Whales Are Quietly Gobbling Up These 3 Tokens—Here’s What Comes Next

Crypto’s smart money is placing big bets before the next rally. These aren’t your grandma’s altcoins—they’re high-octane plays with serious accumulation patterns. Let’s break down where the deep pockets are parking their USDT.

---

The Contenders: Three Tokens With Unusual Whale Activity

Chainlink (LINK): Oracle giant seeing stealth buys from institutional wallets. Network upgrades could trigger a supply crunch.

Solana (SOL): The ’Ethereum killer’ that keeps resurrecting. Whale transactions up 300% since last month’s outage (because nothing says confidence like doubling down after collapse).

Arbitrum (ARB): Layer-2 dark horse with recent governance proposals sparking accumulation. Whales know something retail doesn’t about upcoming protocol changes.

---

The Bottom Line: When these 8-figure wallets move, pumps usually follow—just don’t expect the suits to tell you when they’re taking profits. After all, someone’s got to pay for those yacht upgrades.

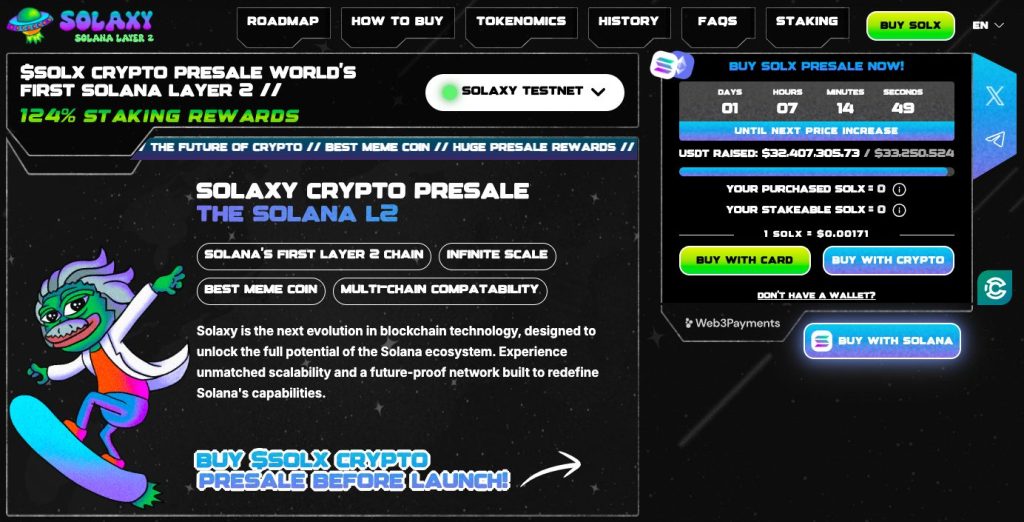

Solaxy ($SOLX): Whales Stockpile Tokens for Solana’s First Layer 2

Solaxy ($SOLX) is shaking up the Solana ecosystem with its first-ever Layer 2 scaling solution.

By improving throughput, reducing transaction fees, and addressing congestion issues, Solaxy is setting the stage for more efficient, scalable network.

It works much the same as Ethereum Layer 2s, processing transactions in a speedier second layer before sending them back to the first layer to get added to the ledger.

Solaxy also integrates seamlessly with Ethereum, allowing for cross-chain liquidity and making it more versatile in the broader DeFi space.

Currently, its tokens are offered at a fixed presale rate of $0.00171 with slight price increases planned as the sale progresses.

With the likeliness of the US SEC approving Solana investment vehicles in the form of spot ETFs, demand for Solaxy ($SOLX) could skyrocket.

The project has already raised over $32.4 million – a clear sign that whales are loading up on SOLX.

Cardano ($ADA): A Veteran in the Race for Institutional Adoption

Cardano ($ADA), with a $25.2 billion market cap, remains a top Ethereum rival and one of the most viral tokens in the space.

Recently, it caught attention after Donald Trump mentioned it as a possible candidate for a U.S. crypto reserve asset as a hold-only asset— a nod to its perceived long-term potential.

Cardano founder Charles Hoskinson, was one of Ethereum’s original creators before parting ways over disagreements about the project’s not-for-profit direction. He went on to build Cardano as a more scalable and transparent blockchain alternative.

According to the chart, Cardano is now breaking out of a descending wedge pattern as shown by the falling green support and red resistance lines. This shape signals a potential breakout.

In the last hour, Cardano has risen 0.4%, reversing a 2.1% loss in the last 24 hours, which was due to a market-wide dip. A relative strength index of 56 and climbing indicates buying momentum, so today’s $ADA holders are likely to turn over a profit by the weekend.

Dogecoin ($DOGE): The Meme Coin That Won’t Quit

Once seen as a joke, Dogecoin ($DOGE) has become a $26.1 billion giant – leading the $59.2 billion meme coin sector and inspiring viral tokens everywhere.

Launched in 2013 as a parody by Billy Markus and Jackson Palmer, Dogecoin now benefits from deep market liquidity, strong brand recognition, and real-world adoption that newer meme tokens can’t match.

Currently trading at $0.1757, Doge is moving in tandem with Cardano, up 0.4% in the past hour.

As one of the largest cryptocurrencies, Dogecoin often behaves more like a traditional asset in the market.

The chart shows DOGE breaking out of a descending wedge – a bullish setup that, if paired with positive news, could trigger a rally toward $0.25, a key support zone.

At the same time, adoption is steadily growing.

Tesla continues to accept DOGE for select purchases, while platforms like PayPal and Revolut have integrated the token, strengthening its position as a legitimate digital asset.