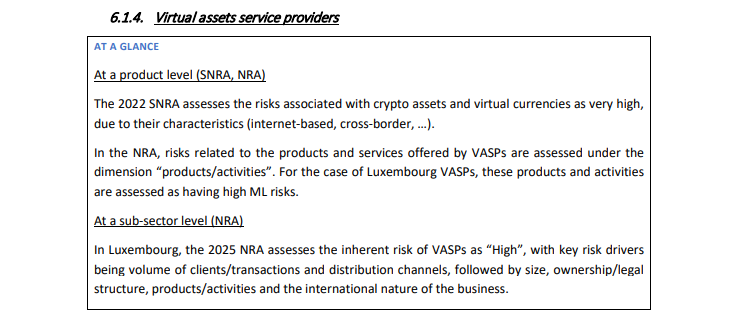

Luxembourg Slaps ’High Risk’ Label on Crypto Firms in 2025 AML Crackdown

Luxembourg’s financial watchdog just threw crypto under the bus—branding digital asset firms as top-tier money laundering threats in its latest risk assessment. The Grand Duchy’s report drops amid global regulatory frenzy, putting exchanges and wallet providers in the same risky category as offshore shell companies.

While the report doesn’t cite specific incidents, the move signals tightening scrutiny as Europe’s wealthiest per-capita nation guards its banking crown jewels. Crypto lobbyists are already crying foul, but let’s be real—when a tax haven starts clutching pearls about financial transparency, you know the compliance hammer’s coming down hard.

Bonus jab: Nothing unites regulators faster than the chance to charge $500/hour compliance consultancy fees.

Report Cited Weak Compliance and Regulatory Gaps

The report indicates that VASPs often operate in a decentralized environment, which impedes adequate supervision and complicates the identification of illicit financial flows.

A key vulnerability noted is the ease with which digital assets can be transferred across jurisdictions with minimal regulatory oversight.

This makes the sector attractive for money laundering operations, especially involving proceeds from cybercrime, fraud, tax offenses, and corruption.

The report also cites cases where some VASPs in Luxembourg were registered without adequate understanding or application of AML rules.

In other instances, firms failed to meet essential compliance obligations such as customer due diligence, ongoing transaction monitoring, and reporting suspicious transactions.

Regulatory authorities, including the Commission de Surveillance du Secteur Financier (CSSF), have undertaken oversight efforts.

However, the report warns of capacity constraints and the need for improved supervisory tools tailored to the fast-evolving crypto industry.

Notably, the 2025 assessment builds upon Luxembourg’s previous efforts to strengthen its anti-money laundering (AML) framework.

These efforts were accelerated following the FATF’s 2023 evaluation, which showed the weaknesses in enforcement and risk-based supervision.

Classifying crypto firms as high-risk is expected to shape Luxembourg’s policy priorities and resource allocation in the fight against financial crime.

It may also influence how the country implements the upcoming EU-level Markets in Crypto Assets (MiCA) regulation in late 2025.

While the report does not accuse specific firms of wrongdoing, it signals a warning to domestic and foreign VASPs operating in or through Luxembourg.

Enhanced monitoring, more stringent compliance checks, and targeted guidance will likely follow as authorities respond to the sector’s elevated risk profile.

Luxembourg Adopts Cautious Path in MiCA Implementation

As of May 2025, Luxembourg has not published official figures on the number of Crypto-Asset Service Providers (CASPs) authorized under the European Union’s MiCA regulation.

The country has opted for a cautious, methodical rollout, taking full advantage of MiCA’s 18-month transitional period, which extends from December 30, 2024, to July 1, 2026.

This transition period allows existing VIRTUAL Asset Service Providers (VASPs) to continue operations while gradually adapting to MiCA’s new compliance standards.

Despite the absence of a published registry of authorized CASPs, key developments indicate regulatory momentum. On May 16, 2025, Bitstamp became one of the first major exchanges to secure its CASP license under MiCA from Luxembourg’s financial regulator, the Commission de Surveillance du Secteur Financier (CSSF).

https://twitter.com/cryptonews/status/1923374509349806531?s=46As one of the world’s longest-operating crypto exchanges, Bitstamp’s approval marks a critical milestone in Luxembourg’s phased adoption of the regulation.

In a similar move, UK-based banking giant Standard Chartered announced in January 2025 its intention to establish a crypto and digital asset custody hub in Luxembourg.

https://twitter.com/cryptonews/status/1877395970658562232?s=46The bank cited MiCA’s harmonized legal framework as a strategic advantage and named Luxembourg as its operational base for crypto services within the European Union.

Meanwhile, global platforms such as Kraken and Crypto.com have secured regulatory approvals under MiCA in various EU jurisdictions, signaling that the regulation is already reshaping the European crypto landscape.