Crypto Funds Bleed $1.73B in a Week as Bearish Sentiment Grips Market: CoinShares Report

Digital asset investment products just posted their largest weekly outflow since the 2022 bear market. The $1.73 billion exodus signals a dramatic shift in institutional sentiment.

The Great Unwind

It wasn't a trickle—it was a flood. After weeks of positive inflows, the mood flipped. Investors aren't just taking profits; they're heading for the exits. The data suggests a classic 'risk-off' move, with capital fleeing perceived volatility for safer harbors.

Following the Leader

Bitcoin funds bore the brunt, accounting for the overwhelming majority of the outflows. Where did the money go? Short-Bitcoin products saw inflows—a clear bet that the pain isn't over. It's a hedge, or perhaps a conviction that lower prices are ahead.

The Contrarian Playbook

History rhymes. Major outflows often cluster near local sentiment extremes. For every seller, there's a buyer getting a better price. The smart money watches these flows not as a doom signal, but as a potential gauge of excessive fear. After all, Wall Street's panic is often a crypto native's opportunity—just ask anyone who bought the last 'crypto winter.'

While traditional finance pundits cluck about volatility, they're quietly missing the forest for the trees. This isn't a collapse; it's a liquidity shuffle. The infrastructure being built now will outlast any weekly flow report. The real story isn't who's leaving, but who's building during the noise.

Bitcoin and Ethereum Lead Weekly Redemptions

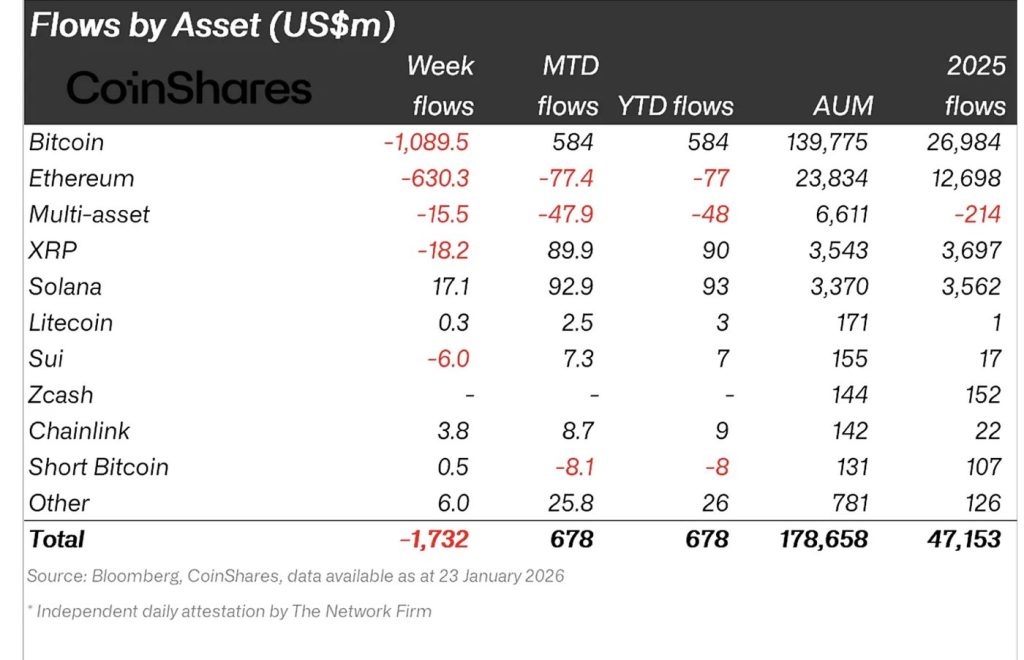

Bitcoin products recorded outflows of $1.09 billion, the largest since mid-November 2025, showing that investor confidence has yet to recover following the October 2025 price crash.

Ethereum followed with $630 million in outflows while XRP investment products saw an additional $18.2 million exit the market — highlighting broad-based weakness across major assets.

Butterfill addes that minor inflows into short-Bitcoin products — totalling just $0.5 million — suggest bearish positioning remains limited, but overall sentiment has not meaningfully improved.

Solana was also a notable exception attracting $17.1 million in inflows and bucking the wider negative trend. Smaller altcoins such as Binance-linked products ($4.6 million) and chainlink ($3.8 million) also posted modest gains.

Regional Flows Diverge Outside the US

While the US dominated the outflows, CoinShares reports that other regions saw investors take advantage of price weakness to add to long positions.

Switzerland recorded inflows of $32.5 million, Canada added $33.5 million, and Germany saw $19.1 million in inflows. Sweden and the Netherlands posted smaller outflows of $11.1 million and $4.4 million, respectively.

The divergence suggests that while US-based investors are reducing exposure, some international allocators continue to view pullbacks as entry opportunities.

Long-Term Adoption Model Points to $317K Bitcoin Floor by 2029

Despite near-term bearishness in fund flows, CoinShares Research maintains a structurally bullish long-term outlook based on its updated adoption-based valuation model.

The framework models bitcoin as a global savings asset competing with deposits, gold, real estate, and bonds. Using conservative assumptions — including sub-1% disposable income allocation and a reduced flow-to-market-cap multiple of 3.5x — CoinShares projects Bitcoin ownership could rise from roughly 560 million owners in 2025 to 1.16 billion by 2029.

Under this scenario, Bitcoin’s valuation floor could reach approximately $317,000 by 2029, implying a potential 3.2x return from mid-November 2025 levels.

CoinShares emphasized that the model is designed to estimate price-supporting bottoms rather than speculative cycle peaks, with ETF growth and emerging-market adoption continuing to accelerate global participation.