Australia Cracks Down on Crypto ATMs as Scams Surge—Because Nothing Says ’Innovation’ Like Regulation

Down Under tightens the screws on crypto kiosks amid a wave of fraudulent activity. Because apparently, the wild west of finance needs more sheriffing.

Regulators slap new restrictions on operators, citing ’consumer protection’—while conveniently ignoring the irony of policing decentralized tech.

Active monitoring and compliance checks now mandatory. Because nothing fosters blockchain adoption like paperwork and surveillance.

Closing thought: If history’s any guide, these moves will either curb scams or drive them underground—while traditional banks keep skimming fees in broad daylight.

Crypto ATMs Increased 15X in Two Years

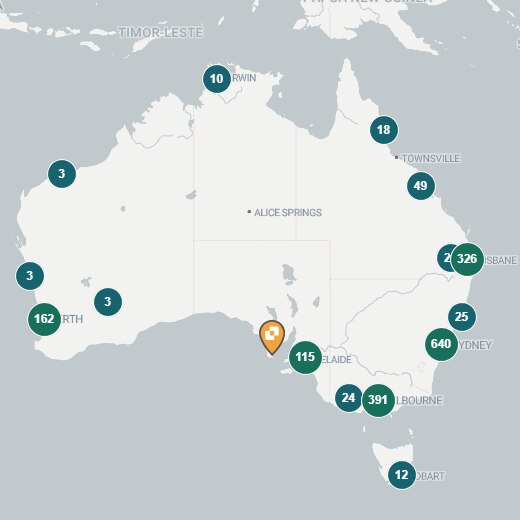

Per Coin ATM Radar, there are around 1,824 crypto ATMs across Australia, with the highest number of machines in Sydney.

The national financial intelligence agency noted that Australia had only 23 operating crypto ATMs in 2019. Besides, the trend increased to 60 in 2022 and over 1,200 in 2024.

“In just two years, the number of crypto ATMs in Australia increased more than 15 times,” the agency said.

Further, Austrac projected that around 150,000 transactions occur annually, with A$275 million ($178 million) being moved using crypto ATMs. About 99% of those transactions are cash deposits for crypto purchases, mostly Bitcoin, ethereum and Tether, it added.

“I WOULD warn anybody who is asked to use one of these machines to send funds to someone to stop and think twice, as once your money is gone, it is almost impossible for authorities to retrieve it,” said Austrac CEO Brendan Thomas.

He added that the agency will continue to monitor the space and take more action if needed.

Austrac Taskforce Uncovers “Disturbing Trends”

According to Thomas, the Austrac taskforce has uncovered “disturbing trends,” after observing customer activity for several months.

“Surprisingly, the 60 to 70 age group were identified as the one of the most prolific users of crypto ATMs in Australia,” he said. They account for 29% of all transactions by value.

Besides, after reviewing 9 crypto kiosk providers, the majority of users are over 50 years of age and account for almost 72% of all transactions by value.

Though the A$5,000 cash limits apply to crypto ATM operators, Austrac is also planning to apply similar limits to crypto exchanges if they accept cash for crypto transactions.

“This will reduce their exposure to money laundering, terrorism financing and other serious crime risks,” said Thomas.

Additionally, the Australian Federal Police’s JPC3, a joint policing cybercrime coordination centre, has come up with educational materials for users. These notices will be placed close to the kiosks, detailing how they work, warning signs, and how to report.