GhostSwap Dominates 2026: The Anonymous Crypto Exchange Redefining Private Swaps

Privacy isn't a feature—it's the foundation. As regulatory nets tighten globally, one decentralized exchange has become the sanctuary for traders who value discretion above all else. GhostSwap isn't just another DEX; it's a silent revolution on the blockchain.

The Architecture of Anonymity

Forget KYC forms and intrusive tracking. GhostSwap's protocol cuts out the middleman entirely, executing swaps through a non-custodial system that leaves no centralized paper trail. It bypasses traditional order books, using liquidity pools where your transaction blends into the collective flow—untraceable and final. The tech leverages zero-knowledge proofs to validate transactions without revealing a single detail about the parties or amounts involved. It's the digital equivalent of a sealed envelope passed in a crowded room.

Why 2026 is the Tipping Point

This isn't just paranoia; it's portfolio management. With several governments proposing draconian transaction surveillance laws and banks freezing accounts based on crypto activity, the demand for financial sovereignty has skyrocketed. GhostSwap meets that demand head-on, offering a haven for everyone from the privacy-conscious retail investor to the institution testing decentralized waters—all while traditional finance scrambles to put genies back in bottles.

The Trade-Off: Speed for Secrecy

Absolute privacy comes with its own calculus. Transactions might take a few extra blocks to settle as they route through GhostSwap's obfuscation layers. And you'll pay for the privilege—liquidity fees can be a notch above your garden-variety DEX. But for its users, that's not a cost; it's an insurance premium. A premium against exposure, against seizure, against the prying eyes of competitors and regulators alike. After all, what's a few basis points compared to the sanctity of your financial strategy?

A Necessary Counterweight

GhostSwap represents the purist's response to an increasingly monitored financial ecosystem. It doesn't just enable private swaps; it guarantees them by design. In a world where your every digital move can be commoditized, maintaining a corner of your economic life that's truly your own isn't just appealing—it's essential. It's the defiant answer to the surveillance state, proving that on the blockchain, freedom of transaction is still non-negotiable. Let the traditional banks keep their ledgers; the future is anonymous, decentralized, and already here.

The Problem: Crypto Exchanges Know Everything About You

When Satoshi Nakamoto created Bitcoin, the vision was clear: peer-to-peer electronic cash without trusted third parties. No banks. No intermediaries. No surveillance.

Fast forward to 2026, and most crypto trading looks nothing like that vision.

What Centralized Exchanges Collect

To use Coinbase, Binance, Kraken, or any major exchange, you must provide:

- Government ID – passport, driver’s license, national ID

- Selfie verification – often with liveness detection

- Proof of address – utility bills, bank statements

- Phone number – linked to your real identity

- Email address – often your primary personal email

- Bank accounts – for fiat deposits/withdrawals

- Employment information – some exchanges ask your occupation

- Source of funds – where your money comes from.

This isn’t optional. Without KYC (Know Your Customer) verification, you can’t trade.

Why This Matters

Crypto exchanges are prime targets for hackers. Not just for the crypto – for the identity data. In recent years, major breaches have exposed millions of users’ personal information:

- Names and addresses linked to crypto holdings

- Transaction histories showing wealth levels

- ID documents enabling identity theft

- Phone numbers enabling SIM swap attacks.

When an exchange gets hacked, your identity is compromised forever. You can change your password. You can’t change your passport number, the GhostSwap team says.

Exchange data is routinely shared with government agencies. Tax authorities, law enforcement, and intelligence services can request (or subpoena) your complete transaction history. Some jurisdictions require exchanges to proactively report user activity.

Even if they’ve done nothing wrong, many users do not want every government agency to know exactly how much crypto they own and every transaction they’ve ever made.

Exchanges analyze your trading patterns, holdings, and behavior. This data is valuable for targeted advertising, credit scoring, insurance pricing, and purposes you’ll never know about, GhostSwap notes.

Centralized exchanges can freeze your funds at any time. Suspicious activity flags, compliance reviews, or simply being from the wrong country can lock you out of your own money, sometimes permanently.

The Solution: Anonymous Crypto Exchanges

An anonymous crypto exchange lets you trade without revealing your identity. No accounts. No KYC. No personal data collection.

How Anonymous Exchanges Work

Unlike centralized platforms, anonymous exchanges operate on a simple model:

That’s it. No registration. No identity verification. No ongoing account relationship.

Types of Anonymous Exchanges

Platforms like GhostSwap execute swaps in minutes. You interact only for the duration of the swap – no persistent account stores your data.

