Crypto Consortium Pulls $342M Power Move—Hires TOBAM to Supercharge Bitcoin Treasury

Wall Street’s latest love affair with Bitcoin just got a $342 million prenup. A blockchain heavyweight—name still under wraps—has enlisted Paris-based quant shop TOBAM to turbocharge its BTC reserves. Because nothing says 'hedge against inflation' like outsourcing your HODL strategy to math geeks with algorithms.

Why This Matters: Institutional players aren’t just dipping toes anymore—they’re cannonballing into the deep end. TOBAM’s Anti-Benchmark tech claims to minimize concentration risk (read: prevent another Mt. Gox-level oopsie).

The Punchline: While traditional finance scrambles to tokenize paperclips, crypto’s old guard is quietly building war chests. Bonus cynicism: Nothing unites bankers and anarcho-capitalists like the smell of freshly minted Tether.

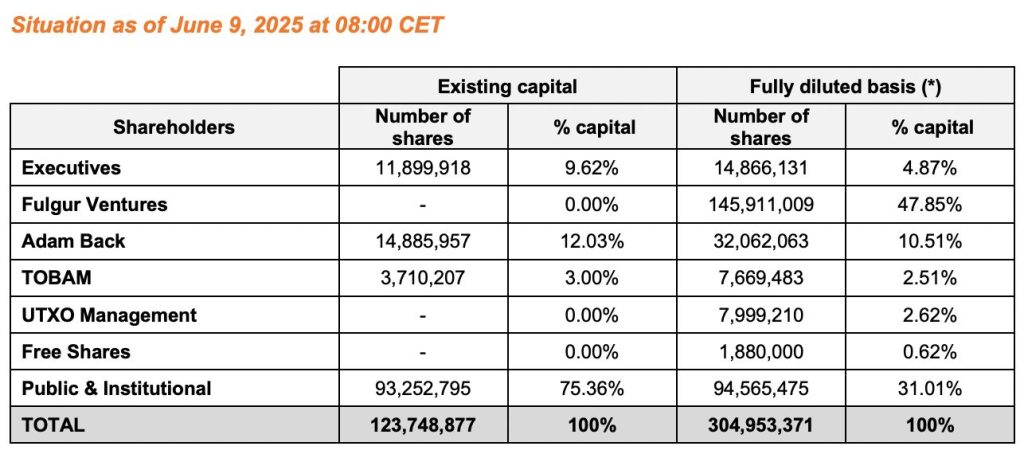

TOBAM Could Overtake Fulgur Ventures and Adam Back in Shareholding

Under the arrangement, TOBAM will consolidate its weekly requests, and Blockchain Group will publish the total number of shares issued and the bitcoin purchases made from each round.

The Blockchain Group Launches a €300 Million “ATM-type” Capital Increases Program with TOBAM

The Blockchain Group Launches a €300 Million “ATM-type” Capital Increases Program with TOBAM

Full Press Release (EN): https://t.co/DbXXbb6OT8

Full Press Release (FR): https://t.co/XbaTfaOqfn

BTC Strategy (EN): https://t.co/EiVKw8s4zB pic.twitter.com/dZQCIckgK8

TOBAM, an early institutional supporter of Bitcoin since 2017, is participating in the deal. However, it is not acting as a financial intermediary and will not receive a fee. The fund manager retains the option to hold or sell its subscribed shares.

If TOBAM takes up its full allocation and chooses to retain the shares, it could own over 39% of Blockchain Group’s capital. That WOULD make it the company’s largest single shareholder. Currently, Blockchain Group’s investor base includes notable names like cryptographer Adam Back and venture firm Fulgur Ventures.

Blockchain Group Ramps Up Bitcoin Strategy After $68.6M BTC Buy

The announcement follows Blockchain Group’s $68.6m purchase of 624 Bitcoins last week, accelerating its expansion into digital assets. This acquisition brought the company’s total Bitcoin holdings to 1,437, now valued at more than $150m. It also marked one of the largest Bitcoin treasury allocations by a publicly traded firm in Europe.

The MOVE follows a shareholder resolution passed in February. That resolution approved capital raises targeting strategic investors in areas like Web3 and AI. Now, a second resolution under review could raise the limit from $40.4m to $538.5m. If passed, it would give the board greater flexibility to extend the program.

Amid rising inflation and broader economic uncertainty, firms are rethinking traditional treasury models. Against that backdrop, Blockchain Group’s aggressive shift toward Bitcoin reflects growing institutional belief in the asset as a long-term store of value.