Solaxy Presale Nears $41M as Whales Bet Big—Can This 100x Play Deliver?

Solaxy’s presale rockets toward $41 million—fueled by a jaw-dropping $1.5 million surge in just 72 hours. With 20 days left, crypto whales are piling in, whispering about 100x returns. But let’s be real—when hasn’t a presale promised moonshots?

Behind the hype: The project’s tokenomics tease aggressive burns and staking rewards, classic bait for the degens. Yet that $1.5M three-day pump smells like coordinated accumulation—either genius positioning or a future ’rug pull’ tweetstorm waiting to happen.

Cynical take: Another ’groundbreaking’ altcoin enters the casino. Will Solaxy defy the 90% post-listing dump trend? Place your bets—the house always wins.

From ETFs to RWA Deals, TradFi Is Moving In – And Solaxy Is the Scalability Key

As more traditional institutions begin to view solana not just as a promising investment but as a viable chain for tokenized real-world assets (RWA), expectations for increased network activity are mounting fast.

For example, global asset manager VanEck – along with 21Shares, Bitwise, and Canary Capital – filed Solana-based ETF applications in February. VanEck also launched its tokenized U.S. Treasury fund (VBILL) on Solana in partnership with Securitize.

More recently, R3 – the enterprise blockchain firm behind the Corda platform – announced a strategic partnership with the Solana Foundation.

This MOVE aims to bridge R3’s permissioned Corda network with Solana’s high-performance public chain, enabling regulated financial institutions to issue and manage RWAs on decentralized infrastructure.

As part of the partnership, R3 plans to bring over $10 billion worth of tokenized assets from its Corda platform onto Solana – a massive vote of confidence in Solana’s ability to support institutional-grade applications.

JUST IN: r3’s Corda — used by HSBC, SDX, and Euroclear to move $10B+ in tokenized assets — is integrating with Solana.

For the first time, institutions using Corda will be able to settle directly on a public blockchain.

More from The Block: https://t.co/IaNplOGS2c pic.twitter.com/Ap32NwP6jU

Together, these developments send a clear message: TradFi expects Solana to step up, not just as a scalable blockchain, but as a reliable foundation for a flurry of on-chain financial products that’s about to come.

But history has shown Solana can stumble under pressure. That’s precisely why investors are now eyeing Solaxy – the first Layer-2 built for Solana – as a critical piece of the puzzle.

Solaxy is emerging as the contingency plan, the scalability solution, and the institutional-grade LAYER that could finally make Solana the blockchain it was meant to be.

The Layer-2 That Turns Solana Into a True Institutional Chain

Solana has always been known for its speed, but when the network gets crowded, it sometimes struggles to keep up. That’s a problem if big institutions and millions of users start piling in. Solaxy is here to fix that – and make Solana ready for the next wave of adoption.

Solaxy builds on Solana’s strong foundation but adds a powerful off-chain processing layer that helps it scale. This means it can handle far more transactions without slowing down or becoming unstable.

Here’s how it works: Instead of sending every transaction directly to the Solana blockchain, Solaxy processes them off-chain first, bundles them together, and then sends one clean package back to the main network. That keeps things faster and smoother, even during peak times.

What is Solaxy?

Solaxy is the latest and greatest improvement to Solana that: Processes transactions off-chain to reduce congestion

Processes transactions off-chain to reduce congestion Uses rollups to bundle transactions for cost-efficiency

Uses rollups to bundle transactions for cost-efficiency Maintaining security on Solana’s L1

Maintaining security on Solana’s L1

The result? A faster, cheaper, &… pic.twitter.com/aphIimSVOy

Its modular architecture also gives developers more freedom to build different types of apps – whether it’s meme coins, micro-payments, games, or even serious finance platforms. And because much of the heavy lifting happens off-chain, users enjoy lower fees and faster performance.

In short, Solaxy is built for scale. It’s designed to support real-time apps, high-volume trading, and massive user growth – all while keeping costs low and transactions lightning-fast.

If Solana is the engine, Solaxy is the turbocharger that makes it ready for the road ahead.