On-chain platforms like Uniswap or dYdX where you trade directly from your wallet. Fully decentralized but limited to single-chain tokens (can’t swap BTC for ETH on Uniswap).

Marketplaces connecting buyers and sellers directly. More complex and slower, but maximum privacy when done correctly.

Trustless cross-chain swaps using cryptographic protocols. Technically elegant, but limited liquidity and pairs.

For most users seeking privacy with convenience, instant swap services offer the best balance.

Why Use GhostSwap for Anonymous Crypto Trading

Among anonymous exchanges, GhostSwap stands out for several reasons:

True No-KYC Policy

Many exchanges claim “no KYC” but trigger verification requests for larger amounts or certain coins. GhostSwap says it processes over 99.5% of swaps without any identity verification, regardless of amount or cryptocurrency.

No accounts. No emails. No phone numbers. No ID uploads. Ever.

1,600+ Cryptocurrencies

GhostSwap supports more coins than most competitors:

- Major coins: BTC, ETH, SOL, XRP, ADA, DOT, AVAX

- Privacy coins: XMR (Monero), ZEC (Zcash)

- Stablecoins: USDT, USDC, DAI, BUSD (multiple networks)

- Meme coins: DOGE, SHIB, PEPE, BONK, FLOKI

- DeFi tokens: UNI, AAVE, LDO, ARB, OP

- And 1,500+ more.

If it’s a legitimate cryptocurrency, GhostSwap probably supports it.

Cross-Chain Private Swaps

This is where GhostSwap says it shines. You can privately swap between completely different blockchains:

- Bitcoin to Ethereum – BTC → ETH

- Ethereum to Monero – ETH → XMR

- Solana to Bitcoin – SOL → BTC

- USDT to Monero – Stablecoin → Privacy coin.

Users can’t do this privately on a DEX, as they only work within single ecosystems.

Non-Custodial Architecture

GhostSwap claims it never holds users’ funds in an account balance.

The swap flow:

No “exchange wallet” accumulating your assets. No balance that could be frozen or a honeypot for hackers to target.

Proven Track Record

GhostSwap reports:

- $750M+ in completed swap volume

- 1.5M+ users served

- Years of continuous operation.

Scam platforms don’t reach these numbers, the team says, adding that legitimate volume at this scale indicates a real, functioning business.

Fast Execution

Most swaps complete in 10-30 minutes, depending on blockchain confirmation times. bitcoin swaps take longer (more confirmations required). Solana and Tron swaps are nearly instant.

Telegram Bot Access

GhostSwap offers a Telegram bot for swapping directly in the messaging app. No website needed. Useful when:

- Traveling with restricted internet

- Wanting extra privacy (Telegram’s encryption)

- Preferring mobile convenience.

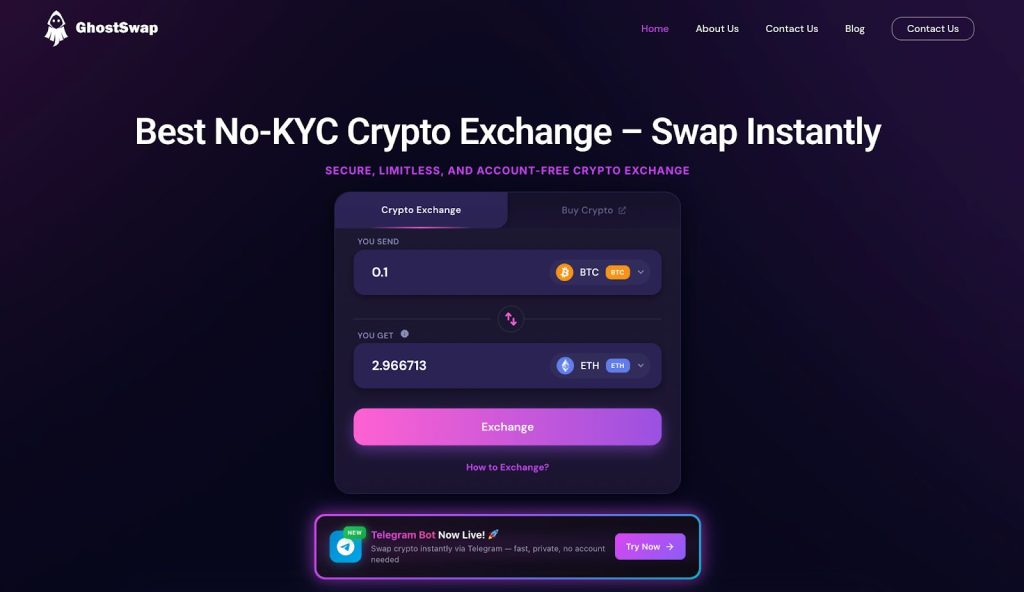

How to Make a Private Swap on GhostSwap

Here’s exactly how to swap crypto anonymously:

Step 1: Go to GhostSwap

Visit ghostswap.io or open the Telegram bot.

