CEX.IO Strikes Gold in Spain: Central Bank Greenlights VASP License for Crypto Expansion

Another day, another crypto exchange playing nice with regulators—but this time with actual paperwork.

CEX.IO just pulled off a regulatory hat-trick in Europe, securing Spain’s coveted VASP license from the Bank of Spain. No more lurking in regulatory gray zones—this is full-fat compliance.

The move kicks open doors for EUR onboarding and institutional deals in one of Europe’s most crypto-curious markets. Because nothing screams ''legitimacy'' like a central bank’s rubber stamp—even if it’s the same institutions that once called Bitcoin ''a tool for criminals.''

Spain’s crypto scene just got a new heavyweight contender. Watch out, local incumbents—the compliance game just leveled up.

The platform allows buying and selling crypto, spot trading, staking, and savings. The supported payment methods include card transactions and SEPA (Single Euro Payments Area) to deposit funds, as well as SEPA to withdraw assets.

Eduardo Marin, CEX.IO Managing Director in Spain, said that “securing a local license enables us to better tailor our services to the market and strengthen our presence. Based on current momentum, we anticipate continued growth in the region.”

You may also like: CEX.io Partners with MoneyGram and stellar to Enhance Crypto Cash-In and Cash-Out Services Crypto exchange CEX.io has partnered with financial services company MoneyGram and the Stellar blockchain to enhance its crypto cash-in and cash-out capabilities. The collaboration aims to provide CEX.io users with access to seamless conversion between Circle''s USD Coin (USDC) and physical cash, available at participating MoneyGram locations, the firms said in a press release shared with CryptoNews. The integration will initially target customers across regions such as the European...94% Surge in Spain-Based Transaction Volume

Managing Director Marin further commented that CEX.IO chose Spain as the second European hub because it has emerged “as a leader in cryptocurrency adoption, with a steadily growing user base.”

The exchange’s internal data showed that in Q1 2025, wallet transaction volume among Spanish users surged by 94% quarter-over-quarter. At the same time, spot trading volume jumped by more than 340%.

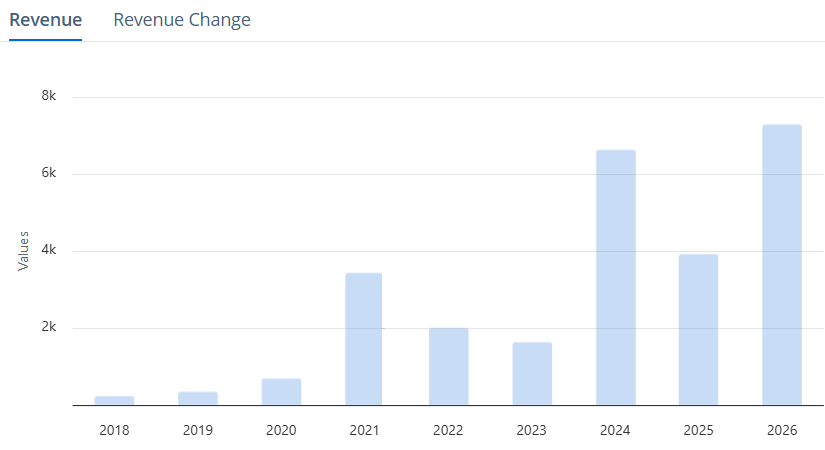

Furthermore, per, revenue in Spain’s crypto market is projected to reach $1.3 billion this year.

But the exchange will not stop here, the team says. This license is part of its broader strategy, as it’s pursuing more of them. CEX.IO is currently in the process of acquiring a MiCA license, which will enable it to significantly grow its presence in the European Union.

At the time of writing, the exchange holds 40 licenses and registrations worldwide. This includes 35 Money Transmitter Licenses (MLTs) in the US, a license in Spain, a registration in Lithuania, and a FINCEN registration.

Meanwhile, in September 2024, CEX.io partnered with financial services companyand theblockchain to boost its crypto cash-in and cash-out capabilities. This way, the exchange’s users gained access to conversion between USDC and cash.

The integration initially targeted customers across the European Economic Area (EEA), Africa, and Latin America.

You may also like: Deutsche Bank and Accenture-Backed Teams Taurus and Parfin Work to Fuel Institutional Adoption in EU and LatAm Taurus, a Swiss digital asset infrastructure provider backed by Deutsche Bank and Credit Suisse, and financial technology company Parfin, have teamed up to hasten institutional adoption of digital assets in Latin America and Europe. According to the press release shared with Cryptonews, the collaboration places four features at its center: innovative technology, security, governance, and compliance. Notably, Taurus says that working with a trusted regional provider boosts its expansion...