If Solana Wants to Compete with Ethereum on RWAs, It Needs Solaxy

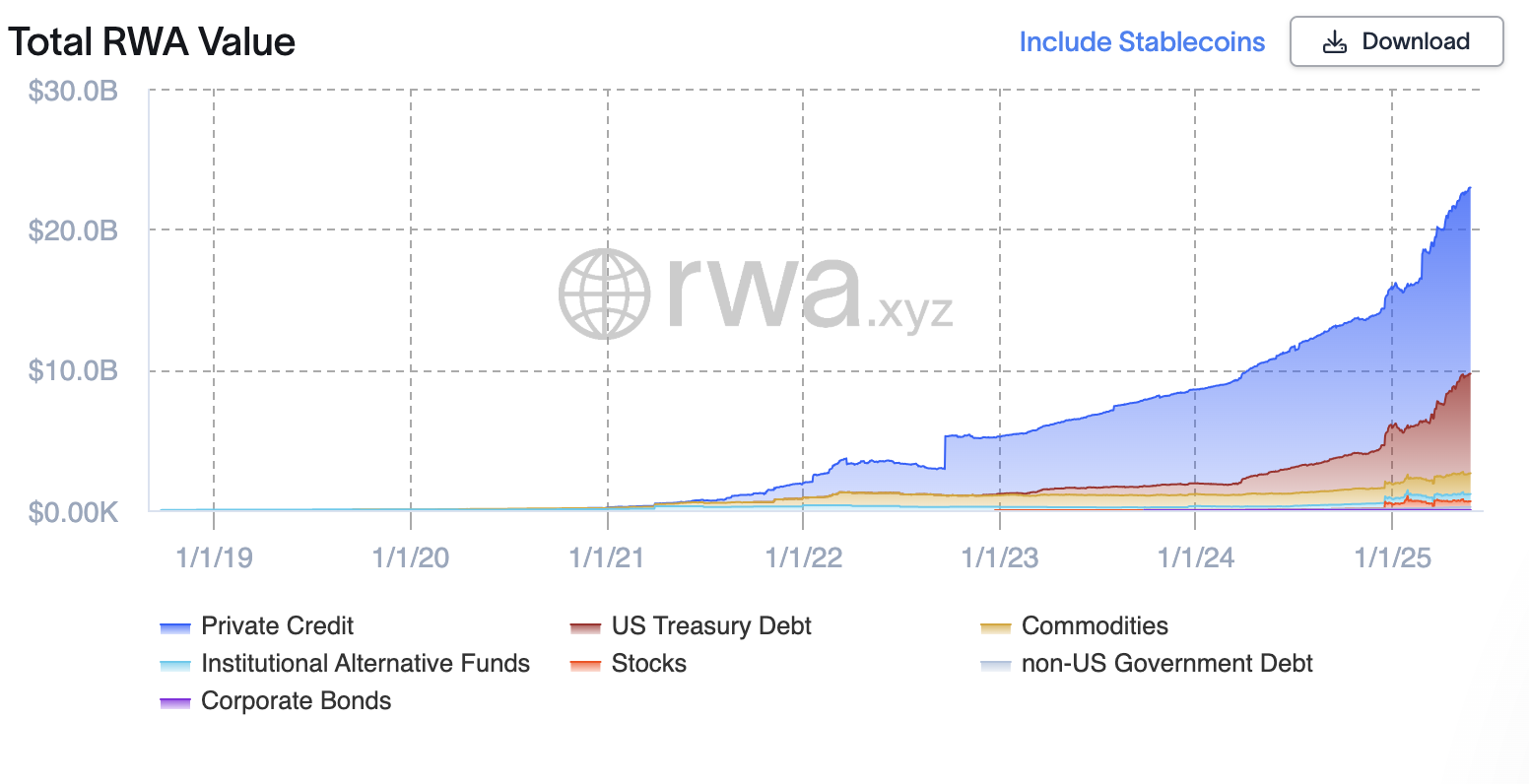

Tokenized real-world assets (RWAs) are no longer a future trend – they’re already here, with over $22.96 billion in tokenized assets (not including stablecoins) now live on public blockchains.

From U.S. Treasuries to real estate, the shift to on-chain finance is accelerating – and institutions like BlackRock, Franklin Templeton, and WisdomTree are leading the charge.

But one chain still dominates: Ethereum.

According to RWA.xyz, ethereum currently holds 59% of the RWA market – over $7.1 billion in tokenized value. Solana, despite its clear performance edge, holds just 2.79%, or about $338 million. That’s a massive gap – and a massive opportunity.

Closing that gap means solving one thing: scalability without sacrificing security. That’s exactly what Solaxy is built to deliver.

With off-chain processing, modular infrastructure, and optimized batching, Solaxy gives Solana the stability layer it’s been missing – one that can finally support the kind of high-frequency, institutional-grade volume RWAs demand.

If Solana is going to challenge Ethereum’s RWA dominance, this is how it happens.

$SOLX Isn’t Just a Token – It’s the Foundation for Solana’s Institutional Future

Indeed, $SOLX is not just a token; it’s the mechanism behind a more resilient, more capable Solana. It powers staking, validation, governance, and long-term network utility.

And with over $41 million already raised, the window to secure early access is closing fast.

Solana can’t win RWAs to its network without Solaxy – but you can get in before the RWA floodagates open.

To grab your stake while there’s still time, visit the Solaxy website and connect a supported wallet. Newly acquired $SOLX tokens can be staked immediately, with a dynamic 98% APY that adjusts based on pool activity and total participation.

For the smoothest experience, Best Wallet is the recommended option – offering full visibility of pre-launch $SOLX allocations and seamless multichain support across both Solana and Ethereum.

For updates, join the Solaxy community on Telegram and X.