3.7 Million Crypto Tokens Declared Dead—Was Meme Mania the Executioner?

The crypto graveyard just got crowded—3.7 million tokens officially marked ’dead’ in 2025’s post-meme coin hangover. Did reckless speculation finally meet its reckoning?

The Meme Coin Massacre

Pump-and-dump culture left a trail of carcasses: 90% of these tokens never survived their first 12 months. Most were ERC-20 projects with less liquidity than a dried-up faucet.

VCs vs. Degens: Who Blew More Capital?

While retail traders chased dog-themed nonsense, ’serious’ investors pumped $2.3B into metaverse land deals now worth less than a Decentraland screenshot. At least meme buyers got laughs—VCs got Excel sheets full of regrets.

The survivors? Protocols that shipped actual utility (and didn’t rely on Elon Musk tweets). But let’s be real—the next bubble is already brewing. Wall Street’s waiting with their ’blockchain ETFs’ and straight faces.

Why Did 1.8 Million Tokens Collapse in Early 2025?

The first quarter of 2025 alone saw 1.8 million token failures, accounting for 49.7% of all recorded shutdowns.

This surge in failed projects coincided with heightened market instability following Donald Trump’s presidential inauguration in January 2025.

The event triggered a downturn that exposed the fragility of many newly launched, low-effort coins. Politically-themed joke coins were hit hardest.

Tokens like $MELANIA (Melania Trump-themed) and Libra, linked to Argentina’s President Javier Milei, suffered catastrophic losses, each declining more than 95% in value.

Nansen reported that 86% of Libra token traders, around 15,430 wallets, collectively lost over $251 million.

How Pump.fun Fueled the Memecoin Graveyard

According to Coingecko, the rapid expansion of meme coins greatly contributed to recent cryptocurrency market instability.

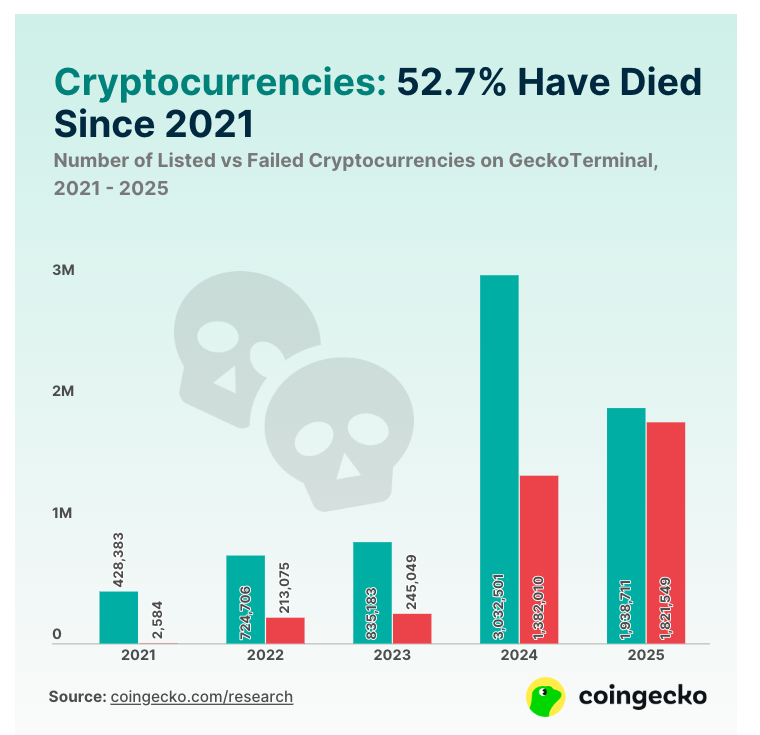

Between 2021 and 2025, the number of tracked crypto projects grew from 428,383 to nearly 7 million.

