Dalio Warns: U.S. Crisis Looming as Bitcoin Faces Intense American Selling Pressure

Ray Dalio's latest warning hits like a market correction—the U.S. is teetering on the edge of a financial precipice. And Bitcoin, the supposed hedge against systemic failure, finds itself caught in the crossfire of domestic sell-offs.

The American Exodus

Forget foreign FUD. The real pressure cooker is domestic. U.S.-based investors are dumping digital assets, creating a gravitational pull that's trapping Bitcoin's price action. It's a classic case of the 'safe haven' narrative colliding with on-chain reality—when liquidity dries up at home, even crypto feels the squeeze.

Dalio's Dire Calculus

The Bridgewater founder isn't mincing words. Debt cycles, political polarization, and dollar dominance challenges are converging. His thesis suggests traditional hedges might falter—and now crypto's proving equally vulnerable to good old-fashioned American profit-taking. Nothing unravels a bullish thesis faster than investors actually needing their money back.

Bitcoin's Institutional Bind

Here's the ironic twist: the very institutional adoption that promised price stability is now amplifying the sell pressure. Pension funds, ETFs, and corporate treasuries—they all have redemption buttons too. When traditional markets wobble, everything becomes correlated. Even digital gold.

The cynical take? Wall Street spent years figuring out how to package crypto for mainstream consumption, only to discover the product works exactly like everything else they sell—it goes down when people need to sell it. The revolution will be monetized, and then liquidated, apparently.

So we're left watching the ultimate stress test: can Bitcoin decouple from American balance sheets before the broader system cracks? The answer might determine whether it graduates from speculative asset to actual hedge—or becomes just another casualty of the very crisis it was supposed to transcend.

Dalio’s Crisis Warning Meets Bitcoin’s Range-Bound Reality

Dalio’s long essay positions current American conditions within Stage 5 of his Big Cycle framework, where “” precede systemic breakdown.

“We are now clearly on the brink of crossing from Stage 5 (pre-breakdown) to Stage 6 (breakdown),” he wrote, pointing to unsustainable debt loads that force governments to either “print a lot of money, which depreciates its value” or implement painful austerity.

