AAVE’s Aggressive Buyback Strategy Fuels $190 Breakout Speculation – Will the Rally Hold?

AAVE cranks up the pressure with a buyback blitz—just as the token flirts with a critical resistance level. Market watchers are split: Is this a bullish masterstroke or another ’number-go-up’ gimmick to distract from DeFi’s shrinking TVL?

Technical indicators show AAVE consolidating near $180, with whales accumulating at key support. A clean break above $190 could trigger FOMO momentum—but with crypto, ’could’ does a lot of heavy lifting.

Pro traders are hedging bets, noting thin order books above $195. Meanwhile, retail piles into leveraged longs—because nothing screams ’sustainable rally’ like 50x positions funded by yield-farmed stablecoins.

Inside Aave’s Explosive On-Chain Growth And The $1M Weekly Plan Fueling $AAVE’s Rally

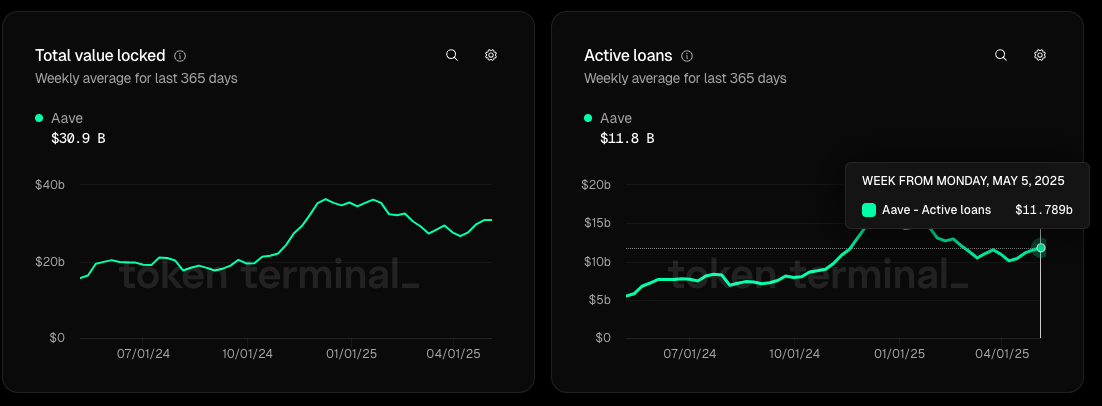

According to Token Terminal data, Aave currently holds over $30.8 billion in total value locked (TVL).

In addition, active loans on the platform surged to $11.8 billion, a 15.7% increase in the last 24 hours alone.

Aave remains one of the top revenue-generating protocols in the space, accumulating $569.3 million in total fees over the past year, of which $93 million was recorded as protocol revenue.

Investor sentiment around $AAVE has improved following the announcement of a buyback program. In March, the protocol committed to repurchasing $1 million worth of $AAVE tokens weekly for at least six months.

You can now track AAVE buybacks via @Token_Logic’s dashboard. pic.twitter.com/yXnWiEyF3c

— Aave (@aave) April 18, 2025Given that Aave generates approximately $50 million in monthly fees, part of this revenue is now being returned to token holders, contributing to a 14.85% price increase over the past 30 days.

Aave’s Trump-Backed DeFi Alliance And Expansion to Celo, Aptos, and MetaMask

Aave has also attracted high-profile interest. For example, in October 2024, World Liberty Financial, Donald Trump’s crypto venture, proposed building a DeFi platform on Aave.

The proposal included a 20% revenue-sharing model with AaveDAO and a 7% allocation of WLFI, its native governance token. By December, WLFI invested $1 million into Aave and received over 3,357 $AAVE tokens in return.

On March 16, Aave V3 launched on Celo, a Layer-2 blockchain offering low-cost, high-speed transactions. This deployment supports $CELO, $USDT, and $USDC as both collateral and borrowable assets.

In April, Aave began preparations to deploy its technology on Aptos, with the mainnet launch expected soon.

The protocol also recently partnered with MetaMask, so that Aave USDC (aUSDC) can be used with the MetaMask Card, allowing users to earn yield and spend simultaneously.

Earn with Aave. Spend on @MetaMask Card.

Live now https://t.co/NgHSG0l1BH

https://t.co/NgHSG0l1BH

Further expanding its ecosystem, Aave facilitated the integration of Ripple’s RLUSD enterprise-grade stablecoin into its V3 Ethereum Core market in April. Users can now supply and borrow RLUSD via the platform.

Technical Outlook: $AAVE Targets $190 With Inverse Head and Shoulders Setup

On the technical side, the $AAVE/$USDT chart shows a well-defined Inverse Head and Shoulders pattern, a well-known indicator of a potential trend reversal after a downtrend.

The left shoulder formed NEAR $160, followed by a head that dipped to the $148–$150 zone. The right shoulder is now roughly at the same level as the left, indicating pattern symmetry.

A confirmed breakout above the neckline, located around $174–$176, especially with volume confirmation, could see $AAVE trade towards the $185–$190 target range.

The only chart for $AAVE you need.

Price action can seem random and chaotic, but through the lens of the Gann angle resonance grid, there is finally some order to the chaos!

Aave has huge potential all the way up to it’s topping channel. The tariff liquidation was again the best… https://t.co/CJtRw4AaJf pic.twitter.com/NrmIhcJJ7n

The 50-day EMA (orange) is acting as dynamic support around $165, a level from which AAVE recently bounced, coinciding with the bottom of the right shoulder.

Meanwhile, the 200-day EMA (red) around $152 supported the head formation, reinforcing bullish sentiment.