BREAKING:

PUMPFUN MEMECOINS ARE DUMPING HARD WITH LESS 1% SURVIVAL RATE

UTILITY SUPERCYCLE IS COMING! pic.twitter.com/6F9fOZvXJZ

This growth was largely facilitated by platforms like Pump.fun, a Solana-based service that simplified token creation down to a few clicks, requiring no demonstration of utility or sustainable design.

During the peak “Meme Season 2024” period, Solana-based meme tokens generated billions in daily trading volume.

However, Coingecko data reveals that of the 3 million+ crypto tokens launched that year, over 1.3 million have already failed.

These conditions have spurred widespread criticism of the crypto industry’s unchecked token creation culture.

The ease of launching coins, many without whitepapers, clear roadmaps, or real-world use cases, has diluted the market and undermined investor confidence.

Aside from memecoins, the NFT market, once at the forefront of Web3 development in 2022, has seen its cultural relevance fade. This downturn has contributed to broader concerns about the cryptocurrency industry’s ability to develop and maintain substantive, enduring applications beyond speculative trading.

Are Stablecoins the Only Reliable Crypto Bet Now?

From just 66 coins in 2013 to millions today, the 13,573% rise in token creation has not been matched by long-term viability.

Unlike past bull runs in 2017 and 2021, where altcoins rallied en masse, the current market has seen most altcoins remain down at least 40% from their prior all-time highs.

Why ALTSEASON is delayed ?

In 2013-2014 – 500 tokens

In 2017-2018 – 3,000 tokens

In 2021 – 300k- 3M tokens

Today in 2025 – 36.4 million Tokens

and expected to reach 100 million.

Market is Diluted AF, Exchanges only

listing memes to grab volume and

grow their user base.… pic.twitter.com/kf6ov8owGe

This stagnation has tarnished the broader image of the crypto sector. Traditional investors now see crypto as just a “pump-and-dump arena” — and the data backs their skepticism.

As a result, cautious capital tends to concentrate on blue-chip assets like Bitcoin, Ethereum, XRP, and Solana, which are also in negative YTD territory.

Amid the chaos, stablecoins have emerged as one of the most robust crypto use cases.

As of April 29, the total stablecoin market cap reached $240 billion, nearing an all-time high. Tether (USDT) holds the majority, with a 61.92% market share, followed by USDC, USDe, and DAI.

Even traditional finance is taking note. In a recent report, Citigroup projected that the stablecoin market could exceed $2 trillion by 2030, assuming regulatory clarity and continued adoption.

Citigroup has projected a rise in stablecoin market, forecasting its total market cap to soar from $240 billion to $2 trillion by 2030. #Stablecoin #Citigrouphttps://t.co/tGNT3XfNC0

Citigroup has projected a rise in stablecoin market, forecasting its total market cap to soar from $240 billion to $2 trillion by 2030. #Stablecoin #Citigrouphttps://t.co/tGNT3XfNC0

Even Federal Reserve Governor Christopher Waller acknowledged their potential, stating that U.S. dollar-backed stablecoins could support the dollar’s international dominance.

Frequently Asked Questions (FAQs)

Why did Trump’s inauguration trigger a memecoin crash?The crypto community expected Trump to mention digital assets or announce pro-crypto policies. When he omitted any reference to cryptocurrencies or Bitcoin, traders saw this as government indifference. This triggered massive sell-offs, and the price slump was particularly felt in politically themed memecoins that had rallied in anticipation.

Which blockchain has the highest token failure rate?Solana currently has the highest token failure rate. Its low fees and easy-to-use tools like Pump.fun enabled a flood of low-quality memecoins. While Ethereum sees failures too, Solana’s combination of accessibility and hype create perfect conditions for disposable tokens, and many projects vanish within weeks as creators cash out, leaving investors helpless.

Do dead crypto tokens impact Bitcoin and Ethereum prices?Dead tokens mainly damage confidence in speculative altcoins rather than major assets. While Bitcoin and Ethereum may see brief dips during mass sell-offs, their prices typically recover quickly.