Celsius Collapse Fallout: 200+ Victims Demand Justice as Mashinsky’s Sentencing Looms

Celsius creditors swarm court filings—Mashinsky’s reckoning arrives as crypto’s ’trust us’ era faces brutal accountability.

Subheader: From Yield Promises to Handcuffs

The same platform that lured users with double-digit APY now delivers a masterclass in financial carnage. Victims’ pleas read like a graveyard of DeFi’s broken promises.

Subheader: Sentencing Day = Crypto’s Reality Check

Prosecutors sharpen their knives while traders whisper—when the music stops, the ’geniuses’ always have chairs. The rest get paperwork.

Clawback Lawsuits Deepen the Pain for Celsius Victims

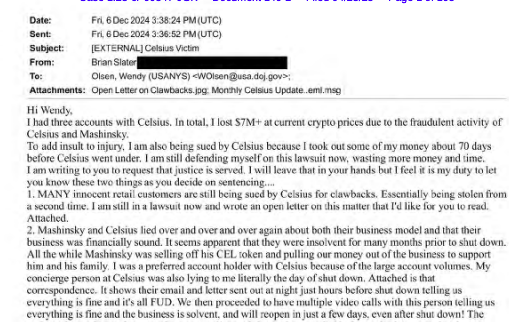

One victim, Brian Salter, lost over $7 million across three Celsius accounts. Despite this, he now faces a lawsuit from Celsius for withdrawing funds before the collapse, a move the company calls a “clawback.”

“I am still defending myself in this lawsuit now, wasting more money and time,” he wrote, expressing both frustration and disbelief.

Salter’s experience is similar to that of most Celsius victims’: many were repeatedly assured by Mashinsky and company representatives that the platform was financially sound and customer assets were secure, even in the days leading up to its withdrawal freeze.

I just received a letter in the mail today.

I am being summoned in a New York Bankruptcy Court by Celsius Network LLC.

They’re trying to claw back HUNDREDS of THOUSANDs dollars that I withdrew before the collapse. Their goal is to take the money I initially deposited. pic.twitter.com/eXmizFfjF7

Several victims were reassured by Celsius staff, that the company would not collapse.

When withdrawals froze in mid-2022, users were stranded. One customer had over 80% of his net worth tied to the platform.

“I obviously know now that was the biggest financial mistake of my life,” he said.

Others voiced anger over the proposed retail clawbacks targeting users who withdrew over $100,000 within 90 days of the shutdown, a group limited to around 1,900 people.

“If stealing from innocent people is unethical, it doesn’t become ‘right’ just because the sum is over $100K,” one user stated. “The solution to theft isn’t more theft. We’re here because of the abuse by Mashinsky and his executives, not the people trying to protect their savings.”

Mashinsky’s Plea Deal Reshapes Crypto Fraud Accountability

Founded as a crypto lending platform, Celsius once allowed users to deposit crypto to earn yield and take out loans using crypto as collateral.

In July 2022, Celsius filed for bankruptcy. A year later, the Justice Department charged Mashinsky with seven counts of fraud, alleging he misled investors and orchestrated a multibillion-dollar scheme.

Today we charged Celsius and its Alex Mashinsky with fraud and the unregistered offer and sale of securities.

https://t.co/BoulI5RzVh pic.twitter.com/E9ygRtwC7g

The former Celsius boss accepted a plea deal, admitting to commodities and securities fraud, crimes that carry a maximum sentence of 30 years if served consecutively. His admission sets a rare precedent in the crypto sector where a founder accepted personal liability rather than hide behind corporate bankruptcies.

The CFTC also ruled that both Celsius and Mashinsky had violated U.S. trading laws and failed to register the platform appropriately.

After protracted legal proceedings, Celsius began returning funds to creditors in August 2024, ultimately paying back about 84% of the total assets owed, amounting to $3 billion.

However, not all affected users have received or even claimed their assets.

According to court filings, 64,000 creditors are owed less than $100, while 41,000 others are due between $100 and $1,000 in crypto.

With crypto prices surging, many of these small claims would be worth much more today if they had been held.

DOJ’s New Rules Target Crypto Lending Risks Post-Celsius

The fallout from Celsius and similar bankruptcies like FTX, Voyager, Genesis, and Gemini has pushed the U.S. Department of Justice to reconsider how victims of digital asset bankruptcies are compensated.

In an April 7 memo, the DOJ announced it is weighing regulatory reforms or legislative fixes to ensure fairer outcomes.

Deputy Attorney General Todd Blanche: "Ending Regulation by Prosecution." “The Department of Justice is not a digital assets regulator.” “The Justice Department will no longer pursue litigation or enforcement actions that have the effect of superimposing regulatory frameworks on… pic.twitter.com/t5IiwERGZs

— Richard Heart (@RichardHeartWin) April 8, 2025Under current rules, creditors are typically compensated in fiat based on the value of crypto at the time of bankruptcy, often far below today’s market rates.

For instance, Bitcoin was trading at around $19,820 when Celsius filed for bankruptcy in July 2022. It is now trading above $92,000, showing the vast financial gap created by existing laws.

The DOJ’s reassessment could lead to the first major update to U.S. bankruptcy laws as they apply to crypto, setting a precedent for future enforcement actions and investor protections.

Frequently Asked Questions (FAQs)

How does crypto bankruptcy work and where do funds come from to repay customers?A crypto company files for bankruptcy when it runs out of money and can’t pay what it owes. Courts take control. They order the company to repay users by selling assets, squeezing out every possible dollar. Some companies liquidate, turning Bitcoin, property, and investments into cash. Others slash costs, stall payments, or hunt for emergency funding.

How much did Celsius lose following its bankruptcy filing?Celsius blew a $1.2 billion hole in its balance sheet. When it declared bankruptcy, the crypto lender owed customers $4.7 billion in deposits. How? It gambled with deposits, loaned recklessly, and then froze withdrawals when crypto prices tanked.

Has there been any other bankruptcy cases in crypto since 2023?Yes. Silvergate Bank collapsed in early 2023 after the crypto meltdown gutted its business. By September 2024, its parent company, Silvergate Capital, surrendered and filed for bankruptcy.