Strive Targets $150M War Chest for Aggressive Bitcoin Acquisition Strategy

Another day, another nine-figure crypto fundraise—but this one's betting the house on digital gold.

The Bitcoin Accumulation Play

Strive isn't whispering about diversification. The firm's latest capital push screams a single, focused mandate: stack more Bitcoin. Forget altcoins, DeFi protocols, or NFT flips. This is a concentrated wager on the original cryptocurrency's long-term store-of-value thesis. They're bypassing the noise and going straight for the cornerstone asset.

Fueling the Treasury

That $150 million isn't for office perks or marketing blitzes. Every dollar's earmarked for direct accumulation. Think strategic treasury allocation, but on steroids. The move signals a deep conviction that current prices are a generational buying opportunity—or at least, that's the narrative they're selling to investors. It's the kind of bold capital allocation that makes traditional portfolio managers clutch their balanced funds.

The Bigger Picture

This isn't just a company making a trade. It's a statement. When institutional players start publicly raising funds specifically to hoard Bitcoin, it shifts the entire market psychology. It creates a feedback loop: announced buying begets price stability, which begets more institutional interest. Suddenly, holding Bitcoin looks less like speculation and more like prudent corporate strategy—a classic case of narrative becoming reality in finance, where confidence is often the most valuable currency of all.

One cynical observer might note: nothing fuels a bull market quite like fresh, fee-generating capital from believers convinced they're getting in early. Again.

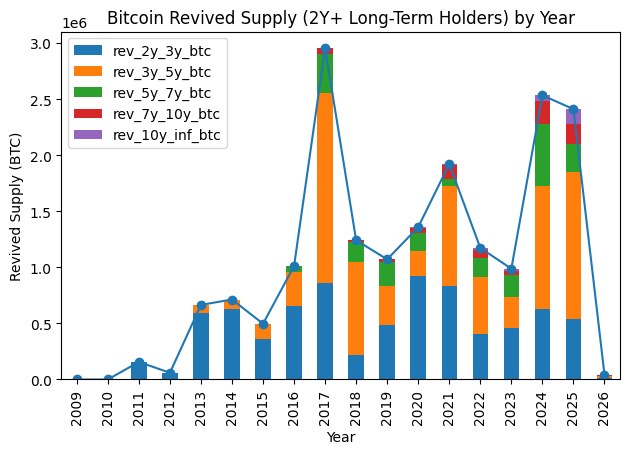

Source: CryptoQuant

Source: CryptoQuant

Analysts interpret this as a fundamental shift in ownership from early holders focused on halving cycles to newer participants driven by macro factors and liquidity considerations.

Strategic Debt Reduction and Treasury Expansion

Strive intends to deploy capital from the stock sale alongside existing cash reserves and proceeds from terminating capped call transactions tied to Semler Scientific’s outstanding $4.25% Convertible Senior Notes due 2030.

The company plans to use funds for “the redemption, repurchase, repayment, satisfaction and discharge or other payment of all or a portion” of these convertible notes and Semler Scientific’s borrowings under its master loan agreement with Coinbase Credit Inc., according to the announcement.

The firm is simultaneously negotiating separate transactions with certain noteholders to exchange portions of the Semler Convertible Notes for shares of SATA Stock.

Strive expects to reduce the offering size proportionally if these exchanges proceed, though the company emphasized that “this offering is not conditioned on the closing of any such exchange.“

Any completed exchanges WOULD be conducted under Section 4(a)(2) of the Securities Act as private transactions not involving public offerings.

Barclays and Cantor are serving as joint book-running managers for the offering, with Clear Street acting as co-manager.

The sale follows regulatory protocols under an effective shelf registration statement filed with the Securities and Exchange Commission.

Market Dynamics Support Institutional Accumulation

The capital raise unfolds against a backdrop of continued institutional Bitcoin accumulation despite short-term price volatility.

CryptoQuant analysis shows that “since January, Bitcoin whales have continued to accumulate aggressively despite short-term volatility and corrective phases, while retail investors have exited.“

Even after recent geopolitical escalation, whale holdings on a monthly basis “have not declined but instead continued to increase, indicating that the current phase is structural accumulation rather than distribution.“

Market conditions remain mixed, however.

Bitcoin’s estimated leverage ratio on Binance surged to approximately 0.184 NEAR the $90,000 price level, marking its highest reading since last November and reflecting “a notable return to leverage following a period of relative risk aversion.”

This elevated borrowing among futures traders increases market susceptibility to sharp liquidation events during rapid price movements in either direction.

Asian markets opened higher today as Bitcoin edged toward $90,000 following President Donald Trump’s comments indicating a “framework of a future deal” involving NATO over Greenland, easing immediate tariff concerns.

Bitfinex analysts noted the focus now centers on stabilization signals, including flattening ETF flows, positive spot taker cumulative volume delta, and sustained price action above $90,000 with declining volatility.

Aggressive Treasury Strategy Follows Industry Leaders

Strive’s expansion follows significant corporate moves to accumulate Bitcoin.

The company previously announced a $500 million preferred stock offering in December 2025 and completed a merger with Semler Scientific in an all-stock transaction valued at a 210% premium.

The combined entity now pursues Bitcoin-per-share growth to “” according to Chairman and CEO Matt Cole.

Strategy, led by Michael Saylor, purchased 22,305 BTC for approximately $2.13 billion between January 12-19 at an average price of $95,284 per coin, bringing total holdings to 709,715 Bitcoin.

![]() Michael Saylor’s @Strategy bought 22,305 $BTC for $2.13B at $95,284 per coin, lifting total holdings to 709,715 bitcoin.#Strategy #Bitcoinhttps://t.co/orZmJ4iT5E

Michael Saylor’s @Strategy bought 22,305 $BTC for $2.13B at $95,284 per coin, lifting total holdings to 709,715 bitcoin.#Strategy #Bitcoinhttps://t.co/orZmJ4iT5E

Meanwhile, 91-year-old burger chain Steak ‘n Shake also entered corporate Bitcoin ownership with a $10 million treasury purchase, establishing a “” that channels all Bitcoin received from Lightning Network payments directly into holdings rather than converting to cash.