Bittensor Surges 19% Amid AI Token Mania—Is $500 the Next Stop for $TAO?

AI tokens are stealing the crypto spotlight again—and Bittensor’s TAO is leading the charge with a 19% rally. Retail traders are piling in, chasing the next ’sure thing’ in a market that never learns.

Can TAO crack $500? The chart says maybe. The fundamentals say ’good luck explaining that to your accountant.’

Behind the hype: Bittensor’s decentralized machine learning network keeps gaining traction. But let’s be real—half the buyers probably think ’AI token’ means it’ll write their trading bots for them.

Key levels to watch: A clean break above $450 could trigger FOMO buys. Below $380? Cue the ’rug pull’ tweets from the same geniuses who called it ’undervalued’ last week.

One thing’s certain: When the suits start pitching AI tokens as ’the new internet,’ it’s time to check your stop-losses—and your sanity.

Bittensor ($TAO) Emerges as AI Crypto Leader

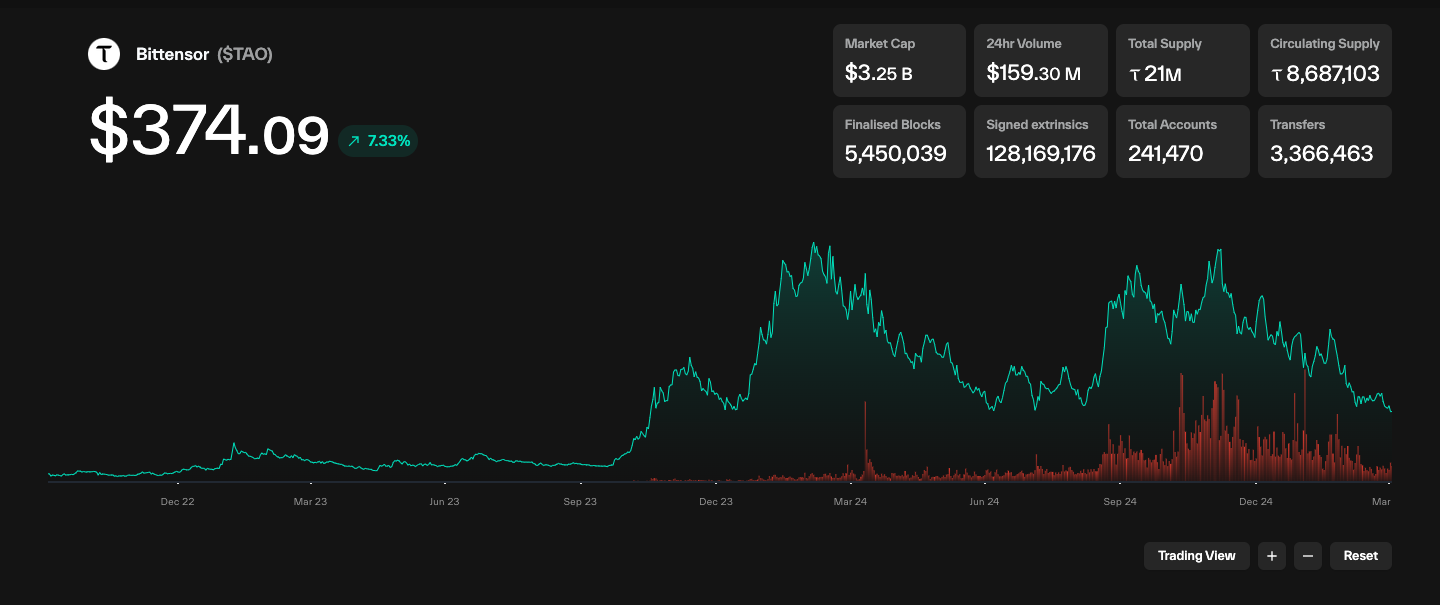

Bittensor ($TAO) has cemented its place as the leading AI token by market share, reaching a valuation of $3.24 billion and overtaking NEAR Protocol ($NEAR), which currently holds a market cap of $3.12 billion.

The project was created as a decentralized peer-to-peer marketplace where users can share and monetize AI models.

$TAO serves as the network’s native token, incentivizing participants to contribute to develop and expand decentralized AI technologies.

Since its inception, $TAO has exhibited marked price volatility, twice surpassing $700 in 2024 before retracing to around $200 on both occasions.

$TAO hits $700

Setting a new All time high for #Bittensor pic.twitter.com/pUC7ZYYB70

As of press time, $TAO is trading NEAR $374, reflecting a 19.27% increase over the past seven days and spearheading the rally among AI-related cryptocurrencies.

Data from Messari shows growing interest in Bittensor’s derivatives market, with futures volume exceeding $175 million and open interest sitting around $183 million.

Network Growth and Real-world Integration

On-chain metrics point to continued network strength. Over 6.2 million $TAO tokens have been staked, representing a 72% increase year-to-date out of a total of 8.4 million tokens in circulation.

Bittensor is also expanding its reach beyond the crypto sphere.

On January 27, the project integrated DeepSeek AI’s large language models (LLMs) into two subnets, granting users free access to DeepSeek’s capabilities for blockchain-related tasks.

$TAO – @deepseek_ai has now been integrated within Bittensor.

As @BarrySilbert’s quoted; "Bittensor $TAO is going to eat the AI world". pic.twitter.com/jM4GrPoB5c

Another major milestone came when Grayscale Investments launched the Grayscale Bittensor Trust in October 2024.

This investment vehicle offers institutional investors exposure to $TAO through a traditional security, eliminating the complexities associated with direct token custody. Grayscale currently holds over $10 million worth of $TAO for its clients.

Although the Trust’s Net Asset Value (NAV) currently stands at $6.99 per share, more than 50% below its December 2024 peak of $14.04, market sentiment suggests TAO could be on track for a strong recovery.

Technical Resistance Ahead: Will $TAO Break Past $498?

Following a clear bottom formation in the $160–$170 range, the TAO/USDT 4-hour chart shows a reversal in market structure.

A five-wave Elliott Wave correction pattern appears to have been completed, indicating the end of the downtrend.

On March 10, $TAO broke above key resistance at $222.4 with increasing volume, confirming a shift toward bullish momentum.

Since then, the price has steadily advanced, recently breaching the $375.2 resistance zone and consolidating near $373.3.

Technical indicators continue to support the bullish bias.

The MACD remains in positive territory, with the MACD line trading above the signal line, although narrowing slightly, which is a sign of sustained upward momentum despite minor consolidations.

$TAO

Looks like a reclaim on the daily timeframe, should be good for continuation into $450+ where next resistance awaits

retest around $280 are for buying if it happens https://t.co/PHuQZKr7Eq pic.twitter.com/nhGBSNmq4u

Looking ahead, the next major is around $498.8. If bulls maintain the current momentum and hold support above $375.2, a rally toward this next target appears achievable.

Conversely, a pullback could see TAO retest the $320–$330 zone before attempting another leg higher.