Crypto Bloodbath: Why Markets Are Tanking on May 28, 2025

Another red day for digital assets—traders wake up to double-digit dips across major coins. Here’s the damage.

Macro Mayhem: Fed whispers of prolonged rate hikes send risk assets spiraling. Bitcoin? collateral damage.

Liquidity Crunch: Asian markets led the sell-off after a major OTC desk froze withdrawals (again).

ETF Outflows: Spot BTC funds bled $420M yesterday—institutional ‘hodlers’ proving they’ve got paper hands after all.

Cynical take? Wall Street’s algo-traders just needed an excuse to rebalance into their 27th consecutive quarter of ‘AI-driven growth stocks.’

Crypto Winners & Losers

At the time of writing, six of the top 10 coins per market capitalization are down over the past day, one is up, and one is unchanged.

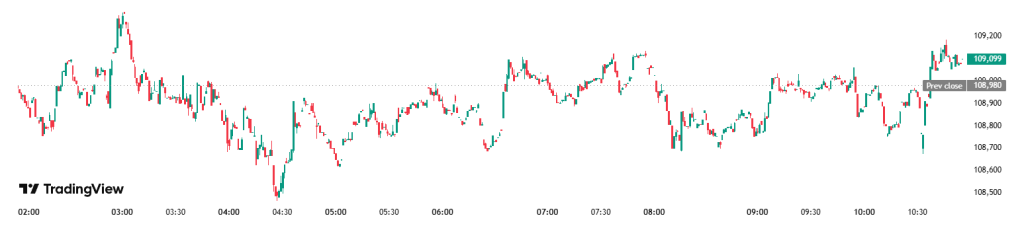

hit an intraday high of $110,407, decreasing to $108,897 by the time of writing. Overall, the price is down 0.7% in a day. The coin hit its all-time high of $111,814 on 22 May, falling 2.6% since.

is the only coin in this category that increased today. It’s up 0.5%, now trading at $2,639.

The biggest decrease is2.5% to the price of $0.223.

Of the top 100 coins, about 20 recorded price increases. The highest gainer is. It’s up 8.9% to $115.

fell the most in this category. It’s the only coin with a double-digit drop: 14.4% to the price of $334.

After the volatility shook the traditional sector, investors are still (and increasingly so) turning towards crypto as a safe haven. Therefore, the current drop still suggests a typical post-rally short-term pullback. However, a number of positive news, including, did not manage to push the prices higher, so this may suggest a further downturn.

That said, there are some interesting developments to observe. Bitcoin 2025 has begun, with some high-profile figures in attendance. Investors will keep an eye on this.

Furthermore, El Salvador is feeling theheat. The latter stated that it would work to “ensure” that the total amount of bitcoin the government holds remains unchanged.

Thank you Coach / @SenTuberville! The pleasure was entirely mine, and thank you for your continued advocacy of US derivative markets. https://t.co/FrHNbuRJDj

— Brian Quintenz (@BrianQuintenz) April 9, 2025In the US, Brian Quintenz, US President Donald Trump’s pick for the(CFTC) leader, disclosed $3.4 million in assets tied to crypto ventures.

However, the outgoing CFTC Commissioner Christy Romero warned that the current trend of “big swings” between “regulation and deregulation” could obstruct the success of the nation’s financial markets.

‘Major Players Still Convinced of BTC’s Long-Term Value’

Blockchain data and intelligence providerfound that spending by older BTC holders is on the rise, and older coins are on the MOVE again. “Aggregate volume from the 1y–5y cohorts just hit $4.02B – the highest since February,” it said on Tuesday.

Here’s how the current spending of older $BTC Stacks up against this cycle’s peaks: Oct 2024: $9.25B (led by 1-2y cohort)

Oct 2024: $9.25B (led by 1-2y cohort) Mar 2024: $6.11B (led by 2–3y)

Mar 2024: $6.11B (led by 2–3y) Feb 2025: $5.42B (led by 2–3y)

Feb 2025: $5.42B (led by 2–3y) Nov 2024: $4.39B (led by 3–5y)

Nov 2024: $4.39B (led by 3–5y) May 2025: $4.02B (led by 3–5y) pic.twitter.com/duhehwk6qp

May 2025: $4.02B (led by 3–5y) pic.twitter.com/duhehwk6qp

Furthermore, Gadi Chait, Head of Investment at, argues that BTC has “spent the past week catching its breath just below its all-time high, trading around $109,000 as powerful forces pull the market in different directions.”

