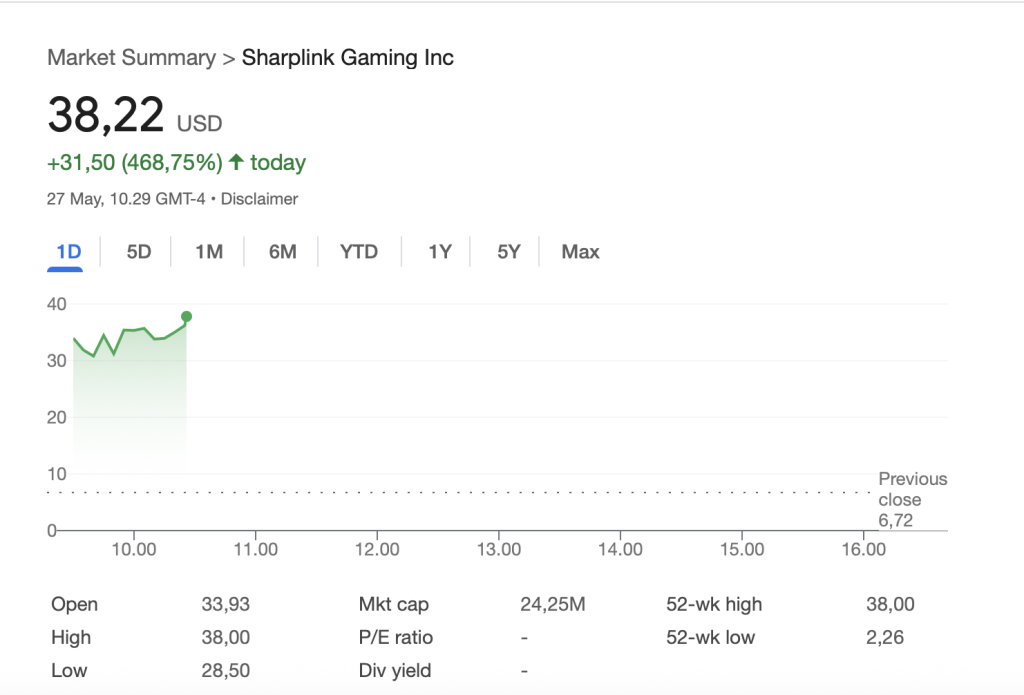

Consensys Backs $425M PIPE Deal—Sharplink Shares Explode 468% on Ethereum Gambit

Wall Street meets crypto chaos as Sharplink’s stock moonshots on Consensys-fueled cash infusion. The $425M private investment in public equity (PIPE) deal sends traders scrambling—proof that even traditional finance can’t resist Ethereum’s siren song.

PIPE dreams come true: Sharplink’s valuation detonates like a DeFi yield farm in 2021. The 468% surge smells like desperation and genius—Wall Street finally realizing ETH might eat their lunch.

Bonus cynicism: Nothing unites bankers and degens like the smell of fresh leverage. Just don’t ask what happens when the music stops.

As part of this latest move, the company said it plans to adopt ethereum as its primary treasury reserve asset, marking a landmark moment for crypto’s integration into the balance sheets of public companies.

The PIPE agreement includes the purchase of over 69 million shares of common stock at $6.15 per share (or $6.72 for certain management participants), and is expected to close around May 29, 2025, pending customary closing conditions.

The capital raise also featured participation from prominent crypto venture firms and ecosystem leaders, including ParaFi Capital, Electric Capital, Pantera Capital, Galaxy Digital, and others.

Joseph Lubin to Join Board as Chairman

As part of the deal, Joseph Lubin, Founder and CEO of Consensys and Co-Founder of Ethereum, will become Chairman of SharpLink’s Board of Directors upon closing.

The collaboration reflects Consensys’ growing push to bring Ethereum deeper into corporate finance strategies, leveraging its ecosystem expertise in decentralized finance, identity, and infrastructure.

“This is a significant milestone in SharpLink’s journey and marks an expansion beyond our Core business,” said Rob Phythian, Founder and CEO of SharpLink. “On closing, we look forward to working with Consensys and welcoming Joseph to the Board.”

“This is an exciting time for the Ethereum community. I am delighted to work with Rob and the team to bring the Ethereum opportunity to public markets,” said Lubin.

ETH Becomes Treasury Reserve Asset

Proceeds from the offering will be used to acquire ETH as a long-term treasury reserve, pending general corporate and working capital needs.

This makes SharpLink one of the first U.S.-listed companies in the iGaming and sports betting space to commit to Ethereum as a reserve strategy, potentially indicating a broader adoption trend among digital-native companies. A.G.P./Alliance Global Partners acted as the sole placement agent for the deal.

The securities are being issued via private placement under exemptions from SEC registration and are subject to resale restrictions, with a registration rights agreement in place for future compliance.

SEC Drops Lawsuit Against Consensys

In February, the SEC agreed to end its lawsuit against crypto company Consensys as the federal regulator halted its regulation-by-enforcement approach to digital assets, according to Consensys co-founder Joseph Lubin.

The SEC officially dropped its cases against Consensys, Kraken, and Cumberland DRW as the agency shifts its regulatory approach.#CryptoRegulation #CryptoPolicy #SEChttps://t.co/pn7Utn0XLL

The SEC officially dropped its cases against Consensys, Kraken, and Cumberland DRW as the agency shifts its regulatory approach.#CryptoRegulation #CryptoPolicy #SEChttps://t.co/pn7Utn0XLL

In an X post published on the afternoon of February 27, Lubin announced that the SEC and his blockchain software firm agreed “in principle” to formally halt the litigation, with the regulator set to file a stipulation in court that will “effectively close the case.”