Russian Ruble-Pegged Stablecoin Soars Past $100B in Transactions in Under a Year – Explosive Growth

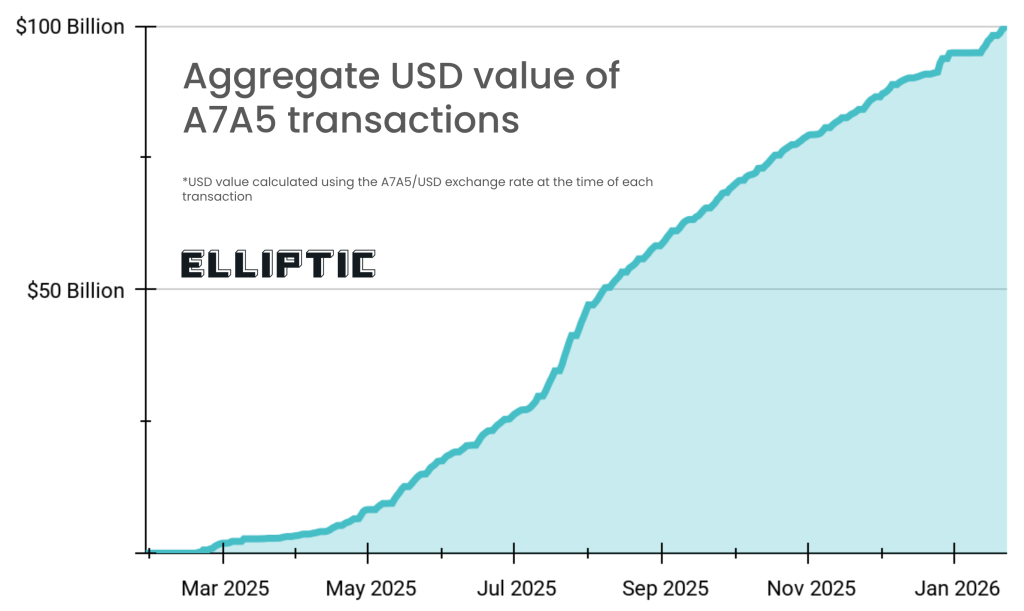

A digital asset pegged to the Russian ruble just crossed a staggering milestone—over $100 billion in transaction volume in less than twelve months. That’s not a typo. It’s a velocity that makes traditional forex corridors look like they’re moving in slow motion.

The Mechanics of a Sanctions-Buster

Forget slow SWIFT transfers and correspondent banking headaches. This stablecoin operates on decentralized rails, bypassing legacy gatekeepers entirely. It’s a digital life raft for cross-border commerce, cutting settlement times from days to seconds and offering a predictable value anchor in turbulent economic waters. The protocol doesn’t ask for permission—it just executes.

What the $100B Figure Really Means

That number isn't just vanity metrics. It represents real economic activity—a flood of capital finding a more efficient path. It signals deep, organic adoption where it matters most: in the movement of value for trade and remittances. While central bankers debate digital currencies, this network is already processing volumes that rival small national payment systems.

A New Front in Financial Sovereignty

This isn't merely a tech experiment. It's a strategic financial tool, demonstrating how blockchain networks can create parallel economic infrastructures. They offer resilience and autonomy, especially in regions facing complex geopolitical finance rules. The genie is out of the bottle—sovereign-grade monetary tools are now downloadable.

The bottom line? A hundred billion in transactions proves the model works at scale. It turns the promise of decentralized finance into a tangible, unstoppable force. And it does so while giving a sly wink to the old guard—after all, who needs a permission slip from a legacy bank when you have cryptography and a global ledger? Sometimes the most revolutionary finance happens not on Wall Street, but on a blockchain quietly moving billions in the background.

A7A5 Stablecoin Hits $100B Transactions – Here’s How

The asset, which is currently listed only on Uniswap, has a market cap of more than $540 million, per CoinMarketCap data.

Further, the Elliptic data shows that 35,500 accounts now hold the stablecoin, an increase from the 14,000 in July 2025.

“Total A7A5 exchange volumes have now reached $17.3 billion,” Elliptic added. “The primary trading pairs, A7A5/rubles ($11.2 billion) and A7A5/USDT ($6.1 billion), highlight the stablecoin’s primary role as a bridging asset between rubles and USDT.”

Stablecoin Supply Stalled Amid Heavy Western Sanctions

Besides, the stablecoin activity is currently showing signs of stalling after heavy sanctions by the US, UK and EU on Russia-linked cryptos. The Western sanctions were imposed on Russia, targeting finance, energy and goods, since the nation’s full-scale Ukraine invasion.

“Despite relatively high transaction volumes, there are indications that demand for A7A5 has stalled,” Elliptic report noted. “There are just over 42.5 billion A7A5 in circulation, with a US dollar value of $547 million.”

Additionally, the transaction volumes have dropped from a peak of over $1.5 billion per day to around $500 million per day.