Chainlink’s $66B Surge Sparks Wild Predictions: Can $LINK Really Hit $36.5?

Analysts are throwing gasoline on the Chainlink hype train—some claim a 300% explosion could send $LINK soaring past $36.5. Cue the skeptical Wall Street eye-roll.

Oracle networks aren’t supposed to be this exciting. But with $66B in value now tied to Chainlink’s ecosystem, the crypto crowd’s betting big on decentralized data feeds. Just don’t ask them about last cycle’s ’sure thing’ that cratered 80%.

Buckle up. This rocket might moon—or leave bagholders staring at the launchpad.

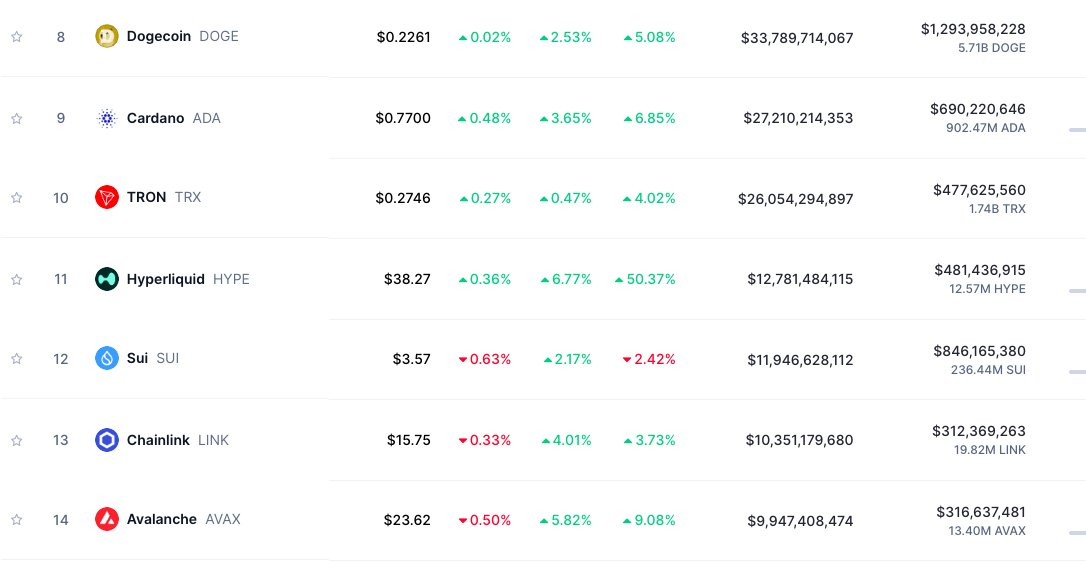

Chainlink loses spot to sui and Hyperliquid/ Source: CoinMarketCap

Chainlink loses spot to sui and Hyperliquid/ Source: CoinMarketCap

Even with a $10.3 billion market cap and growing developer activity, $LINK’s sluggish price performance threatens its position in the crypto market.

Chainlink Expands to Solana and DeFi Chains Despite Slow Price Growth

Despite the price stagnation, the development team behind Chainlink appears unfazed. Their focus remains firmly on enhancing the project’s core offering: its decentralized oracle network.

A key component of this is the Cross-Chain Interoperability Protocol (CCIP), which facilitates secure data sharing across different blockchain networks.

On May 19, Chainlink’s CCIP officially launched on the solana mainnet, a major milestone that is expected to bolster Solana’s DeFi ecosystem by allowing access to over $18 billion in assets across chains.

Chainlink recently shared an adoption update that detailed 16 new integrations of its standards across six services and 16 blockchains, including Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Polygon, Solana, and ZKsync.

⬡ Chainlink Adoption Update ⬡

There were 16 integrations of the Chainlink standard across 6 services and 16 different chains: Arbitrum, Avalanche, Base, Bitlayer, BNB Chain, Celo, Ethereum, opBNB, Optimism, Polygon, Ronin, Rootstock, Scroll, Solana, Sonic, and ZKsync.

New… pic.twitter.com/j3cnAnc3UC

In another development, Web3 gaming giant MapleStory Universe integrated Chainlink VRF (Verifiable Random Function) into its AVAX-based Layer-1 infrastructure.

Chainlink Secures $66B as Bulls Eye ‘Swift and Violent’ $LINK Repricing

According to a recent report by Santiment, Chainlink recorded over 530 GitHub updates in the past month alone.

ChainLink ( $LINK ), Avalanche ( $AVAX ) & Stellar ( $XLM ) lead RWA space in developer activity. @chainlink recorded over 530 major Github updates in the past month!

ChainLink ( $LINK ), Avalanche ( $AVAX ) & Stellar ( $XLM ) lead RWA space in developer activity. @chainlink recorded over 530 major Github updates in the past month!

Source: Santiment pic.twitter.com/4OEvOvSnKt

This sustained activity has further cemented Chainlink’s dominance in the oracle sector of DeFi, where it currently secures more than 68% of the total oracle TVL, with $66 billion in Total Value Secured (TVS).

These milestones have inspired renewed Optimism among loyal Chainlink supporters.

One prominent $LINK enthusiast even claimed that investors might soon be “tired of winning,” predicting that “the repricing of $LINK will be swift and violent.”

A crypto investor and chart analyst also expressed confidence that $LINK’s current downtrend channel is nearing a breakout, supporting this sentiment.

$LINK’s downtrend channel is about to break out.

This rise is likely to proceed smoothly to the $36.5 level, where there is a selling wall. pic.twitter.com/CaN2agtchk

He added that the recent price recovery will likely push $LINK smoothly to the $36.5 level, with a sell wall.

Chart Outlook: $LINK Faces Resistance at $20, Eyes $36.5 Breakout

At press time, the $LINK/$USDT chart suggests the market is attempting a gradual recovery. The token is currently trading at around $15.67.

In April, a period of price consolidation, marked as a “cluster” on the chart, triggered a 15% breakout, supported by increased trading volume that indicated a resurgence of buying interest.

Technically, the first resistance lies at $20, a psychologically important level previously acting as a zone where sellers regained control. A break above this could push $LINK’s price toward the next resistance range between $25.62 and $26.56.

Beyond that, the mid-term price target is between $28.67 and $30.07, coinciding with highs observed in late 2024.

The MACD (Moving Average Convergence Divergence) indicator shows the MACD line currently trending below the trigger line, typically a bearish indicator.

However, the histogram is relatively neutral, implying that selling momentum may weaken. If the trend reverses, a bullish crossover could soon follow.