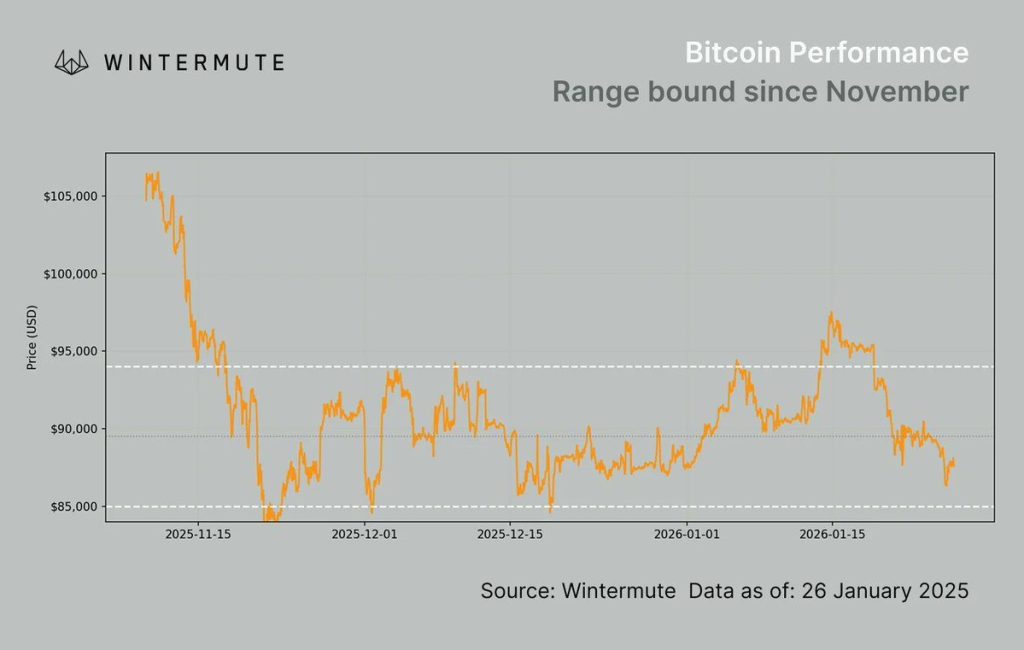

The analysis comes as Bitcoin trades range-bound for 60 consecutive days, an unusual pattern for an asset class often marketed as protection against exactly the monetary debasement Dalio describes.

Gold climbed above $5,066 per ounce on Tuesday while silver surged 6.4% to $110.60, both setting fresh records as investors sought traditional inflation hedges.

Dalio warned that “later stages may involve capital controls, reserve freezes, and cross-border restrictions, turning funds into political tools,” conditions that typically favor “freely transferable assets” and investments “prioritizing resistance to freezing and blockades.“

Bitcoin proponents have long argued that crypto fits this profile, yet the asset has failed to attract safe-haven flows amid elevated macro uncertainty.

U.S. Institutions Drive Selling as ETF Flows Turn Negative

Wintermute’s OTC desk identified American selling pressure as the primary force keeping Bitcoin suppressed within its trading range.

“The Coinbase premium confirms it. US counterparties are net sellers, more so than Europe (marginal buyers) or Asia (neutral),” the firm’s market update stated, noting that “ETFs drive momentum in this market; when that bid disappears, you get choppy, directionless price action.“

U.S. spot Bitcoin ETF products recorded their largest weekly outflow since February 2025 last week, reversing the strong inflows that accompanied January’s brief breakout attempt toward $97,000.

The failure of that rally left Bitcoin back in the middle of its established range, with $85,000 serving as tested support.

CryptoQuant’s on-chain analysis suggests the selling pressure also comes from opportunistic profit-taking rather than forced capitulation.

The Miners’ Position Index printed NEAR -1.5, indicating miners “are now selling less than their 1-year average” after aggressive inventory monetization at $110,000-$120,000 levels.

Similarly, exchange whale ratios remain elevated, but deposits fall “well below prior spike highs, implying tactical, price-sensitive distribution rather than all-in capitulation.“

Catalyst-Rich Week Could Break Two-Month Deadlock

Speaking with Cryptonews, Arthur Azizov, Founder at B2 Ventures, framed Bitcoin’s weakness within the context of competing safe-haven narratives.

“When uncertainty rises, capital first moves into classic defensive assets. We see this now from gold breaking above $5,000,” Azizov said, adding that “Bitcoin is often called ‘digital gold,’ but in reality, it’s still, first and foremost, a risk asset.“

Multiple macro catalysts converge this week that could finally break Bitcoin from its compressed range.

The Federal Reserve announces its policy decision on Wednesday alongside key earnings from Microsoft, Meta, Tesla, and Apple, while Trump’s fresh 25% tariff threat against South Korea adds geopolitical uncertainty.

Wintermute analysts expect continued consolidation absent a clear directional catalyst.

“Sixty days of compression meeting this much event risk, something gives,” the firm concluded, identifying $85,000 as the critical support level with ETF Flow reversal required before Bitcoin can “break convincingly above mid-$90K levels.“

Market Performance Indicates Cautious Recovery

Bitcoin traded at $88,553 earlier today and rose 1.4% as Asian markets opened with tentative Optimism despite fresh tariff threats.

However, at the time of writing, Bitcoin is back below the $88K support level, pushing the total crypto market cap to $3.06 trillion, down 0.18% on the day.

The uncertain trajectory came as broader risk assets found footing ahead of the Fed decision, though Azizov’s “,” with expectations that Bitcoin will “,” which previously served as strong support through late 2025.