Bitcoin ETFs Bleed $1.62B in Four Days — Are Hedge Funds Dumping BTC?

Bitcoin exchange-traded funds just hemorrhaged capital at a staggering rate—$1.62 billion vanished in under a week. The sudden exodus raises a single, pointed question: is this the sound of institutional whales quietly heading for the exits?

The Great Unwind

Outflows hit like a tidal wave, flipping the script on months of steady inflows. The sheer velocity of the move—four days, nine figures—smacks of coordinated action, not retail panic. It's the kind of capital flight that makes desks buzz with one name: hedge funds.

Follow the Smart Money (Or Is It?)

When large, leveraged players rebalance, markets feel it. These funds treat ETFs as a high-liquidity parking spot, a way to gain synthetic exposure without touching the underlying asset. A swift redemption doesn't necessarily mean they've lost faith in Bitcoin's thesis—it could just mean they've found a better, or cheaper, hedge elsewhere. Or maybe their risk models flashed red. After all, nothing moves a portfolio manager's hand faster than a potential bonus haircut.

Context Is King

Zoom out. A multi-billion dollar bleed sounds apocalyptic, but it's a blip against the sector's total assets. This is the new normal for a maturing asset class—volatile, headline-grabbing flows that test the infrastructure's mettle. The ETFs did their job: they provided the escape valve without crashing the underlying spot market. A cynical take? The whole ETF structure was built for this exact moment, allowing hot money to flee without forcing a fire sale of actual Bitcoin. The system worked, even if it makes for ugly charts.

What Comes Next

Watch for stabilization. The key signal won't be the outflows stopping, but whether buying pressure steps in to absorb the selling. True conviction shows up when prices get punched. This isn't a story about ETF failure; it's a stress test. And in finance, every stress test is just an opportunity for someone else to buy the dip—usually after the 'smart money' has finished selling.

BlackRock’s IBIT Leads Bitcoin ETF Outflows as BTC Slips Below $90K

As of January 22, 2026, US-listed spot Bitcoin ETFs recorded net daily outflows of $32.11 million, extending a streak of redemptions that peaked at $708.71 million on January 21, following $483.38 million on January 20, Sosovalue data shows.

In the last one week, net outflows amounted to 1.22 billion.

Trading activity stayed strong on January 22, with Bitcoin spot ETFs recording $3.30 billion in volume, even as assets under management dipped to $115.99 billion, about 6.49% of Bitcoin’s market cap.

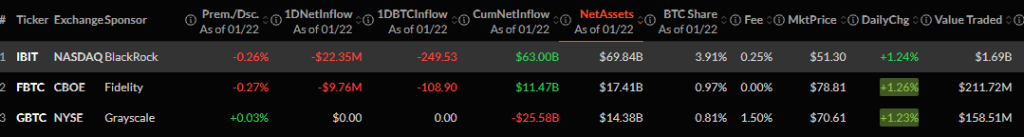

BlackRock’s iShares Bitcoin Trust led daily outflows, with $22.35 million redeemed, equivalent to roughly 249.5 BTC.

Despite the withdrawal, IBIT remains the dominant product, holding $69.84 billion in assets and nearly 4% of the Bitcoin supply represented in ETFs.

Fidelity’s FBTC followed with $9.76 million in outflows, while Grayscale’s GBTC reported flat daily flows but remains deeply negative overall, with $25.58 billion in cumulative net outflows as investors continue rotating away from its higher 1.5% fee.

Other issuers, including Bitwise, Ark and 21Shares, VanEck, Invesco, Valkyrie, Franklin, and WisdomTree, recorded largely unchanged flows, showing a pause rather than broad panic selling.

The ETF pullback has unfolded alongside weakness in Bitcoin’s price.

BTC was trading around $89,982 on January 22, down 1.3% on the day and nearly 5% over the past week, after briefly dipping to $88,600.

Trading volume has also cooled, falling nearly 28% to $37.77 billion, a sign that market participation is thinning as prices consolidate below $90,000.

Compressed Yields Trigger Hedge Fund Exit From Bitcoin ETFs

Market observers point to hedge fund positioning as a key driver behind the ETF outflows.

Amberdata shows that yields on the Bitcoin basis trade, a strategy that buys spot Bitcoin via ETFs while selling futures to capture price spreads, have dropped below 5%, down from around 17% a year ago.

As returns compress and approach the yield available on short-dated US Treasuries, fast-moving capital has less incentive to stay deployed.

Analyst noted that while hedge funds likely represent only 10% to 20% of ETF holders, their activity can overwhelm flows in the short term when the trade stops working.

Bloomberg data shows that the unwind is visible in derivatives markets as well.

Bitcoin futures open interest on Chicago Mercantile Exchange (CME) has fallen below Binance’s for the first time since 2023, showing reduced participation in cash-and-carry trades by US institutions after ETFs launched there.

One-month annualized basis yields now hover NEAR 4.7%, barely clearing funding and execution costs, as spreads tighten and arbitrage opportunities fade.

CryptoQuant indicators show apparent demand turning negative, whale and dolphin wallets shifting from accumulation to distribution.

Also, the Coinbase premium remained deeply negative, suggesting weaker appetite from US institutions.

At the same time, leverage in Bitcoin futures has climbed to its highest level since November, increasing the market’s sensitivity to sharp moves in either direction.

Flows in other crypto ETFs underline that the sell-off is not uniform.

Ethereum spot ETFs also recorded heavy outflows this week, including $41.98 million on January 22, while XRP and Solana-linked products saw modest inflows, pointing to selective institutional repositioning rather than a wholesale exit from digital assets.