Banks Target Stablecoin Yield Domination as 2026’s #1 Strategic Priority

Forget lending margins and fee income—the real money in 2026 is being printed on-chain. Traditional finance giants are pivoting hard, making the capture of lucrative stablecoin yields their paramount objective for the year. It's a full-scale invasion of DeFi's most fertile territory.

The Yield Gold Rush

Why the sudden urgency? The numbers don't lie. The annual yield generated by major stablecoin protocols now dwarfs the net interest income of all but the largest global banks. That revenue stream, once the exclusive playground of crypto-natives and degen farmers, has grown too massive for Wall Street and Main Street to ignore. We're witnessing a land grab for digital-era seigniorage.

Building the On-Ramps (and Toll Booths)

Banks aren't just dipping a toe in; they're constructing entire infrastructures. Expect a wave of proprietary stablecoin offerings, integrated custody-yield products for wealthy clients, and regulatory-friendly "walled garden" DeFi pools. Their playbook? Leverage trusted brands and regulatory compliance to onboard the institutional capital that's been sitting on the sidelines—then skim a hefty management fee for the privilege. After all, why innovate when you can intermediate?

A Clash of Financial Cultures

This move sets the stage for an epic clash. On one side: the permissionless, code-is-law ethos of original DeFi. On the other: the permissioned, KYC-heavy, risk-managed world of TradFi. The banks' entry will bring unprecedented liquidity and legitimacy, but it also brings the specter of centralization and rent-seeking. The cynical finance jab? Watching institutions that spent years dismissing crypto as a 'fraud' now scramble to repackage its core mechanics for their richest clients—with a 2% management fee attached, of course.

The ultimate irony? To save their bottom lines, banks must become what they once feared. The race to harness stablecoin yields isn't just a priority—it's an admission that the future of finance is being built elsewhere, and they're desperate for a seat at the table before the music stops.

Banking Industry Intensifies Pressure on Lawmakers

The coordinated push comes as Senate Banking Committee negotiations over digital asset market structure legislation remain deadlocked over stablecoin reward provisions.

Banking executives have spent months warning that yield-bearing tokens could trigger massive deposit outflows, with Bank of America CEO Brian Moynihan estimating that $6 trillion in deposits could migrate into stablecoins under permissive regulatory frameworks.

JPMorgan CFO Jeremy Barnum also warned during the bank’s fourth-quarter earnings call that interest-bearing stablecoins risk creating “a parallel banking system that sort of has all the features of banking, including something that looks a lot like a deposit that pays interest, without the associated prudential safeguards.“

![]() @JPMorgan backs blockchain innovation but warns yield-bearing stablecoins mimic bank deposits without oversight.#JPMorgan #Stablecoinhttps://t.co/4Fbu8pMOwk

@JPMorgan backs blockchain innovation but warns yield-bearing stablecoins mimic bank deposits without oversight.#JPMorgan #Stablecoinhttps://t.co/4Fbu8pMOwk

Community bankers have been particularly vocal, with the Community Bankers Council urging Congress in early January to close what it called a “” allowing stablecoin issuers to indirectly fund yield through exchange partners.

The group warned that large-scale deposit outflows could reduce credit availability for small businesses, farmers, students, and homebuyers in local communities.

Senator Tim Scott’s draft crypto market structure bill released January 9 includes language prohibiting digital asset service providers from paying interest or yield solely for holding stablecoins, though the provision allows activity-based rewards tied to functions like staking and liquidity provision.

Crypto Coalition Mobilizes Against Expanded Restrictions

A coalition of 125 crypto and fintech organizations, including Coinbase, PayPal, Stripe, Ripple, and Kraken, delivered a forceful rejection of expanded yield restrictions in December.

The Blockchain Association-led group argued that banking industry efforts represent “” measures rather than consumer protection, noting that banks face no similar restrictions on credit card rewards despite engaging in riskier balance-sheet activities.

“The push to restrict stablecoin rewards beyond that agreed to in GENIUS is not a technical refinement or a consumer protection fix,” the coalition stated.

