Hyperliquid Meme Coins vs. Pump.Fun: The Battle for Degenerate Dominance

Solana's meme coin casino just got a fresh challenger. Hyperliquid—the perpetuals-focused L1—now lets degens spin up their own shitcoins with a few clicks. Sound familiar?

Pump.fun's empire of instant rug pulls now faces competition from a platform with deeper liquidity and leverage. But let's be real—both are just feeding the same speculative frenzy.

Key differences? Hyperliquid cuts out the BNB middleman, bypasses Ethereum's gas wars, and offers perpetual contracts for maximum degeneracy. Meanwhile, Pump.fun still dominates with its frictionless ponzinomics.

Who wins? Probably the VCs funding both sides while retail bags the losses. Place your bets—the house always wins.

A Quiet but Steady Expansion

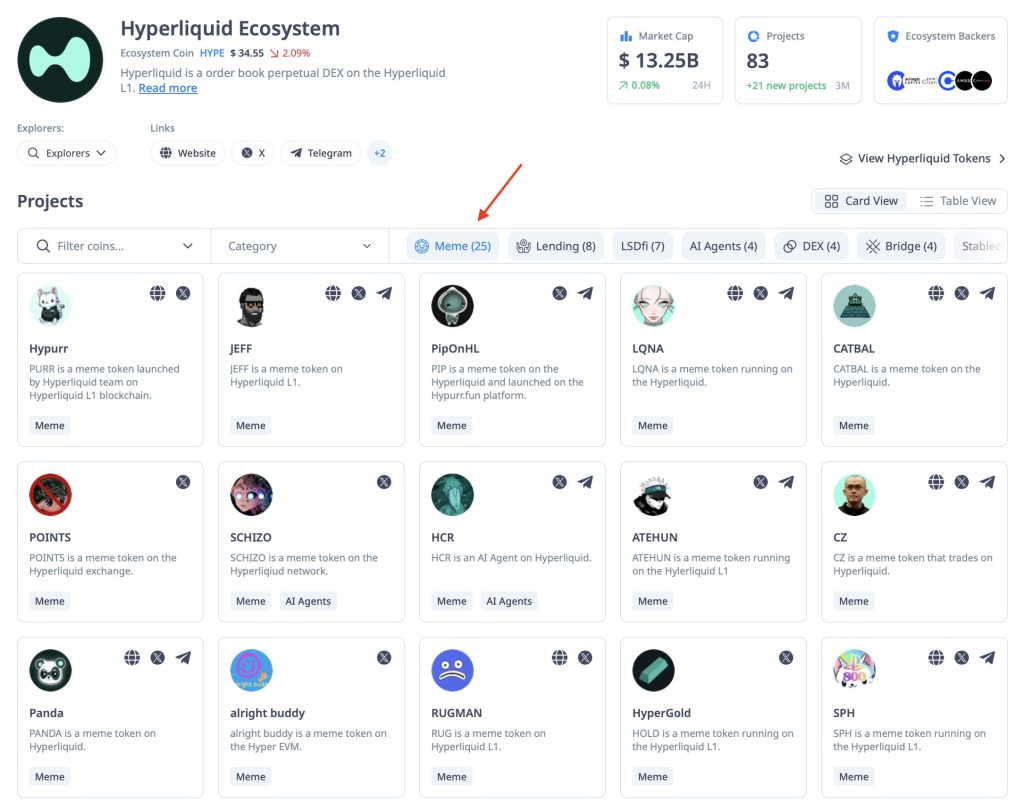

Compared to Pump.Fun, Hyperliquid meme coins haven’t generated the same viral hype, at least not yet. Pump.Fun still leads in daily volume and user count, but signs of fatigue are starting to show. In contrast, Hyperliquid’s approach appears slower and more ecosystem-focused.

Despite fewer tokens overall, meme coins on Hyperliquid are beginning to play a more visible role within the platform. Users can launch coins directly through the Hyperliquid chain, but the preferred method now seems to be HyperEVM, alongside related tools like Hypuur.fun. Most of the recent token activity is concentrated there.

Trading volume on HyperEVM reached $75 million as of June 6. One example is Lilly (LILLY), a meme coin launched on June 5, which surged by over 500% in 24 hours.

