From $87M Meltdown to Reinvention: The Unlikely Comeback of Crypto Trader James Wynn

Once a high-flying crypto trader, James Wynn watched $87 million evaporate in a market tantrum—now he’s rewriting the playbook.

The crash that changed everything

Wynn’s nine-figure wipeout became a cautionary meme during the 2022 crypto winter. Unlike the ’diamond hands’ crowd, he actually liquidated—at the worst possible moment.

Building back better (or at least smarter)

These days you’ll find Wynn consulting for hedge funds that somehow still trust him, preaching risk management like a convert at a tent revival. His new venture? A ’anti-fragile’ trading protocol that—irony alert—uses leverage.

The crypto cycle continues

As markets flirt with new highs again, Wynn’s story serves as both warning and inspiration. Because nothing fuels a comeback like freshly printed Tether and institutional amnesia.

Source: Hyperdash.info

Source: Hyperdash.info

At the time of writing, Wynn holds an open long position on Bitcoin worth 5,063.59 BTC. While the P&L on that trade is slightly positive, the unrealized weekly P&L across the wallet stands at a negative $36.79 million.

‘Never Ever Show Your Positions in Public’

Wynn’s large positions became the biggest on Hyperliquid and sparked renewed interest in both the platform and decentralized exchanges (DEXs). While some admire his transparency, others remain skeptical.

Many in the trading community believe it’s bad luck to show trades publicly, especially when they involve large volumes. It adds emotional pressure and can increase the chance of poor decisions when markets turn. In Wynn’s case, thousands are now watching his P&L fall in real time.

James Wynn aka "40x Bitcoin whale" is a good example of why you should never trade based on emotions.

A week ago, he was literally ruling the crypto market.

From 5th May to 23rd May, his PNL went from $5.7M to $87M.

And then excessive greed took over.

He started opening $1B+… https://t.co/g3M03K63nj

Wynn is also known for a successful trade on the meme coin Pepe (PEPE). In April 2023, he posted a prediction on X that PEPE’s market cap WOULD grow from $4 million to $4 billion — and it did.

I predict $PEPE meme coin to go to $4.2B dollars. With a B.

Current mc: $4.2m

Why?

Globally recognised meme

Passionate and fun community

Dog tokens are beyond boring

Elon Musk loves #Pepe

Bull run is on the horizon

1,000x to $4.2B.

Called at $600k. pic.twitter.com/xOtyFWmeIv

According to Lookonchain, he made $25.3 million from Pepe trades on Hyperliquid.

James Wynn(@JamesWynnReal), a legendary figure, recently known for opening a $1B+ $BTC position on Hyperliquid.

But his most impressive trade? $PEPE — where he made a staggering $65.2M.

Back when $PEPE’s market cap was under $600K, he invested early using 24 wallets, spending a… pic.twitter.com/w8j2DjLwfR

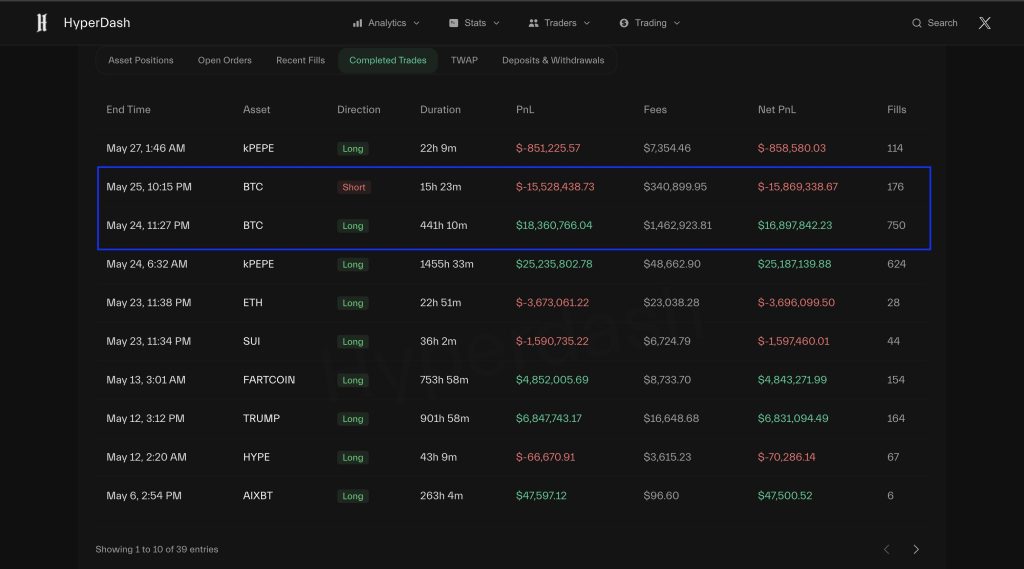

James Wynn has also traded other assets with leverage, including Ethereum (ETH), Sui (SUI), and Fartcoin (FARTCOIN). At its peak, his wallet showed nearly $87 million in profit. That quickly dropped, prompting some in the crypto space to mock the losses.

Honestly, I understand why James Wynn kept gambling.

$87M is not enough to retire comfortably if you have a family of 4 and live in an expensive city. https://t.co/EAczC4pjVD

Still, James Wynn remains active on social media. On May 27, he wrote that despite the recent downturn, his overall wallet is still up around $25 million.

To all the fans and haters:

We had a good run gambling on perps

At peak the account was up $87,000,000 profits from like $3-$4m.

Now decided to leave the casino with my $25,000,000 profit

It’s been fun, but now it’s time for me to walk away a wynner

Wynn 1-0 Haters… pic.twitter.com/vuUiET2CQZ

James Wynn’s Trades Took a Hit, but Hyperliquid Stayed Profitable

Trades as large as James Wynn are rare on decentralized exchanges, which usually carry unique risks. But Wynn has been vocal about his support for Hyperliquid. In one post, he said he won’t switch to centralized exchanges and explained why he’s public about his trades. He explained:

Half the reason I’m shilling my trades publicly is because I want HL to dominate the exchange market share because other exchanges are corrupted.

His trading activity also boosted platform metrics. For example, the fee on his profitable May 24 Bitcoin trade alone was $1.5 million.

Earlier, Cryptonews reported that Hyperliquid had become the leading DEX for perpetual futures by both daily active users and trading volume. According to CoinGecko, the HYPE token has risen by 113 percent in the past 30 days, making it one of the top-performing tokens in the market.

Source: CoinGecko

James Wynn’s trading strategy offers a rare real-time look into whale behavior on a decentralized exchange. His rise and partial fall have sparked debate around transparency, emotional risk, and leverage. But while his wallet may be down, Hyperliquid continues to benefit from the visibility.

Whether Wynn recovers or not, his case shows how fast fortunes can shift in crypto, especially when the entire market is watching.