Currency.com Scores Tennessee MTL License—One Step Closer to Dominating All 50 States

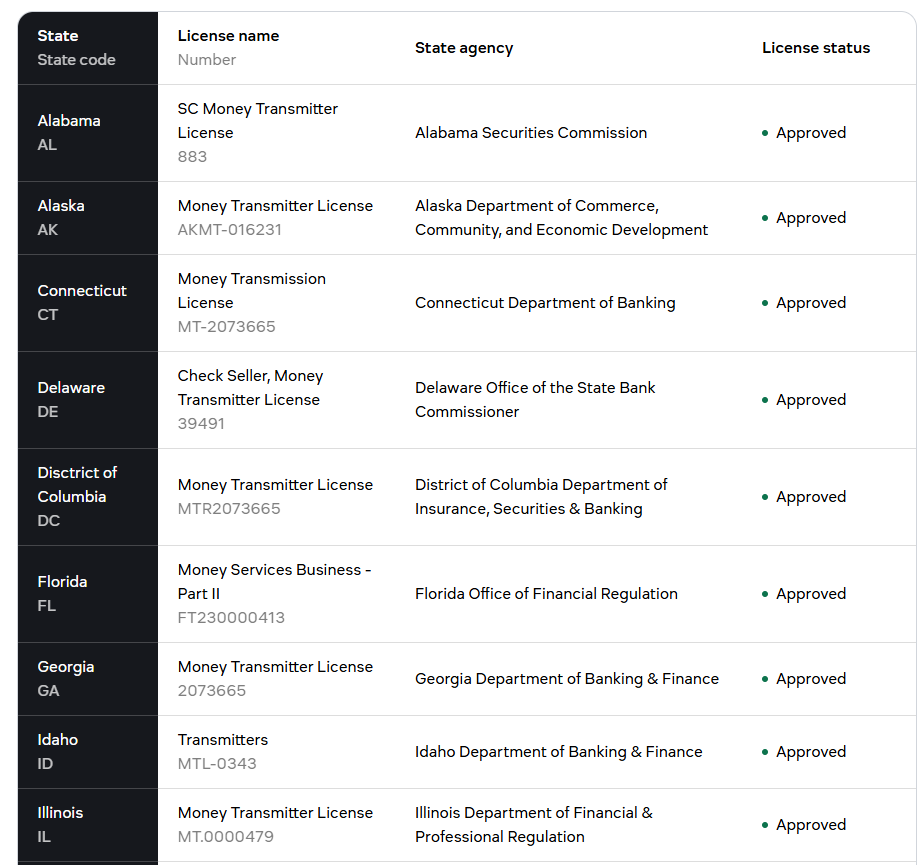

Another day, another regulatory hurdle cleared—this time in crypto’s favorite southern playground. Currency.com just bagged a Money Transmitter License (MTL) in Tennessee, tightening its grip on the U.S. market.

Why it matters: Tennessee’s pro-crypto stance makes it low-hanging fruit, but don’t mistake this for altruism. Every license is a chess move in Currency.com’s 50-state land grab—because what’s finance without a little territorial imperialism?

The punchline: While regulators play whack-a-mole with sketchy exchanges, the big players are quietly building empires. Guess compliance pays—who knew?

Source: Currency.com

Source: Currency.com

This state-by-state strategy will position it to “rapidly scale its offering once nationwide crypto regulation is firmly established.” It’s all a part of “a broader vision to establish a fully regulated, future-proof financial platform in the U.S.—one capable of supporting both institutional clients and individual users.”

CEO Konstantin Anissimov commented that the company wants to become a leading player in the U.S. digital finance space.

“We’re securing the necessary licenses today so we can hit the ground running when the regulatory landscape matures. Tennessee is another critical step toward that vision,” he said.

You may also like: PayPal Adds Solana and chainlink for U.S. Users in Expanded Crypto Offering PayPal has expanded its digital asset services by adding support for Solana (SOL) and Chainlink (LINK) for users in the United States and its territories. According to an update on the company’s crypto FAQ page, customers can now buy, sell, hold, and transfer these two cryptocurrencies directly through PayPal’s platform. Previously, users could only access SOL and LINK via third-party services like MoonPay while using PayPal as a payment method. PayPal’s Latest Crypto Move Marks...(Re)Turning to the U.S., One at a Time

Currency.com says it serves businesses, enterprise clients, and retail users. It is operational in more than 100 countries, with “a growing network of regulatory approvals” in the United States, the European Union, and the Middle East.

Another major FinTech partnership!

Our CEO shared his ideas with @PYMNTS:

“SMEs are turning to stablecoins as banking rails get harder to use. Faster payments = more working capital.” https://t.co/4jLo1LsE4X#Stablecoins #Crypto #FinTech #Currencycom

https://t.co/4jLo1LsE4X#Stablecoins #Crypto #FinTech #Currencycom

Per the website, the company is registered with the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) as a money services business (MSB). It’s neither a registered broker-dealer nor a member of the Financial Industry Regulatory Authority (FINRA) or the Securities Investor Protection Corporation (SIPC).

Internationally, Currency.com is regulated by the Financial Supervision Commission of Poland as a VIRTUAL Asset Service Provider under the Polish Regulatory Framework.

Meanwhile, crypto companies seem to have amped up their efforts to (re)enter the U.S., after years of regulatory challenges. While the regulatory clarity is not there, the environment is somewhat more crypto-friendly.

For example, Deutsche Bank and Standard Chartered are now exploring options to expand their crypto operations in the United States.

Traditional banking giants JPMorgan, Bank of America, Citi and Wells Fargo are considering a consortium-backed stablecoin to compete in the crypto space.#Stablecoin #Banks https://t.co/sWFJQ8R9oD

Traditional banking giants JPMorgan, Bank of America, Citi and Wells Fargo are considering a consortium-backed stablecoin to compete in the crypto space.#Stablecoin #Banks https://t.co/sWFJQ8R9oD

Within the country itself, some of Wall Street’s major banks are reportedly exploring crypto expansion. However, according to four unidentified executives, banks hesitate to be the first to make this step, fearing a rule change. Instead, they are waiting for initial test cases to pass.

Overall, we’re likely to see this trend continue.

You may also like: Why Is Crypto Up Today? – June 3, 2025 After several days of consecutive slight decreases, the crypto market has turned green. The majority of the top 100 coins are up over the past 24 hours. At the same time, the cryptocurrency market capitalization has decreased by 1% to $3.43 trillion. The total crypto trading volume is at $101 billion. Why Is Crypto Up Today? Crypto Winners & Losers At the time of writing, of the top 10 coins per market capitalization, nine are green. Only one has seen a decrease, but so minor that...