Bitcoin Bloodbath: $831M Wiped Out in Elon-Trump Twitter Feud Fallout

Crypto markets got caught in the crossfire of billionaire egos this week—because what's a little retail investor pain between titans?

Liquidation carnage hits record levels as Bitcoin becomes political football. Who needs fundamentals when you've got celebrity tweet wars moving markets?

Pro tip: Next time billionaires play high-stakes chicken, maybe don't leverage long your life savings. Just a thought.

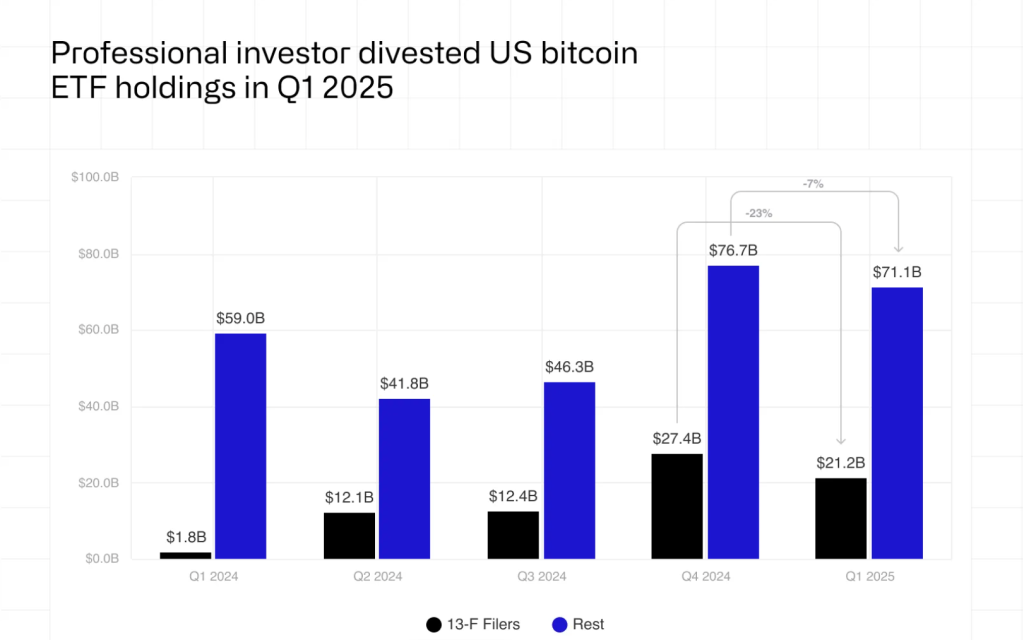

Bitcoin exposure in Q1 2025. Source: CoinShares

Bitcoin exposure in Q1 2025. Source: CoinShares

Notably, financial advisors were one of the few groups that slightly increased their exposure, signaling some resilience within certain investor classes. However, the larger institutional trend suggests a pivot away from short-term speculation and toward long-term treasury-style holdings, particularly among corporates.

Adding to the downside pressure, BlackRock’s iShares bitcoin Trust (IBIT) recorded a staggering $430 million in outflows on May 30, the largest single-day exit since inception. This ended a 31-day streak of inflows, stoking fears of continued selling.

Musk vs Trump Fallout Sparks Panic Selling

Sentiment soured further as a very public feud between U.S. President Donald TRUMP and Tesla CEO Elon Musk roiled risk assets. The disagreement, which centered around a disputed Congressional spending bill, escalated after Musk called for Trump’s resignation and threatened to push for impeachment. Trump, in turn, defended the bill as a historic tax-cutting measure.

The Trump tariffs will cause a recession in the second half of this year https://t.co/rbBC11iynE

— Elon Musk (@elonmusk) June 5, 2025This clash rattled investor confidence, especially given prior rumors about Musk potentially joining Trump’s 2025 tech policy team. The political drama triggered a broad wave of risk-off sentiment that bled into crypto markets.

Over $831 million in crypto liquidations followed, with long positions accounting for $765 million of that total.

OVER $800M LIQUIDATED IN CRYPTO IN LAST 24 HOURS

More than $800 million in crypto positions were wiped out across major exchanges in a single day.

The surge in liquidations reflects extreme market volatility and leverage unwinding.

Source: Coinglass https://t.co/ogMh2rr4to pic.twitter.com/hMofVtR7lW

Bitcoin’s fear and greed index dropped sharply from 62 to 57, reflecting the market’s swing toward caution. BTC fell below the key $102,000 mark and now hovers NEAR $101,500, posting a 3.16% loss in the past 24 hours. ETH and altcoins followed suit, compounding losses across the board.

Can Bitcoin Recover Amid Macro Headwinds?

Despite the panic, some analysts believe this dip may open up long-term buying opportunities, especially if Bitcoin follows gold’s historical pattern of rallying during recessions.

With Musk warning that Trump’s tariffs could spark a U.S. recession in H2 2025, safe-haven assets may come back into favor.

Key Technical Levels:

- Resistance: $102,178 → $103,127 → $104,561

- Support: $100,766 → $99,807 → $98,772

- Bullish Case: Close above $102,178 may lead to $103,127 test.

- Bearish Case: Breakdown below $100,766 opens path to $98,772.

Until volatility cools, caution is warranted. However, growing corporate use of BTC as a treasury asset may provide a long-term support base even amid institutional ETF outflows.

BTC Bull Token Presale Nears $7.78M Cap as 61% APY Staking Draws Yield Hunters

With Bitcoin trading near $102K, investor focus is shifting toward altcoins, especially BTC Bull Token ($BTCBULL). The project has now raised $6,858,262 out of its $7,911,528 cap, leaving less than $1 million before the next token price hike. The current price of $0.00255 is expected to rise once the cap is met.

BTC Bull Token links its value directly to Bitcoin through two Core mechanisms:

- BTC Airdrops reward holders, with presale participants receiving priority.

- Supply Burns occur automatically every time BTC increases by $50,000, reducing $BTCBULL’s circulating supply.

The token also features a 61% APY staking pool holding over 1.73 billion tokens, offering:

- No lockups or fees

- Full liquidity

- Stable passive yields, even in volatile markets

This staking model appeals to both DeFi veterans and newcomers seeking hands-off income.

With just hours left and the hard cap nearly reached, momentum is building fast. BTCBULL’s blend of Bitcoin-linked value, scarcity mechanics, and flexible staking is fueling strong demand. Early buyers have a limited time to enter before the next pricing tier activates.