Solaxy Nears Explosive CEX Debut as $44.8M Funding Round Enters Final Countdown

Move over, Elon—Solaxy's gearing up for its own fireworks show. With $44.8 million already banked and just 10 days left in its funding round, the project's ticking toward what could be a seismic centralized exchange listing.

The clock's ticking

Investors scrambling for pre-CEX exposure face a hard deadline—miss it, and you're stuck buying from the 'greater fools' on Binance later. The project's war chest suggests institutional interest, though cynics might note that $44.8M doesn't buy what it used to before inflation ate everyone's lunch.

Make or break moment

All eyes on whether Solaxy delivers post-listing or joins the graveyard of overhyped launches. One thing's certain—the next ten days will separate the FOMO-driven from the genuinely strategic.

Institutional Moves Signal Solana’s Next Breakout – And Solaxy’s Timing Couldn’t Be Better

Confidence among major players in Solana is accelerating. One of the newest to enter the arena is SOL Strategies, a Canada-listed firm that just filed to raise as much as $1 billion in equity and debt to deepen its Solana exposure.

This follows a $500 million convertible note raise, with the first $20 million already used to purchase 122,000 $SOL tokens.

SOL Strategies has filed a preliminary base shelf prospectus, allowing for up to $1B USD in potential financings.

This filing increases our flexibility to MOVE decisively as strategic opportunities emerge across the Solana ecosystem.

In blockchain, timing matters. Our goal is… pic.twitter.com/piBw3R22SF

Meanwhile, DeFi Development Corp became the first public company to invest in Solana-based liquid staking tokens (LSTs). Using Sanctum’s infrastructure, they launched dfdvSOL, allowing users to stake $SOL while keeping it liquid for DeFi participation.

Even more bullish: Solana ETF filings are now awaiting approval, setting the stage for a broader institutional influx.

All signs point to Solana gearing up for a major cycle. And this time, it has Solaxy to handle the surge in activity – a scaling solution ready when it’s needed.

Solaxy: Scaling Solana From the Inside Out

Solaxy was built to extend Solana’s capabilities – not by replacing anything, but by offloading network pressure and enabling faster, cheaper transactions. It’s the first Layer-2 engineered for the ecosystem’s most demanding use cases: meme coin trading, real-time gaming, and high-frequency DeFi.

At the Core is roll-up bundling, compressing thousands of transactions into fewer submissions, cutting costs, and improving efficiency. A modular architecture allows parallel processing so transactions don’t get stuck in queues.

It also features off-chain enhanced logic, letting complex computations like swap engines and prediction models run off-chain and anchor results back on-chain, maximizing performance while preserving security and finality.

Now, that infrastructure is live on testnet.

The Solaxy Testnet lets users explore what the network can do. You can:

- Bridge SOL from Solana Devnet via bridge.solaxy.io

- Deploy contracts using Solana’s native toolchain

- Transfer assets across the rollup

- Track activity through the Solaxy Explorer

Hey Solaxy Community it’s here.

Hey Solaxy Community it’s here.

The Solaxy Testnet is LIVE. Your first chance to interact with Solana’s first LAYER 2 and experience the speed, scale, and simplicity Solaxy brings.

Connect via Backpack Wallet:https://t.co/FBrV3FohC8

Connect via Backpack Wallet:https://t.co/FBrV3FohC8

You can:

– Bridge SOL (Solana… pic.twitter.com/FQY9AIwSdx

The Igniter Protocol and DEX trading are coming soon, but the CORE engine is already running. This is no longer a theory. Solaxy is real, functional, and ready to scale what’s next.

