Bitget’s Gracy Chen Declares Gold Bull Run Still Charging — Bitcoin Could Be Wildly Undervalued

Gold's historic rally has more room to run, and Bitcoin might be the screaming buy hiding in its shadow. That's the bold call from Bitget Managing Director Gracy Chen, who sees the traditional safe-haven's momentum as a tailwind for digital gold.

The Undervalued Digital Twin

While institutional money floods into gold ETFs, Chen argues a parallel narrative is being overlooked. Bitcoin's fixed supply and hardening network fundamentals create a scarcity play that could dwarf precious metals in the coming cycle. The math just works differently when your asset is programmable and globally borderless.

A Hedge Against the Old Guard

Central banks keep buying bullion, signaling deep-seated distrust in the current financial architecture. Smart money, however, isn't just diversifying into a shiny rock—it's allocating to a system that bypasses the rock altogether. Bitcoin doesn't just store value; it settles it on a network no single government can freeze.

The Real Inflation Fight

Gold advocates tout its millennia-long track record. Crypto natives counter with network effects and adoption curves that move at internet speed. In a world where monetary policy feels like a blunt instrument, a decentralized protocol with predictable issuance starts to look less like a speculative asset and more like a strategic necessity. After all, traditional finance's idea of a 'hedge' often just means losing money slightly slower.

Chen's stance cuts through the noise: the macro winds fueling gold's ascent are the same ones that could launch Bitcoin to its next paradigm. The only question is which asset truly represents the future of value. One's kept in vaults; the other secures itself on thousands of computers globally. The choice is becoming clearer by the block.

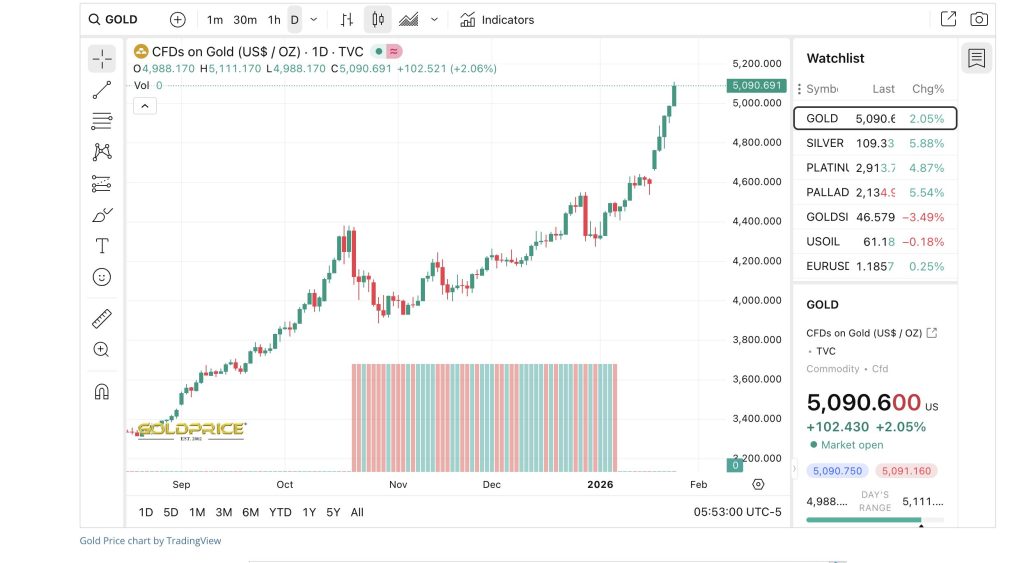

She added that strong buying interest holding around $4,830 indicates the current MOVE is part of a sustained trend rather than a topping pattern.

Gold Remains the Anchor in Uncertain Markets

Gold has benefited during periods of heightened global instability and Chen believes the current environment will continue to support its role as a defensive asset.

With many investors reassessing risk exposure across equities and emerging markets, the precious metal is once again being positioned as a portfolio hedge against inflation, geopolitical shocks and currency volatility.

The resilience of demand at key technical support levels suggests that gold’s rally is being driven by structural factors rather than short-term speculation.

Bitcoin Undervalued Despite Macro Headwinds

Chen also drew parallels between gold’s trajectory and Bitcoin’s outlook arguing that the world’s largest cryptocurrency remains undervalued relative to its long-term potential.

“Bitcoin is on a similar trajectory considering it is an undervalued asset currently,” she said.

While bitcoin remains sensitive to macroeconomic events Chen highlights several forces that could support an increasingly bullish breakout over the next year.

ETF Inflows and US Regulation Fuel Bullish Setup

The key catalysts Chen points to continued institutional demand through spot Bitcoin ETFs which have provided steady inflows and reinforced Bitcoin’s growing role in mainstream portfolios.

She also notes that Bitcoin volatility has declined compared to major tech stocks showing maturation in the asset class.

In the policy arena ongoing progress on a US crypto market structure bill could also provide greater regulatory clarity, potentially unlocking further institutional participation.

Bitcoin Could Reach $180K by End of 2026?

Chen believes Bitcoin’s current market cycle may also be diverging from historical norms with structural adoption and regulatory momentum creating conditions for sustained upside.

“If these forces persist Bitcoin has a credible path toward $150,000–$180,000 by the end of 2026,” she said.

Traditional Safety Meets Digital Upside

Chen’s outlook shows a broader theme emerging across global markets: investors are increasingly balancing traditional stores of value like gold with digital alternatives such as Bitcoin.

As geopolitical risks continue to linger and financial systems evolve both assets may continue to benefit from their roles as hedges—one rooted in centuries of history – the other driven by institutional adoption and technological change.