No account creation. No email signup. Just the swap interface.

Step 2: Select Your Trading Pair

Choose:

- You send: The crypto you’re swapping away (e.g. BTC)

- You receive: The crypto you want (e.g. ETH).

The interface shows the current exchange rate and the estimated received amount.

Step 3: Enter the Amount

Type how much you want to swap. GhostSwap displays:

- Exchange rate

- Network fees

- Final amount you’ll receive.

Minimums are low (a few dollars), the team says. Maximums are generous, they add. There are no artificial limits pushing users toward KYC.

Step 4: Provide Your Receiving Address

Enter the wallet address where you want your swapped crypto sent.

Use a wallet you control. Not an exchange wallet. Self-custody preserves your privacy.

Recommended wallets:

- Bitcoin: Electrum, Sparrow, Ledger, Trezor

- Ethereum: MetaMask, Rabby, Ledger, Trezor

- Monero: Feather Wallet, Cake Wallet, Monero GUI

- Multi-chain: Trust Wallet, Exodus.

Step 5: Send Your Crypto

GhostSwap provides a deposit address. Send your crypto from any wallet.

You’ll receive a transaction ID to track the swap’s progress.

Step 6: Receive Your Swap

Once your deposit confirms on the blockchain, the swap executes automatically. Your new crypto arrives in your wallet within minutes.

Done. No account created, identity revealed, or data stored, says the team.

The team invites everyone to try a private swap via the official website.

Best Anonymous Swaps for Privacy

Some swap pairs offer more privacy benefits than others, GhostSwap says.

Maximum Privacy: Swap TO Monero

Monero (XMR) is the gold standard for financial privacy. Its technology makes transactions untraceable.

Swapping any transparent cryptocurrency to Monero is the ultimate privacy move:

Once you hold XMR, your subsequent transactions are completely private, the team claims.

Breaking Chain Analysis: Any Cross-Chain Swap

Blockchain analysis companies track funds across transparent chains. A cross-chain swap disrupts this:

- BTC → ETH: Breaks Bitcoin chain analysis

- ETH → SOL: Separates Ethereum and Solana activity

- Any → Different chain: Creates analytical gaps.

Even without Monero, cross-chain swaps make tracking significantly harder.

Stablecoin Privacy

Need to hold a stable value privately? Swap to stablecoins on privacy-friendly networks:

Anonymous Exchange Comparison: GhostSwap vs Alternatives

How does GhostSwap compare to other anonymous trading options? This is what the team says.

GhostSwap vs Changelly

GhostSwap says it offers stronger privacy guarantees. Changelly frequently triggers KYC on privacy coin swaps and larger amounts.

GhostSwap vs ChangeNow

Both are solid options. GhostSwap says it has more coins and the Telegram bot advantage.

GhostSwap vs Bisq

Bisq is more decentralized but significantly slower and harder to use. GhostSwap says it wins on convenience.

GhostSwap vs Uniswap (DEX)

DEXs are great for single-chain swaps but can’t handle cross-chain or Bitcoin. GhostSwap says it covers everything.

Privacy Best Practices for Anonymous Swapping

Using an anonymous exchange is step one. Maximize your privacy with these practices:

Use a VPN

Mask your IP address when accessing any crypto service. Recommended privacy-focused VPNs:

- Mullvad (accepts crypto, no account needed)

- ProtonVPN

- IVPN.

Use Fresh Wallet Addresses

Don’t reuse addresses. Generate new receiving addresses for each swap to prevent linking transactions.

Avoid Exchange Wallets

Never send anonymous swap proceeds to a centralized exchange. That immediately links the funds to your KYC’d identity.

Consider Tor Browser

For maximum anonymity, access GhostSwap through Tor. This hides your IP even from VPN providers.

Don’t Announce Holdings

Privacy technology means nothing if you post your wallet addresses on social media or discuss specific holdings publicly.

Split Large Transactions

For significant amounts, consider splitting into multiple smaller swaps across time. This reduces single-transaction visibility.

Is Anonymous Crypto Trading Legal?

This is a common concern. The short answer:

What’s Legal

- Using non-KYC exchanges as an individual

- Swapping cryptocurrencies privately

- Holding privacy coins like Monero

- Not volunteering information beyond what’s required.