“It WOULD prohibit the same types of incentive programs for stablecoin payments that banks have long offered on credit cards and other types of payment services.“

Just yesterday, Circle CEO Jeremy Allaire called banking concerns “” during a World Economic Forum panel, drawing parallels to historical opposition to money market funds.

![]() Circle CEO rejects bank warnings on stablecoin yields as "absurd," citing money market precedent as transaction volumes reach $33 trillion in 2025.#Stablecoin #Circlehttps://t.co/kPQw5xYpBh

Circle CEO rejects bank warnings on stablecoin yields as "absurd," citing money market precedent as transaction volumes reach $33 trillion in 2025.#Stablecoin #Circlehttps://t.co/kPQw5xYpBh

“The exact same arguments were made,” Allaire stated, noting that roughly $11 trillion in money market funds has grown without preventing lending activity.

He emphasized that all major stablecoin regulations prohibit issuers from paying interest directly, while partner platforms may offer rewards based on commercial arrangements.

“Rewards around financial products exist in every balance that you have with a credit card that you use,” Allaire said.

The crypto coalition disputed Treasury projections suggesting yield-bearing stablecoins could result in up to $6.6 trillion in deposit flight, citing analysis that found no evidence of disproportionate deposit outflows from community banks.

The groups questioned how banks can claim deposit constraints while holding $2.9 trillion in reserve balances at the Federal Reserve.

Coinbase CEO Brian Armstrong said the exchange could not back Scott’s draft bill, citing provisions that would eliminate stablecoin rewards.

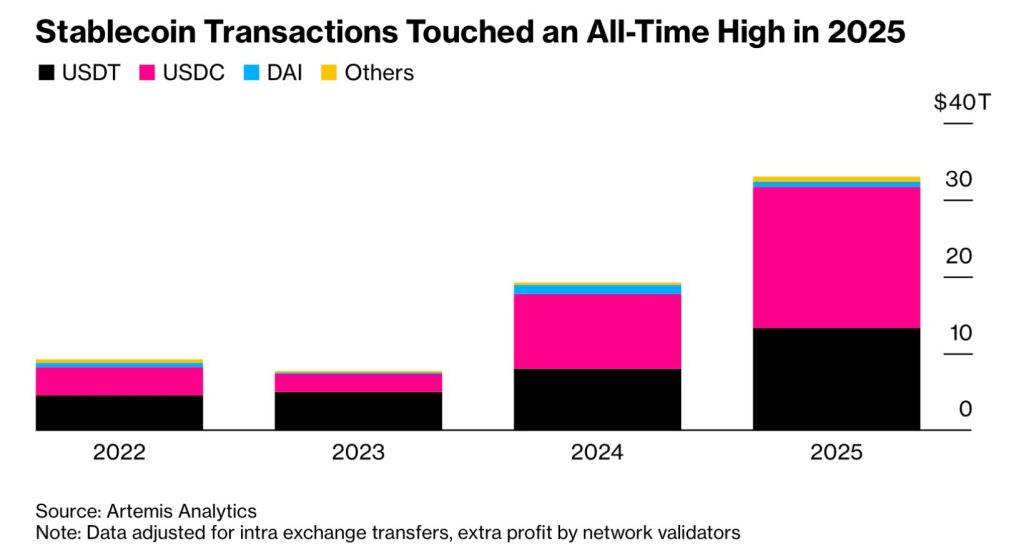

These divisions come as global stablecoin transaction volumes reached $33 trillion in 2025, up 72% from the previous year, with USDC processing $18.3 trillion.

Bloomberg Intelligence predicted that flows could reach $56 trillion by 2030 as institutional payment infrastructure adoption accelerates.

For now, the Banking Committee may postpone further work until late February or March, following Coinbase’s withdrawal of support and divided attention to the new housing policy agenda demanded by Trump.

However, the Senate Agriculture Committee has scheduled a markup of competing legislation for January 27 that takes a fundamentally different approach by excluding payment stablecoins from CFTC authority entirely and deferring regulation to frameworks like the GENIUS Act rather than setting specific yield rules.