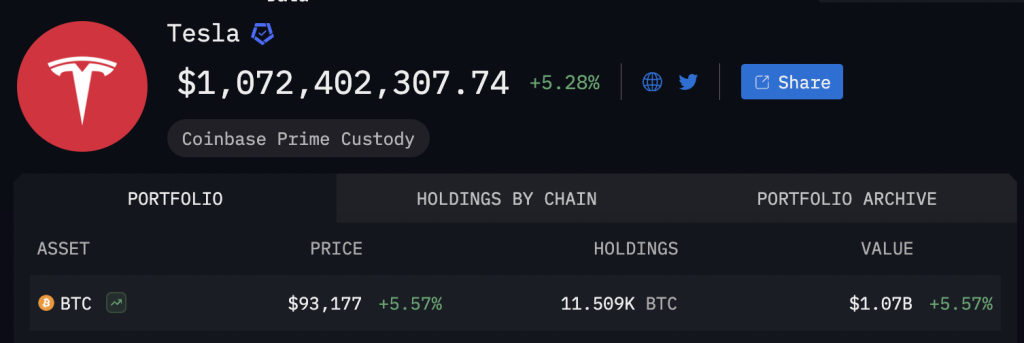

Tesla Holds Firm on $951M Bitcoin Bet as Auto Revenue Skids 20% in Q1

Despite a brutal quarter for its core business, Tesla refuses to flinch on its crypto gamble—proving once again that corporate treasuries treat digital assets like a Vegas weekend. The EV giant’s latest earnings report reveals unchanged Bitcoin holdings valued at $951 million, even as automotive revenues cratered by 20%. Meanwhile, Elon’s silence on Dogecoin leaves meme coin bagholders sweating more than a Cybertruck in Death Valley.

Image Source: Arkham

Image Source: Arkham

FASB Rule Change Lifts the Lid on Unrealized Bitcoin Gains

This isn’t the first time Tesla’s financials have reflected the impact of new accounting standards for digital assets. The latest figure comes under the Financial Accounting Standards Board’s updated rule requiring companies to mark crypto holdings to market each quarter.

Previously, companies had to record the lowest value of the asset during the reporting period, often obscuring unrealised gains. The change now allows firms like Tesla to present a more accurate view of their digital asset positions.

It also comes at a time when institutional confidence in Bitcoin is strengthening, despite ongoing macroeconomic uncertainty.

Q1 Earnings Fall Short as Tesla Battles Cost Pressures and Slowing Demand

Total revenue declined 9% to $19.3b, down from $21.3 billion a year ago. Automotive revenue fell 20%, dropping to $14b from $17.4b in the same quarter last year.

Net income plunged to $409m, or 12 cents per share, down sharply from $1.39b, or 41 cents, a year earlier. The company did not issue new growth guidance for the year and said it would revisit its 2025 outlook in the next quarter.

CEO Elon Musk has been spending significant time in Washington, working with the Trump administration on a broad plan to reduce the size of the federal government. The White House’s sweeping tariff policy has raised concerns for EV manufacturers, as higher import costs for key inputs such as battery components, circuit boards and specialty glass threaten to erode margins.