Raydium, Meteora, and Pump.fun.

As of May 25, Uniswap’s monthly trading activity had risen above its previous highs from the 2021 bull market.

At the same time, the total value locked in its ecosystem has continued to grow steadily. On-chain data shows that the Ethereum-based protocol now holds over $2.73 billion in locked assets.

Uniswap’s TVL also exceeds that of standalone blockchains like Aptos and Avalanche, a rare feat for a single protocol built atop Ethereum.

Analyst Predicts $UNI Breakout to $10 Amid DEX Growth

Uniswap’s strong performance suggests substantial growth, which could help the $UNI token regain its former market position. Analysts point to this trend as a key factor in the token’s potential recovery.

Hayden Adams, CEO of Uniswap Labs, recently shared analytical data illustrating the growing preference among traders for decentralized exchanges like Uniswap over centralized platforms such as Binance.

my fave chart in crypto

defi![]() pic.twitter.com/lc4Lrk22l2

pic.twitter.com/lc4Lrk22l2

![]()

At just a $5.2B market cap, a fraction of BNB’s $94B empire, many argue that the token could 10X if it captures even 10% of Binance’s user base.

The thesis gained fuel when top chartist Ali Martinez flagged $UNI’s breakout pattern.

#Uniswap $UNI is breaking out with momentum and now has its sights set on $10! pic.twitter.com/PClvcLBe3a

— Ali (@ali_charts) June 11, 2025Martinez added that “Uniswap is achieving breakout momentum,” and projected that the token has established $10 as its near-term objective.

Technical Analysis: MACD Bullish Cross Points to $UNI’s Next Leg to $14.73

The $UNI/USDT daily chart displays a bullish harmonic formation, resembling either a Gartley or Bat pattern variation, which has materialized throughout recent price movements.

The ‘XABCD’ structure within this pattern indicates a completed sequence, typically followed by sharp upward price reactions, exactly matching the recent surge from approximately $5.00 to above $8.00.

This substantial rebound, particularly during the ‘C’ to ‘D’ phase, has positioned $UNI within a zone where bullish momentum could accelerate considerably.

Beyond this zone lies a more ambitious target range of $14.73 to $15.22, representing an 87% upside from current levels. Supporting this outlook, the MACD indicator displays a bullish crossover, as the MACD line crosses above its trigger line—a classic continuation pattern.