How Far Can Solaxy Go? Look at What Arbitrum Did for Ethereum

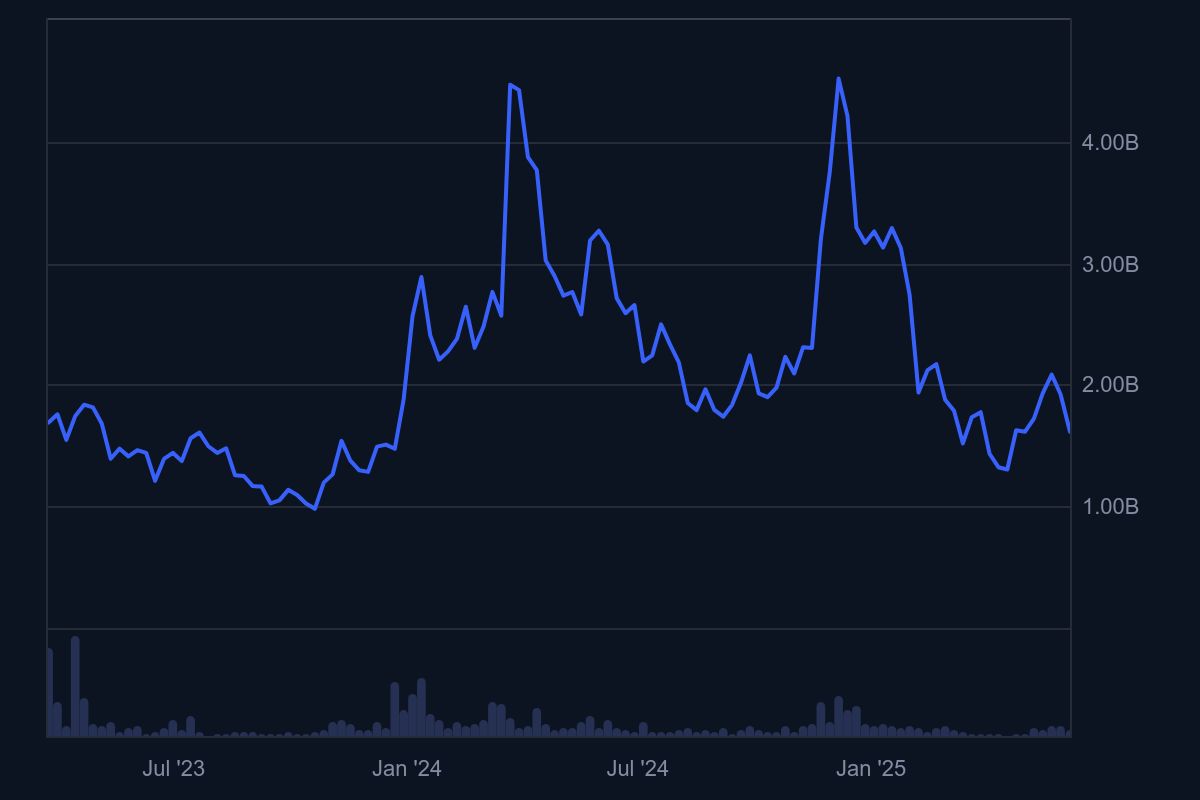

For a glimpse of what Solaxy could become, look at what Layer-2s like Arbitrum ($ARB), Optimism ($OP), and Base did for Ethereum. Arbitrum alone reached a $1.5 billion market cap post-launch, and that was in a crowded L2 field.

Solana has never had a Layer-2 like this – until now.

Solaxy is arriving before Solana hits its next all-time high. That’s fortuitous positioning. With $44.8 million already raised, even a fraction of the growth Arbitrum experienced could translate to 10x to 50x upside – especially as institutional capital continues to FLOW in.

For early contributors, this isn’t just about Solaxy. It’s about Solana finally scaling the way it was always meant to – with Solaxy leading the charge.

How to Join the Solaxy Presale Before Time Runs Out

To get in, just head over to the Solaxy website, connect a supported wallet, and buy $SOLX at the current rate before the price increases. Once purchased, tokens can be staked immediately, with the protocol currently offering a dynamic 90% APY, adjusting based on pool activity.

For the best experience, use Best Wallet, the recommended self-custody option with full presale integration and multichain support.

Stay in the loop by joining the Solaxy community on Telegram and X.

The countdown is on.