Moreover, the foundation beneath BTC’s current price point “appears broader than in past cycles. What once spiked on HYPE is now underpinned by policy shifts, particularly in the US, institutional flows that are currently pouring money into digital assets, and a recalibrated investor mindset that favours alternatives.”

“If this momentum continues, discussions of Bitcoin’s future may finally move beyond short-term concern over its inherent volatility, and instead focus on its future as a foundational asset within the global economy,” Chait says.

Institutional investors continue investing in Bitcoin ETFs, but geopolitical tensions and policy uncertainty “create significant background noise, keeping some investors cautious.” That said, the “aggressive buying on any price dip shows that.”

That said, today, the Glassnode analysts noted that the BTC funding rate turned negative.

$BTC funding rate just flipped negative. Shorts are quietly building across the top 10, with $BNB and $ADA both showing signs of pressure. Notably, #Solana now ranks as the 6th lowest funding rate among all assets you can track on Glassnode Studio: https://t.co/xqigM0dgzP pic.twitter.com/CRZvfiGVkZ

— glassnode (@glassnode) May 28, 2025Levels & Events to Watch Next

After hitting the all-time high of $111,814 last Thursday, BTC briefly hit an intraday high of $110,407, which is quite lower than the near-ATH of $111,807 seen yesterday. Now standing at $108,897, the latest moves suggest consolidation.

The key resistance level stands at $109,653 and $111,935 before it even attempts to take the $113,000 zone. The first support level is $108,731. Should it break that, we may see it go down to $107,078, or even $105,905. Short-term, there doesn’t appear to be a threat of BTC dropping below $100,000.

Meanwhile, the Fear and Greed Index stands at 68, unchanged from yesterday. Therefore, it still indicates positive market sentiment and ongoing bullishness. Compared to last week, when the metric climbed to extreme greed, there is now a somewhat lower chance of overconfidence that WOULD lead to larger downward corrections.

Moreover, on 27 May, US BTC spot exchange-traded funds (ETFs) saw a net inflow of $384.85 million, led by$409.26 million. The total net inflow now reached $44.91 billion. US ETH spot ETFs saw $38.77 million in net inflows, with BlackRock’s $32.48 million leading the way. The cumulative inflow is now $2.8 billion.

The continual inflows signal robust support by the institutional sector.

Digital asset companies are rushing to raise funds for large-scale BTC purchases, fueled by the recent rally. Currently, 113 publicly listed companies hold Bitcoin, up from 89 in April. They hold a combined stash of over 800,000 BTC. “Favourable market conditions are drawing capital,” Aaron Chan oftold the FT.

Trump Media is diving headfirst into crypto, raising $2.5 billion to build one of the biggest Bitcoin treasuries.#TrumpMedia #Bitcoin https://t.co/Fpfqth4KCA

Trump Media is diving headfirst into crypto, raising $2.5 billion to build one of the biggest Bitcoin treasuries.#TrumpMedia #Bitcoin https://t.co/Fpfqth4KCA

, controlled by Trump, is raising $2.5 billion for one of the largest Bitcoin treasuries held by a public company. Given the ethical concerns and red flags raised, market participants should keep a close eye on this.

Finally, the investors will be keeping an eye on theMay meeting minutes. We’ll see whether these affect the market.

Quick FAQ

The crypto market has recorded a slight decrease today, while the stock market saw a notable uptick. Theis up 2.05%, theincreased by 2.39%, and therose by 1.78%. The optimism rose on Wall Street as Donald Trump walked back tariff threats against the European Union and trade tensions softened.

The market may be in a consolidation period. The market capitalization and investor interest remain robust, so major bear action seems unlikely short-term. However, with all the upcoming events, the market may be spooked by negative regulatory or macroeconomic developments.