UK Cracks Down on Crypto Wild West With New Anti-Scam Rules—Plots Cross-Border Sandbox With US

London tightens the screws on digital asset chaos as Treasury unveils draft regulations targeting pump-and-dumps, rug pulls, and other creative forms of financial arson.

The proposed framework—arriving just in time for the next bull run’s inevitable fallout—prioritizes consumer protection while leaving room for ‘responsible innovation’ (translation: banks want in).

Buried in the fine print: Plans for a joint regulatory sandbox with US agencies, because nothing unites nations faster than shared panic over unregulated money.

Bonus jab: The FSA’s 87-page consultation document somehow avoids mentioning stablecoins’ habit of becoming un-stable at mathematically convenient moments.

Chancellor Reeves Unveils Crypto Regulation Draft at London Fintech Summit

The legislation will bring cryptoasset services, including exchanges, dealers, and custodians, within the scope of traditional financial regulation.

Firms offering services for cryptoassets, such as Bitcoin and Ethereum, will be required to meet clear standards on transparency, consumer protection, and operational resilience.

The government hopes this will help prevent scams, reduce risk to consumers, and create a safer environment for legitimate innovation.

UPDATE THE UK JUST DROPPED DRAFT RULES TO REGULATE CRYPTO EXCHANGES AND STABLECOINS! pic.twitter.com/AWY1HejKA1

THE UK JUST DROPPED DRAFT RULES TO REGULATE CRYPTO EXCHANGES AND STABLECOINS! pic.twitter.com/AWY1HejKA1

Crypto ownership in the UK has grown increasingly in recent years. According to research by the Financial Conduct Authority, 12% of UK adults either currently hold or have previously held cryptoassets, a sharp increase from 4% in 2021.

But this rising adoption has also come with increased risks, as scams and failures among crypto firms have left many investors vulnerable.

The new framework will ensure that companies dealing with UK customers are held to the same regulatory standards as those in conventional finance.

Reeves said that “through our Plan for Change, we are making Britain the best place in the world to innovate — and the safest place for consumers.”

He added, “Robust rules around crypto will boost investor confidence, support the growth of fintech and protect people across the UK.”

The draft legislation follows the UK Treasury’s 2023 consultation, which proposed a framework to bring a broad range of crypto-related activities under the purview of financial regulation.

The government has stated it will introduce final legislation “at the earliest opportunity,” following feedback from industry stakeholders.

UK and U.S. Explore Joint Digital Asset Sandbox, Says Chancellor Reeves

Alongside the domestic regulatory push, the UK is also pursuing international cooperation on digital assets. Reeves announced that discussions are underway with the United States to explore a cross-border sandbox for digital securities, a space where firms in both countries could test new products and services under coordinated oversight.

The proposal, first suggested by SEC Commissioner Hester Peirce, is expected to be further explored through the upcoming UK-U.S. Financial Regulatory Working Group.

The Chancellor recently met with U.S. Treasury Secretary Scott Bessent in Washington to discuss opportunities for transatlantic collaboration in fintech and digital assets.

The talks included ideas for supporting innovation and creating shared regulatory environments to help firms scale across borders.

The UK government plans to publish its first Financial Services Growth and Competitiveness Strategy on July 15, identifying fintech as a key sector for long-term development.

Final cryptoasset legislation will be introduced following industry engagement on the current draft.

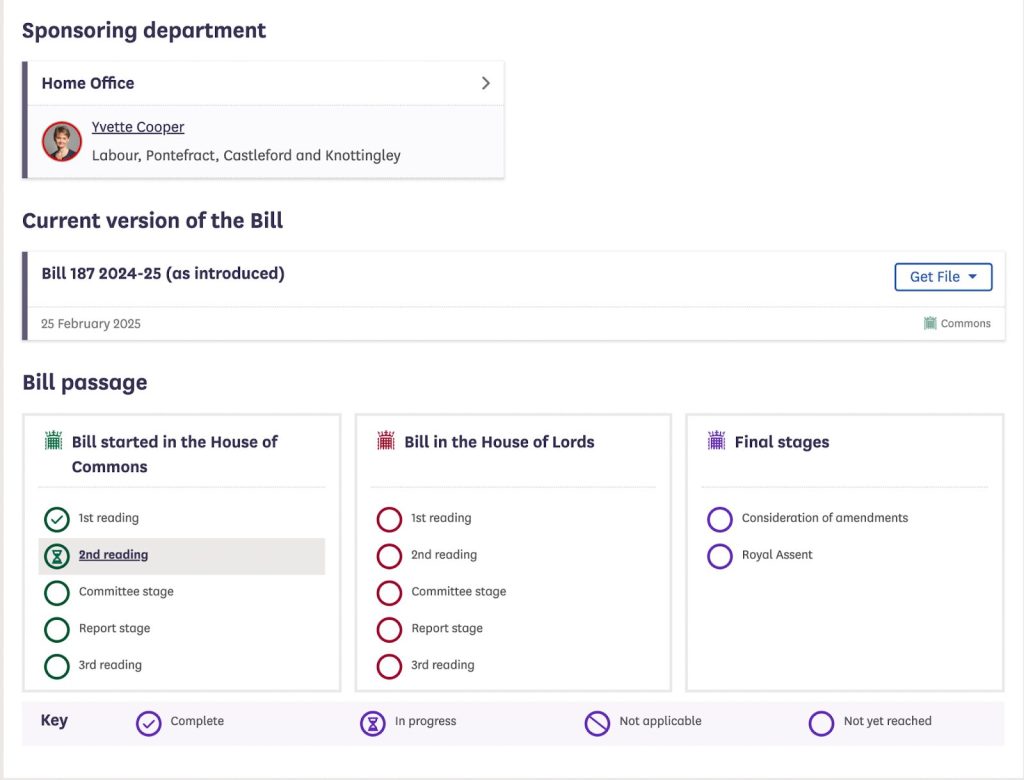

As part of its broader push to tighten crypto oversight, the UK introduced the Crime and Policing Bill on 27 March, expanding law enforcement’s authority to seize digital assets linked to criminal activity.

Now in its second reading in the House of Commons, the bill proposes stronger confiscation powers for Crown Courts and clearer rules on handling unsellable or destroyed crypto.

It builds on the Economic Crime and Corporate Transparency Act of 2023 and follows a string of enforcement actions, like the FCA’s December 2024 move to block access to Pump.fun.

Since early 2024, UK authorities have frozen £6 million in crypto linked to illicit gains, including £1.5 million held in a single Coinbase wallet.