DeFi Whale Drops $12M on Solana as Layer-2 Solaxy Hits $33.5M Presale—Institutional Money Chases the Next ETH Killer

Solana’s ecosystem just scored a major vote of confidence—an unnamed DeFi giant scooped up 82,000 SOL ($12M) amid surging interest in Solaxy, its first Layer-2 solution. The presale smashed $33.5M in record time, fueling speculation that SOL could retest its ATH.

Why the frenzy? Developers are fleeing Ethereum’s gas fees like rats from a sinking ship—Solaxy promises faster settlements and lower costs. But let’s be real: half these ’institutional bets’ are just degens recycling VC money.

Key details: The SOL purchase coincided with Solaxy’s testnet launch, suggesting coordinated accumulation. Meanwhile, BNB Chain loyalists are screaming ’centralization’—pot calling the kettle black, much?

Bottom line: Solana’s proving it’s more than just an NFT chain. Whether that justifies the hype (or the 12x leverage some traders are allegedly running) remains to be seen. Remember kids, in crypto, ’institutional adoption’ often means ’greater fool theory with better PR.’

DeFi Development Corp Bets Big on Solana – $59M in $SOL and Counting

AI-powered real estate software firm DeFi Development Corp. (trading as $DFDV) is going all-in on Solana. Its recent purchase of 82,504 $SOL brings its total holdings to over 400,000 SOL, valued at nearly $59 million. The new tokens are being staked through the company’s own validator infrastructure.

1/ The $SOL stackin’ saga continues!

DeFi Dev Corp has purchased another 82,404.50 $SOL worth ~$11.2M as part of our crypto-forward treasury strategy.

Our total holdings now stand at 400,091 $SOL (including staking rewards), or roughly $58.5 M. pic.twitter.com/eVV25M5WPK

On Monday, the firm revealed it had acquired a Solana validator operation for $3.5 million, paid via $3 million in restricted $DFDV stock and $500,000 in cash.

The acquired infrastructure carries an average delegated stake of approximately 500,000 SOL, or roughly $75 million in value, putting the firm in a strong position to earn validator rewards and deepen its stake in Solana’s economy.

$DFDV just acquired a $SOL validator business with ~500K avg. SOL delegated ($75M).

At 8% yield, that’s +40K SOL/year = $6M at $150.

A strategic move to deepen $DFDV’s SOL accumulation playbook. pic.twitter.com/GB1S6oMcUf

This move is part of a broader digital asset treasury strategy DeFi Development Corp. launched last year, aimed at accumulating high-upside crypto assets. And they’re not alone.

Institutional interest in Solana is heating up: ETF applications from VanEck, 21Shares, Bitwise, and Canary Capital were filed in the Federal Register this February. Bloomberg Intelligence currently puts the approval odds at 90%.

Everything points to a bullish future for Solana – but for it to truly scale and compete with Ethereum, network reliability must improve. Persistent congestion has long frustrated users and developers alike, holding Solana back from fully realizing its performance edge. That’s where Solaxy steps in.

When Solana Slows Down, Everything’s at Risk – Solaxy Keeps It Moving

Dependability is critical for any transaction processor. Imagine Visa or Mastercard going down during a volume surge – billions in fees could vanish, and confidence would evaporate.

In crypto, it’s no different. For those running Solana validators, now including DeFi Development Corp., network outages can disrupt income streams and shake ecosystem trust. Prolonged instability could push developers and capital to rival chains.

Solana’s raw speed is impressive, but its monolithic architecture – where all operations happen on-chain – leaves it exposed during traffic spikes. In contrast, Ethereum has embraced a modular path, relying on Layer-2s to scale.

Recent reports show that at peak congestion, up to 70% of Solana transactions fail – proof that a scalable solution is urgently needed.

Here’s just one X post from Whale Insider reporting a 75.7% transaction failure rate on Solana last year – and some users have recently claimed that number has climbed as high as 90%.

BREAKING: 75.7% of Solana transactions are failing. pic.twitter.com/p1CEa4HRMY

— Whale Insider (@WhaleInsider) April 5, 2024That solution is Solaxy – Solana’s first true Layer-2, designed to offload pressure by processing transactions off-chain and submitting them back for finality. It’s a fix built for the future.

Solaxy Hits Key Milestones Before Mainnet

At its core, Solaxy uses rollup tech to bundle thousands of off-chain transactions into a single, compact submission to the Solana mainnet. This reduces on-chain load while preserving data integrity and finality.

The result: a more scalable and reliable Solana, capable of powering DeFi, meme coin trading, games, and next-gen dApps without freezing under pressure.

And this isn’t just theoretical. Solaxy’s testnet is already live, giving developers a sandbox to stress test and prepare for mainnet. Think of it as test-driving Solana’s second engine.