Meme coins were already being created on Hyperliquid last year, where they traded mainly against USDC. But now, activity has shifted toward Hyper EVM, which uses Wrapped Hyperliquid (WHYPE) as the base asset. The concept and aesthetic of these meme coins are different from what’s typically seen on Solana.

Hyper EVM went live in February 2025 and has only been active for a few months, yet it’s already hosting a growing number of meme coins. It may be shaping up as the new hub for token launches within the Hyperliquid ecosystem.

The HyperEVM is live. This is a major step toward the vision of housing all finance by bringing general-purpose programmability to Hyperliquid’s performant financial system. The initial mainnet release of the HyperEVM includes:

1. HyperEVM blocks built as part of L1 execution,… pic.twitter.com/sleqk1N7T5

Pump.Fun Still Dominates but Faces Challenges

It’s hard to ignore what Pump.Fun has done for the meme coin space. The platform simplified and gamified token creation, making it easy for anyone to launch a coin on Solana. Whether by design or timing, its explosive growth coincided with the 2024 U.S. election cycle, fueling what many called a meme coin mania.

During its peak, Pump.Fun became the most profitable decentralized app (dApp) on solana (SOL). Revenue peaked at $5.31 million in November 2024 and hit an all-time high of $7.07 million in January 2025. In comparison, the highest daily revenue in May was just $2.37 million on May 9.

Token creation hasn’t fallen off as sharply. According to Dune, while Pump.Fun averaged around 50,000 new tokens per day during its peak. The platform still saw over 40,000 tokens launched on several days in April and May 2025.

The platform has also faced growing criticism around content control. Since early 2025, the crypto community has highlighted concerns about tokens containing violent, discriminatory, or offensive themes. Many of these were promoted during live streams by token creators.

A breaking point came in February with the launch of Libra (LIBRA), which became one of the largest scams in crypto history and was associated with Argentina’s president. This event triggered backlash and raised further doubts about the platform’s oversight.

The Pump.Fun team has since attempted to regain control. In early June, they announced plans to launch a native token. While many expected the move, some in the community are skeptical and believe it may be too late to fix reputational damage.

My take, purely speculative:

There’s almost zero chance Pump Fun doesn’t fill this raise.

The $1B target is a PR mega-stunt designed to propel their pivot into streaming.

They have enough liquidity to self-fill if needed, securing both positive press and control over… https://t.co/A3ktQRX8DE

Are Hyperliquid Meme Coins the Next Phase?

Pump.Fun still leads in activity, but signs of fatigue are clear, and new competitors are beginning to reshape the meme coin landscape. Some market participants argue the broader meme coin trend is cooling down, but others point to the rise of alternative platforms as a sign of ongoing interest.

In April 2025, Bonk.Fun launched as a meme coin launchpad tied to the well-known token Bonk (BONK), hoping to attract both creators and traders.

Let’s BONK.

Let’s have fun.

LetsBONKdotFun https://t.co/1hJ1sJtaGK pic.twitter.com/KEuH5LnIvU

https://t.co/1hJ1sJtaGK pic.twitter.com/KEuH5LnIvU

Around the same time, Believe.me underwent a full rebrand and drew attention with several meme coins that posted explosive gains. The platform’s shift in strategy sparked renewed debate about the role and direction of Pump.Fun.

Pumpfun team makes 10m on fees and keeps 100% of the profits for themselves

Launchcoin makes 10m on fees and pockets 20% of 10m.

Pumpfun has backstabbed Raydium with pumpswap a popular protocol that had a flywheel implemented in its token that supported pumpfun since its…

Then came Hyperliquid, a project that over the past few months has grown into one of the leading decentralized exchanges (DEXs) for perpetual futures. That rise has also pushed up the price of its native token, HYPE, which remains among the top-performing assets in the crypto market.

Hyperliquid meme coins are not as widely known as those launched via Pump.Fun or Believe.me. Solana still dominates the meme coin market overall. However, some analysts see potential in Hyperliquid’s ecosystem. The project is expanding, its Total Value Locked (TVL) is growing, and the launch of HyperEVM has made it easier to create tokens directly on the Hyperliquid blockchain.

If Pump.Fun fails to manage its current challenges or mishandles its upcoming token launch, competitors will have an opening. At the same time, Hyperliquid will face pressure from other rising platforms. The meme coin market may be shifting, but it’s not slowing down.