Hyperliquid’s Open Interest Rockets to $4.9B as $HYPE Token Explodes 1,000% – Is This the Next BNB?

Decentralized finance just got a shot of adrenaline. Hyperliquid, the perpetual swaps protocol, just smashed records with $4.9B in open interest—while its native $HYPE token went full moonshot, gaining 1,000% in weeks. Traders are piling in, whispering ’BNB 2.0’ as leverage addicts find their new playground.

Behind the hype? A perfect storm of meme-fueled speculation, real protocol traction, and that classic crypto FOMO cocktail. But let’s be real—when Wall Street starts calling it ’disruptive,’ you know the bubble machine is warming up.

One thing’s certain: in a market where ’fundamentals’ means checking the next influencer’s price prediction tweet, Hyperliquid’s surge proves crypto still runs on pure, uncut narrative. Buckle up.

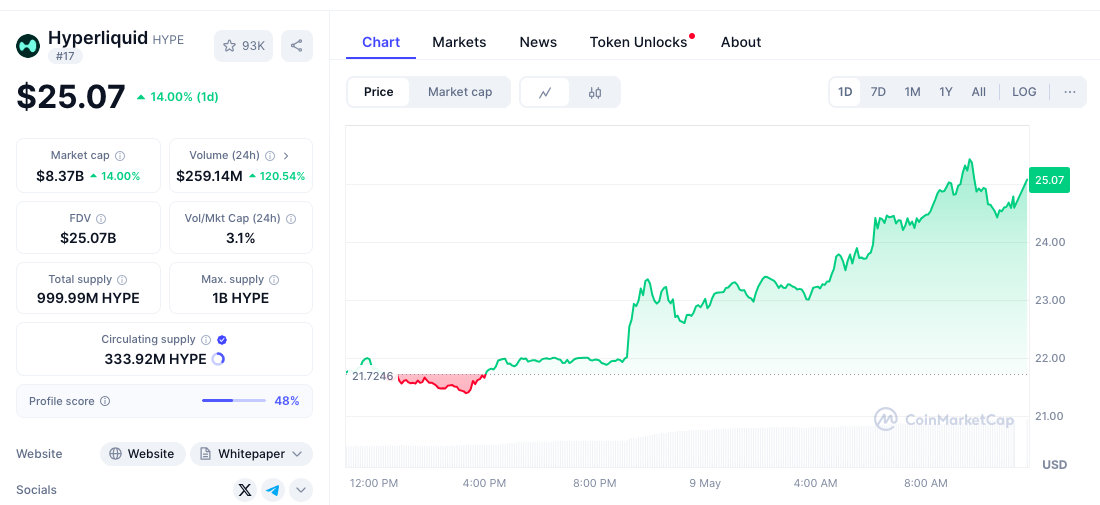

$HYPE price chart/ Source: CoinMarketCap

$HYPE price chart/ Source: CoinMarketCap

The on-chain perpetual exchange, known for its order book design, has seen $HYPE skyrocket from a post-launch low of $3.20 to a high of $35.02.

While broader market conditions have since cooled, the $HYPE token has maintained strong momentum, entering the top 20 crypto assets by valuation.

Ethena’s USDe Launch Adds Momentum to Hyperliquid Ecosystem as it Overtakes Cardano, Polygon in Key Metrics

Hyperliquid is positioned as a blockchain designed to power all forms of finance. Its decentralized exchange (DEX) offers ultra-low fees, lightning-fast transactions, and sophisticated trading tools—features that continue to attract a growing number of traders.

Hyperliquid reached a new all-time high in open interest of >$4.9B. pic.twitter.com/cLowrr4Pr8

— Hyperliquid (@HyperliquidX) May 9, 2025Additionally, Ethena Labs recently launched its USDe stablecoin on both the Hyperliquid exchange and its HyperEVM, allowing users to earn daily auto-airdropped rewards directly on their spot USDe balances.

According to DefiLlama, Hyperliquid now boasts over $948 million in total value locked (TVL) and $279 million in DEX trading volume, outperforming rival blockchains like Polygon, Sei, Cronos, and Cardano across key on-chain metrics.

Can $HYPE Mirror BNB’s Meteoric Rise?

In terms of revenue, Hyperliquid generated $2.3 million in the past 24 hours, ranking it as the second-highest-earning application, trailing only Solana and surpassing ethereum by nearly $1 million.

This demonstrates the presence of real consumer activity on the chain. The $HYPE token directly benefits from this, as Hyperliquid allocates 97% of daily revenue, around $1.3 million on average, toward price support and supply reduction mechanisms.

Hyperliquid allocates 97% of the revenue to buy $HYPE

Hyperliquid allocates 97% of the revenue to buy $HYPE It has an average of 1.3M profit per day.

It has an average of 1.3M profit per day. This means that every day there are daily purchases worth 1M.

This means that every day there are daily purchases worth 1M. Every month 30M in total approx.

Every month 30M in total approx. In this table you can see the years it WOULD take to buy all the… pic.twitter.com/giN6y8tbju

In this table you can see the years it WOULD take to buy all the… pic.twitter.com/giN6y8tbju

Estimates suggest that at the current pace, most of $HYPE’s total supply could be repurchased within 2 to 7 years, depending on market dynamics.

This robust model has led many investors to compare $HYPE’s potential to that of Binance’s $BNB token, which grew from $40 in 2021 to over $620 per token.

Technical Breakout Points to More Upside for $HYPE

Technically, $HYPE spent much of March and early April consolidating between $12 and $14, forming a reliable support base. It has since embarked on a steady upward trend, marked by consistently higher highs and higher lows.

The token recently broke through a major resistance zone at $25, supported by strong trading volume and a large bullish candlestick, indicating continued momentum.

Momentum indicators like the MACD also support the bullish case, with the MACD line trending well above the trigger line and the histogram remaining in positive territory.

$HYPE continues to slowly grind up.

Clear break above $20.

Then clear break above $22.

Soon we will enter the rapid pump phase, when people start feeling the FOMO kick in and market buy into a thin orderbook.

At first I thought $28 could be a hard resistance, but based on the… pic.twitter.com/cxagBp7Pkb

Current projections point to a near-term target of $30.34, a potential 17.72% upside from current levels, coinciding with a major resistance area last tested in February.

If a retracement occurs, the $25 level is expected to act as new support, with a stronger demand zone lying between $14.50 and $16.00, which served as the base for this rally.