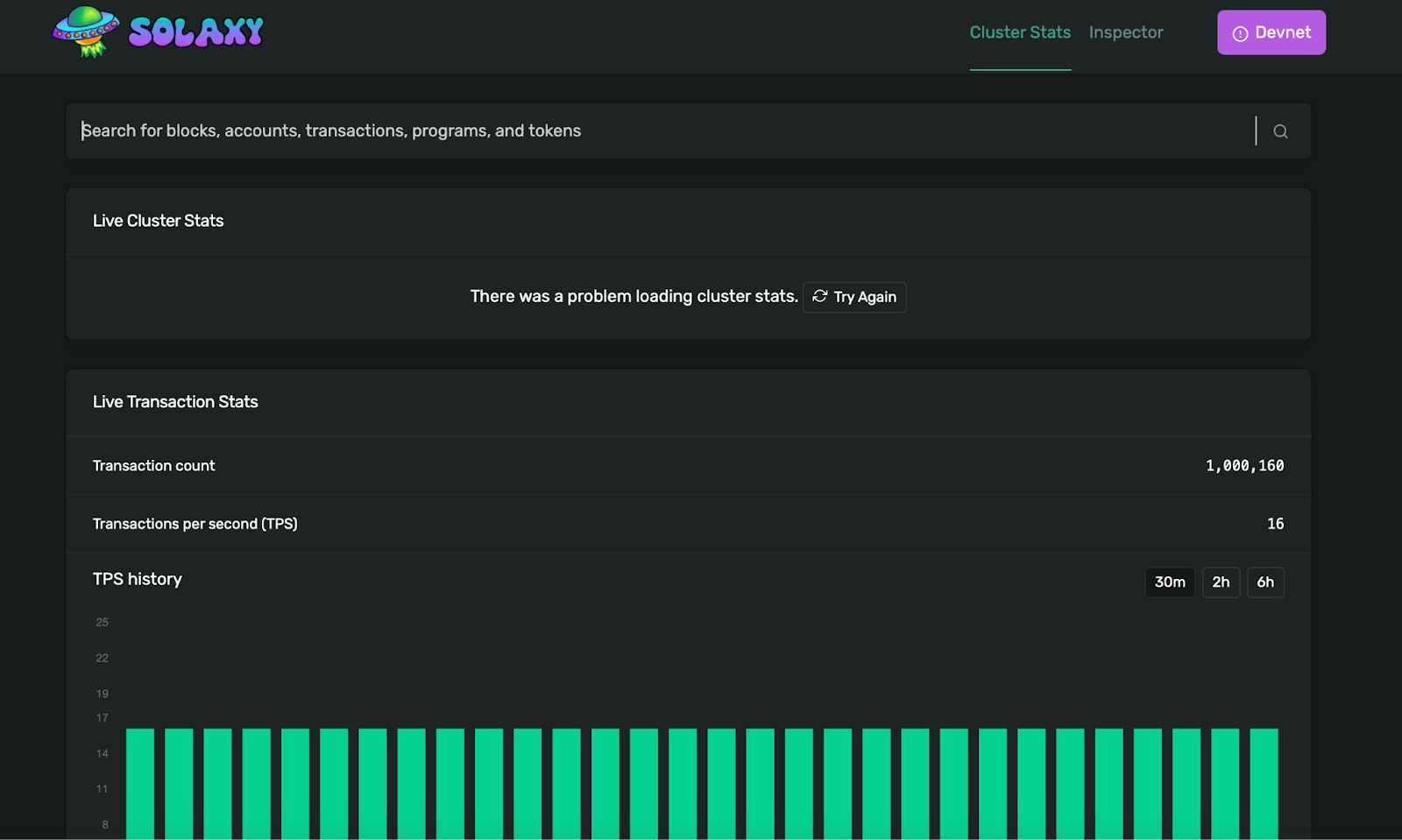

Even more – Solaxy has launched its own block explorer, offering real-time visibility into testnet activity. This level of transparency is rare for a presale-stage project and proves that the engine is already running.

These milestones show that Solaxy isn’t just building – it’s delivering.

Missed Solana at $0.50? The Next 1,000x May Be the Layer 2 Powering It: Solaxy

According to VanEck, Solana could reach $520 this year. At today’s price, that would yield a 3.5x return – solid for new investors. But for those who bought at $0.50, it’s a mind-blowing 1,040x gain.

Source: TradingView

Of course, those early-entry days are gone, so where’s the next shot at a Solana-style return? It might not be Solana itself, but the infrastructure that scales it.

As more transaction load shifts to Solaxy, $SOLX could become the high-utility token powering Solana’s growth. For those chasing the next 1,000x, this may be it.

The Window for Maximum Gains Is Now – Join the Solaxy Presale

To aim for a 1,000x return, timing is everything – and the lowest possible price is only available now, during the presale.

Visit the Solaxy website and connect your wallet to join. Newly purchased $SOLX tokens can be staked immediately, earning a dynamic 120% APY, which adjusts based on pool size.

For the smoothest experience, Best Wallet is the recommended option – it gives you full visibility of your $SOLX holdings even before launch, with multichain access across Ethereum and Solana.

Join the Solaxy community on Telegram and X, and learn more about what could become Solana’s most important upgrade yet.