Your Obligations

- Tax reporting: Most countries require reporting capital gains regardless of how you traded. Using an anonymous exchange doesn’t eliminate tax obligations.

- Source of funds: Funds must be legitimately obtained. Anonymous trading isn’t a money laundering tool.

- Local regulations: Some countries restrict cryptocurrency use generally. Know your local laws.

The Key Distinction

KYC requirements apply to, not to individual users. An exchange must collect KYC to operate legally in regulated jurisdictions. But users choosing non-KYC platforms isn’t illegal, GhostSwap claims. It’s a preference for privacy.

The crypto community often conflates “anonymous” with “illegal.” They’re not the same. Financial privacy is a right, not a crime, the team says.

Who Uses Anonymous Crypto Exchanges?

Privacy isn’t just for criminals, despite what regulators sometimes imply. Legitimate users of anonymous exchanges include:

Privacy Advocates

People who believe financial surveillance is wrong on principle. They use privacy tools not because they have something to hide, but because privacy is a fundamental right.

Security-Conscious Holders

Large holdings on transparent chains make you a target for hackers, scammers, and even physical threats. Anonymous swaps reduce this exposure.

Journalists and Activists

Those working in hostile environments where financial surveillance could endanger them. Receiving funds privately can be a matter of safety.

Business Owners

Entrepreneurs who don’t want competitors analyzing their financial activity on public blockchains.

Residents of Authoritarian Countries

People living under governments that use financial surveillance for political control. Privacy coins and anonymous exchanges provide financial autonomy.

Anyone Who Values Privacy

You don’t need a special reason. Not wanting strangers, corporations, and governments knowing your complete financial history is reason enough.

Frequently Asked Questions

What is an anonymous crypto exchange?

An anonymous crypto exchange lets you trade cryptocurrencies without identity verification (KYC). You swap directly without creating accounts or uploading personal documents. GhostSwap says it is a leading example, processing over 99.5% of swaps without any KYC.

Is GhostSwap really anonymous?

Yes. GhostSwap doesn’t require accounts, emails, or identity verification. You simply select your swap, provide a receiving wallet address, and send crypto. No personal data is collected or stored.

What’s a private swap?

A private swap is a cryptocurrency exchange that doesn’t require identity verification or create records linking your identity to the transaction. GhostSwap’s non-custodial model ensures swaps are private: you send crypto, receive crypto, with no account relationship in between.

Can I swap Bitcoin anonymously?

Yes. Use GhostSwap to swap Bitcoin to any of 1,600+ cryptocurrencies without KYC. Popular anonymous BTC swaps include BTC to ETH, BTC to XMR, and BTC to USDT.

Is it legal to use anonymous exchanges?

In most jurisdictions, yes. KYC requirements typically apply to exchanges as regulated businesses, not to individual users. However, users remain responsible for tax obligations on capital gains. Check your local regulations if uncertain.

What’s the most private cryptocurrency?

Monero (XMR) offers the strongest privacy through ring signatures, stealth addresses, and hidden transaction amounts. Swapping to Monero via GhostSwap provides maximum financial privacy.

How long do anonymous swaps take?

Most swaps on GhostSwap complete in 10-30 minutes. Speed depends on blockchain confirmation times. Bitcoin is slower, solana and Tron are faster.

Does GhostSwap have limits?

Minimums are low (a few dollars to cover network fees). Maximums are high without requiring KYC. Maximums are significantly higher than competitors that cap non-verified users, the exchange says.

Can I use GhostSwap on mobile?

Yes. The website works on mobile browsers, and the Telegram bot offers full swap functionality directly in the Telegram app.

Conclusion: Privacy Is Still Possible

The crypto industry has drifted far from its cypherpunk origins. Centralized exchanges have become surveillance tools, collecting more personal data than traditional banks ever did.

But anonymous alternatives exist.

GhostSwap proves you can still trade crypto privately:

- No KYC – 99.5%+ swaps without verification

- No accounts – nothing to hack or subpoena

- 1,600+ coins – Including privacy coins like Monero

- Cross-chain swaps – BTC to ETH to XMR and beyond

- Non-custodial – your keys, your crypto

- Proven track record – $750M+ volume, 1.5M+ users.

Privacy isn’t about hiding crimes. It’s about maintaining autonomy over one’s financial life. In an age of ubiquitous surveillance, that’s worth protecting, the team says.

Ready to swap privately?

- GhostSwap.io – Web interface

- Telegram Bot – Mobile swaps

- BTC to XMR – Maximum privacy swap

- ETH to BTC – Popular cross-chain.

Your money. Your privacy. Your choice.