Tether Shatters Records: $5.2B Crypto Revenue in 2025 Cements Stablecoin Supremacy

Tether just posted the single largest revenue haul in crypto history—and the traditional finance world is watching its dominance with a mix of awe and anxiety.

The Engine Room of Crypto

Forget speculative altcoins and NFT bubbles. The real money machine in digital assets has a simple, powerful formula: provide the indispensable plumbing. Tether’s USDT became the default dollar for trading, lending, and moving value across borders. That utility, multiplied by a trillion-dollar market cap, generated a staggering $5.2 billion windfall. It’s a masterclass in monetizing infrastructure.

Dominance by the Numbers

The figures tell a story of sheer scale. That $5.2 billion revenue didn't come from a risky bet or a new product launch—it flowed from the relentless, daily use of its stablecoin. Every swap on a decentralized exchange, every collateral post on a lending protocol, every cross-border settlement that bypasses slow correspondent banks adds a tiny fraction to the pile. Multiply that by billions of transactions, and you get a profit powerhouse that rivals legacy financial institutions. A cynic might note it’s the ultimate ‘rent-seeking’ model—charge a toll on the digital economy’s most vital bridge.

The New Financial Order

This isn't just a corporate earnings report; it's a signal flare. It proves that the most valuable real estate in finance isn't a skyscraper on Wall Street—it's the foundational layer of the digital asset ecosystem. Tether’s revenue underscores a massive, permanent shift: global demand for dollar-denominated digital liquidity is insatiable. While bankers debate CBDCs and regulatory frameworks, a private stablecoin just printed a $5.2 billion receipt for solving the problem first.

The takeaway? In the race to rebuild finance, the entity that owns the trusted ledger entry wins. Everything else is just noise.

Tether Leads Stablecoin Issuers To Capture Crypto Revenue Crown

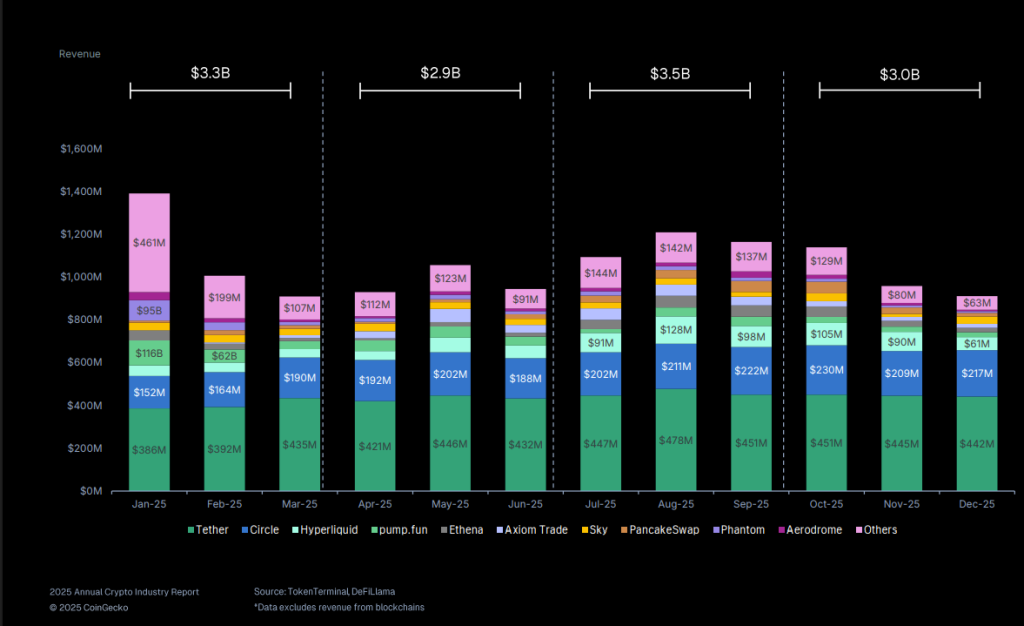

Among more than 168 crypto protocols tracked in 2025, stablecoin issuers collectively generated the highest revenue, with Tether firmly at the center.

INSIGHT: Stablecoins generated $5.2B in revenue in 2025, accounting for 41.9% of total protocol revenue. pic.twitter.com/fjJrAn9k7B

— CoinGecko (@coingecko) January 25, 2026Its $5.2 billion haul placed it well ahead of Circle and other major players, reinforcing USDT’s position as the industry’s primary settlement asset.

Within the top ten revenue-generating protocols, just four entities, led by Tether and Circle, produced 65.7% of total earnings, equivalent to roughly $8.3 billion.

The remaining six protocols in the top ten were all trading-focused platforms, highlighting a sharp divide between stable revenue streams and market-dependent income.

That contrast became clear as trading revenues swung widely with investor sentiment during the year.

Phantom, for example, recorded $95.2 million in revenue in January at the height of the solana meme coin frenzy, only to see earnings fall to $8.6 million by December as speculative activity cooled.

USDT Claims 60% Share Of $311B Stablecoin Market

The broader stablecoin market expanded rapidly, with total market capitalization rising by $6.3 billion in the fourth quarter alone to reach a record $311.0 billion.

That marked ayear-over-year increase, adding $102.1 billion as adoption accelerated across regions.

Tether maintained clear leadership with 60.1% of the total stablecoin market cap, or about $187.0 billion, followed by Circle’s USDC at 24.2%, equivalent to $72.4 billion.

Tether is now the world’s third-largest digital asset by market value at $186.8 billion, up roughly 50% from a year earlier.

While the top players strengthened their grip, shifts within the top five reflected changing risk appetites.

Ethena’s USDe experienced the sharpest reversal, with its market cap plunging 57.3%, or $6.5 billion, after a mid-October depeg on Binance undermined confidence in high-yield looping strategies.

Other stablecoins posted mixed but notable moves as capital rotated within the sector.

PayPal’s PYUSD surged 48.4%, adding $1.2 billion to reach $3.6 billion and briefly claiming the fifth spot before World Liberty Financial’s USD1 reclaimed it by nearly $1.

Additional high-growth tokens included Ripple’s RLUSD, which expanded 61.8% to add $488.2 million, and USDD, which climbed 76.9% with a $366.8 million increase.

Inside Tether’s $500B Valuation Path and Expanding Investment Empire

Looking ahead, Bitwise CIO Matt Hougan recently suggested that Tether could become the world’s most profitable company if its trajectory continues.

“There’s a chance that many emerging market countries will convert from primarily using their own currencies to using USDT,” Hougan said, pointing to Tether’s near-total dominance outside Western markets.

Based on projected interest income, calculations indicate that custody of $3 trillion in assets could generate annual revenue exceeding the $120 billion earned by Saudi Aramco last year.

Tether CEO Paolo Ardoino previously told Cryptonews he remains confident USDT will retain its lead due to the company’s deep understanding of real-world usage.

Beyond stablecoins, Tether has expanded aggressively into traditional assets and investments.

![]() @Tether_to has launched an all-cash bid to acquire Italy’s @juventusfcen, an offer that was reportedly swiftly turned down.#Tether #Cryptohttps://t.co/4iTBXWjo5V

@Tether_to has launched an all-cash bid to acquire Italy’s @juventusfcen, an offer that was reportedly swiftly turned down.#Tether #Cryptohttps://t.co/4iTBXWjo5V

The company recently became the second-largest shareholder in Italian football club Juventus and has reportedly explored raising $20 billion for a 3% stake, a deal that WOULD imply a valuation near $500 billion and place Tether among the world’s most valuable firms.