Brazilian Fintech Méliuz Doubles Down on Bitcoin with $26.5M Purchase—Because Traditional Finance Was Too Stable

Méliuz—the cashback and rewards platform that’s decided volatility is just another form of yield—is loading up on Bitcoin again. This time, they’re dropping $26.5 million to stack more sats, proving that corporate treasuries can FOMO just like retail traders.

Why? Who knows. Maybe they’re hedging against inflation, maybe they’re bored with bonds yielding less than a savings account. Either way, it’s another brick in the wall of institutional adoption—or a future case study in ’aggressive balance sheet management.’

One thing’s clear: in a world where central banks print money like Monopoly tickets, betting on digital scarcity starts to look less like a gamble and more like common sense. Even if it does give accountants nightmares.

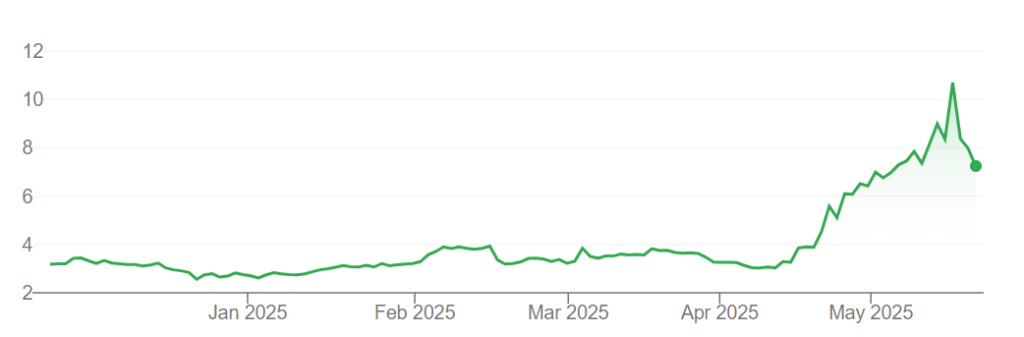

Méliuz (CASH3) share prices on the Brazilian B3 exchange over the past six months. (Source: Google Finance)

Méliuz (CASH3) share prices on the Brazilian B3 exchange over the past six months. (Source: Google Finance)

Méliuz: Bitcoin Plans in Pipeline

The company will continue to buy BTC in the weeks ahead. In a statement, the company declared its intention to raise no less than 150 million real ($26.5 million) on “new BTC acquisitions.”

The firm said it had told its shareholders about its intentions and was now “evaluating” its fundraising options.

Méliuz CEO Israel Salmen said the company WOULD look to an “issuance of shares or convertible debt” in its search for funding.

The firm added that it was working with the São Paulo-based investment banking firm BTG Pactual on its plan.

BTG Pactual will act as a coordinator when Méliuz has the funds in place to complete its next BTC purchase.

Marcio Loures Penna, Méliuz’s Director of Investor Relations and Corporate Governance, confirmed that the company may issue financial assets “representing debt securities.”

These may either be convertible into shares or offered in a non-convertible form, he added.

The company may alternatively choose to carry out a primary public offering for common shares, with possible subscription bonuses.

Méliuz said that while its goal remains raising 150 million real, it may spend even more “if opportunities arise.”

However, the firm warned that its plans remain provisional. It said that it would need to complete an evaluation process before it finalized its next BTC buy.

@MeliuzBitcoin #CASH3 announced yesterday that it is evaluating a potential capital raise to expand its Bitcoin strategy, through the issuance of shares or convertible debt. BTG has been engaged to coordinate a potential public offering.

@MeliuzBitcoin #CASH3 announced yesterday that it is evaluating a potential capital raise to expand its Bitcoin strategy, through the issuance of shares or convertible debt. BTG has been engaged to coordinate a potential public offering.

When Could Méliuz Make Its Next BTC Purchase?

Méliuz also refused to put a timeline on its fundraising efforts or its eventual Bitcoin buy.

Earlier this month, the fintech player uveiled details of its first Bitcoin buy, as well as news that its shareholders have “approved, by a wide majority, the transformation of Méliuz into the first listed Bitcoin treasury company in Brazil.” The company currently holds BTC 320.2.

Penna added that Méliuz “will keep its shareholders and the market informed of any news” on its next BTC buy.

He vowed that the firm would act “in line with best corporate governance practices and in accordance with applicable legislation and regulations.”

Méliuz was founded in 2011. Its services include cashback and voucher offerings for online and brick-and-mortar retailers, in addition to the Méliuz credit card.

The firm launched a successful $103 million initial public offering on the Brazilian B3 exchange in November 2020.