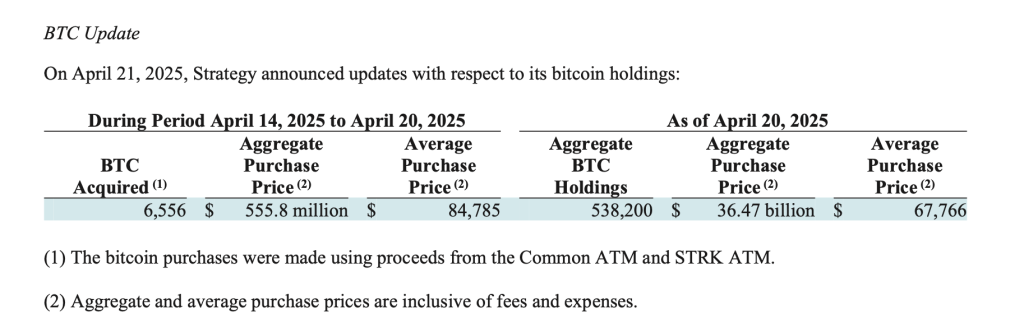

Investment Strategy Allocates $555 Million to Bitcoin—Portfolio Surges to 538K BTC Amid Rising Debt Concerns

A major investment strategy has significantly increased its Bitcoin holdings, adding $555 million worth of BTC to its reserves. This move brings the total stash to 538,000 BTC, underscoring a strong bullish stance despite looming debt obligations in the broader financial market. The accumulation highlights growing institutional confidence in Bitcoin as a hedge against macroeconomic uncertainty, even as debt-related risks persist.

Despite the volatile nature of cryptocurrency markets, the company’s BTC yield for the year-to-date has reached an impressive 12.1%, showing both timing and market momentum.

Saylor’s unwavering belief in Bitcoin as a superior store of value continues to drive this aggressive acquisition strategy.

By using capital markets and maintaining a buy-and-hold approach, Strategy has positioned itself not only as a software company but also as a prominent institutional force in the digital asset space.

This most recent purchase displays continued confidence in Bitcoin’s long-term value and shows how traditional corporations can use financial tools to gain exposure to digital assets.

Strategy May Need to Sell BTC at a Loss to Cover Debt

According to a recent regulatory filing, Strategy revealed it may be forced to sell some of its Bitcoin holdings to meet financial obligations, potentially below cost basis.

Earlier this month, Strategy’s debt burden stood at $8 billion, with $35 million in annual interest and $150 million in yearly dividends further tightening the noose.

The firm’s software operations no longer generate enough revenue to sustain these obligations, and the long-touted promise of Bitcoin’s perpetual appreciation is being put to a brutal test.

Strategy’s Bitcoin playbook was initially praised for entering Bitcoin early, ahead of the 2021 bull run; the company expanded its holdings through a mix of convertible debt and equity offerings.

On April 7, Strategy also halted its Bitcoin purchases during a period of global financial instability, according to a filing submitted to the U.S. Securities and Exchange Commission.

The pause marked a shift in the firm’s usual aggressive Bitcoin acquisition strategy and came as digital asset markets reacted to fresh geopolitical risks. A legal filing dated April 7 revealed that Strategy did not purchase any Bitcoin between March 31 and April 6.