South Korea’s Crypto Watchdog Flexes Muscle—Will Regulation Finally Catch Up to Markets?

Seoul’s Digital Asset Committee drops hints of a regulatory overhaul—just as trading volumes hit record highs. Will bureaucrats play catch-up or crack down?

Behind closed doors, whispers of stricter KYC rules and exchange audits swirl. Meanwhile, retail traders keep stacking altcoins like there’s no tomorrow.

One thing’s certain: when regulators move, markets flinch. And in crypto? The house always wins—just ask the guys still holding Luna bags.

Source: News1

Source: News1

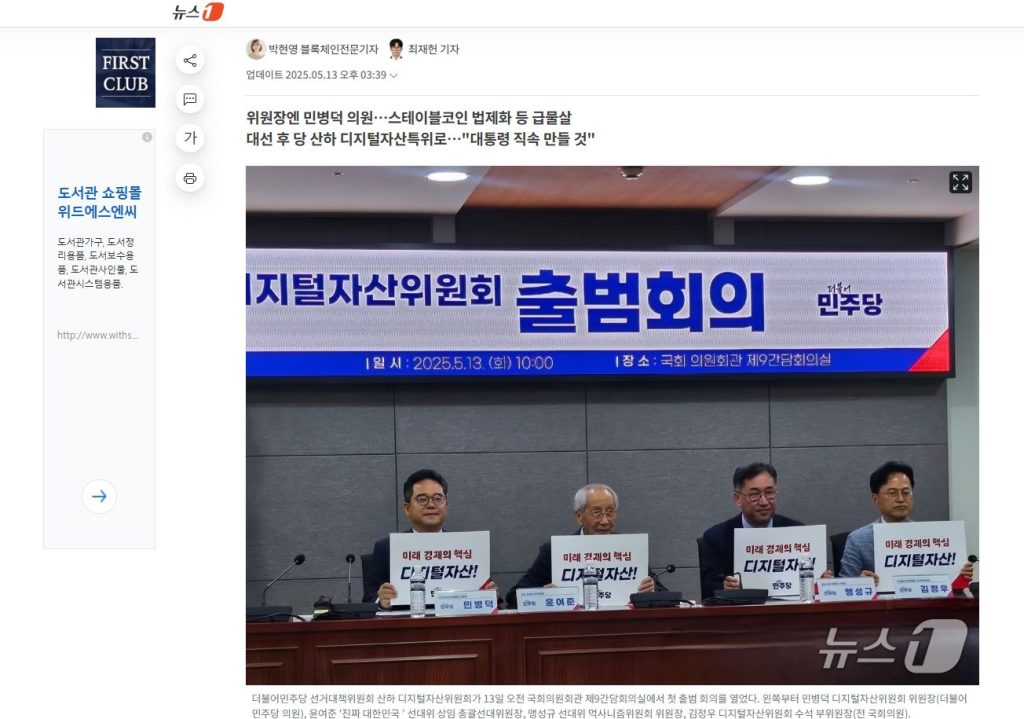

South Korea’s Digital Asset Committee to Draft Crypto Laws, Push Industry Reform

Rep. Min Byeong-deok leads the committee as chairman. He emphasized the long-term vision, stating,

“The goal is to make the Digital Asset Committee directly under the president so that it can have expertise and implement actual policies.”

The committee is structured around two main groups. The Industrial Innovation Growth Committee, chaired by Professor Kang Hyung-goo of Hanyang University, will focus on boosting South Korea’s leadership in the global digital economy.

The Policy and System Support Committee, led by Dr. Yoon Min-seop, will work on laws and regulatory frameworks. In addition, four subcommittees will handle user protection, legal reform, industry growth, and external cooperation.

Experts from exchanges and blockchain companies will participate, reflecting a mix of government and private sector involvement.

Stablecoins were among the topics raised during the launch meeting. The debate also reflects growing political interest.

Democratic Party presidential candidate Lee Jae-myung previously supported a won-linked stablecoin, while rival candidates raised concerns, citing past failures like the Terra-Luna collapse.

“There are discussions about whether stablecoins should be subject to a licensing system or a reporting system,” Chairman Min noted. “There is also debate over whether the Bank of Korea or the Financial Services Commission should lead regulation.”

Bank partnerships with crypto exchanges were also discussed. Currently, one exchange typically pairs with one bank.

Min acknowledged this as a limitation, saying, “There are clear shortcomings to the one-exchange-one-bank principle.”

Yoon Yeo-jun, a senior official with the campaign, warned that unclear regulations are pushing companies and investors abroad.

“We must resolve these issues during the presidential election,” he said, “and achieve both market development and investor protection.”

South Korea’s Central Bank Clashes With Lawmakers Over Stablecoin Control Amid Election Heat

As South Korea’s Democratic Party pushes forward with its new Digital Asset Committee, the Bank of Korea (BOK) is drawing a firm line on who should oversee the nation’s stablecoin future.

Stablecoins, particularly those pegged to the Korean won, have rapidly become a major point of contention in the lead-up to the June 3 presidential election.

On May 12, BOK officials publicly stated that they must have final authority over the approval and issuance of KRW-based stablecoins, citing risks to monetary policy and financial stability.

Koh Kyung-chul, head of the bank’s electronic finance unit, warned that excluding the central bank from early discussions could undermine national monetary control. He emphasized that legal frameworks must be crafted with input from the BOK to avoid destabilizing the country’s financial ecosystem.

The debate comes as Democratic Party candidate Lee Jae-myung calls for South Korea to “enter the stablecoin market quickly,” warning that delays could lead to capital flight.

Democratic Party (DP) presidential candidate Lee Jae-myung appealed for support during a visit to Yeongju, North Gyeongsang, on Sunday, asking, “What did I do so wrong?” https://t.co/YF27ZsVGkG

— The Korea JoongAng Daily (@JoongAngDaily) May 4, 2025Meanwhile, People Power Party candidate Kim Moon-soo has promised to allow major government funds to invest in digital assets and supports institutional reforms to legitimize crypto.

With over 16 million Koreans engaged in crypto, digital asset policy has become a defining issue, transforming the election into a showdown between central bank caution and political ambition.