Bitcoin’s Path to $150K: The Make-or-Break Factors

Forget moon shots—Bitcoin’s next rally needs more than hype to crack $150,000. Here’s the cold, hard math.

Institutional adoption? Check. ETF inflows? Yawn. The real trigger? A supply shock so brutal it’d make a goldbug blush.

Halving cycles have juiced prices before, but this time’s different. With miners hoarding and whales circling, the squeeze could hit faster than a Wall Street ‘correction’.

And let’s be real—if the Fed flinches on rates, even your grandma’s savings account might pivot to BTC. Just don’t expect the suits to admit they’re FOMO-ing.

Image: Copper

Image: Copper

The Path to $150,000

A new report from Copper offers an insight into what needs to happen for bitcoin to reach unprecedented highs.

The digital asset custody firm’s research indicates that flows into exchange-traded funds tracking Bitcoin’s spot price will have a big impact in the months ahead.

But while inflows have proven to be healthy so far in May, Copper argues that this hasn’t been enough to MOVE the needle… yet.

“Wallet data reveals that ETFs and treasuries haven’t brought new demand, just rewrapped old coins … The market’s not accumulating — it’s reallocating. What looks like strength may just be structure.”

About 280,000 BTC has been mined since January 2024, more or less matching the 284,000 coins added to funds run by the likes of BlackRock and Fidelity.

“ETFs may dominate headlines, but beneath the surface, the market’s net demand looks flat. Bitcoin’s growth story right now might be about optics than accumulation.”

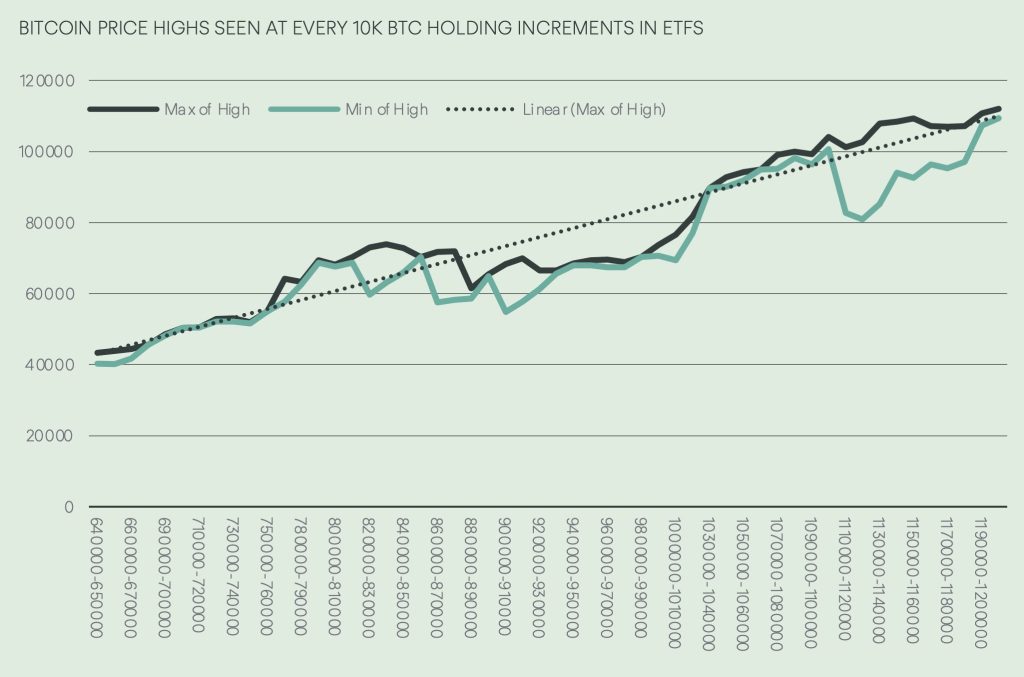

Copper’s researchers say that, as a rule of thumb, BTC’s price appreciates by 2% for every 10,000 BTC added to ETF holdings on Wall Street. This pattern appears to be pretty consistent, too.

“Since breaking through the $100,000 mark in December 2024, ETF-managed balances have grown by more than 100,000 BTC — a 10% increase. Bitcoin’s current price of $110,000 reflects this perfectly.”

Crunching the numbers, head of research Fadi Aboualfa has revealed how much demand WOULD be needed to hit some long-awaited price milestones — telling Cryptonews:

“For Bitcoin to hit $150,000, it would likely need about $20 billion more from ETF buyers. Reaching $200,000 could take closer to $45 billion. That’s a huge amount of new investment — comparable to what ETFs have brought in so far. At $200,000, Bitcoin would be worth more than Microsoft.”

There’s one big caveat to mention here: these figures relate to net investment, meaning that outflows along the way could slow progress.

Overall market sentiment is also shaping up to be a factor, with Copper warning that uncertainty surrounding Donald Trump’s tariffs — and whether the Federal Reserve will cut interest rates this year — remains.

Copper went on to note that BTC often suffers several “failed breakouts” before consistently remaining above psychologically significant price thresholds.

It took 13 attempts for Bitcoin to vault beyond $10,000 and never dip below this price barrier again. Both $30,000 and $40,000 were especially tricky too — with 17 attempts each. But as this chart shows, this appears to be changing.

“Bitcoin’s recent climb past $80,000, $90,000 and $100,000 came with unusually few dropbacks. That’s a break from pattern — and potentially a warning.”

The report argues that pullbacks are perfectly healthy — stressing that heading back below $100,000 in the not-too-distant future “wouldn’t be weakness, just Bitcoin doing what it always does before moving higher.”

Food for thought — and perhaps a little reality check as bullish predictions hit the headlines once again.