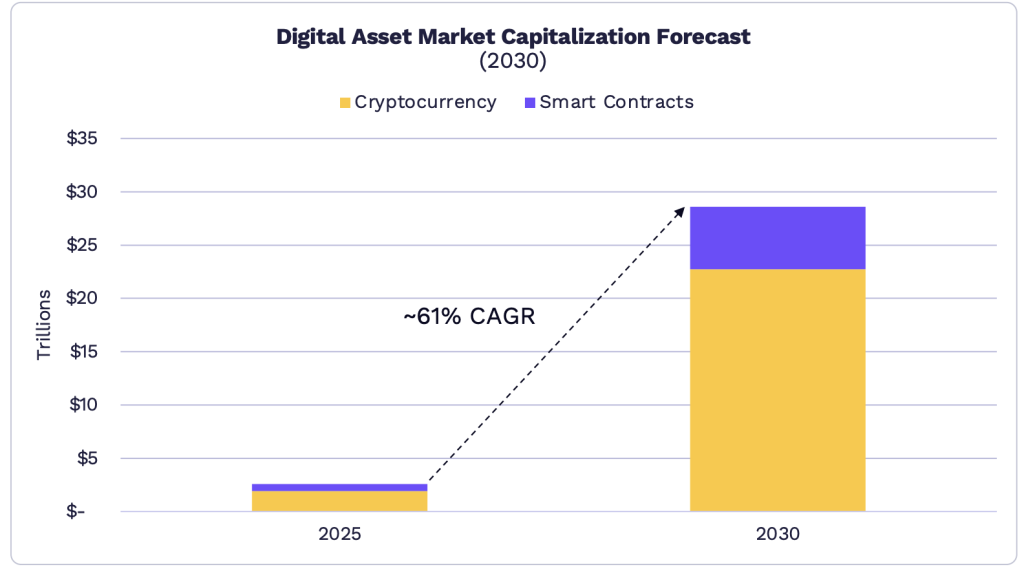

Ark Invest’s Cathie Wood Predicts Digital Assets Will Explode to $28 Trillion by 2030—A 9X Surge

Forget the noise—the real money is building in the digital trenches.

Cathie Wood's Ark Invest just dropped a forecast that should make traditional portfolio managers sweat. They see the total market cap for crypto and blockchain assets rocketing to $28 trillion within this decade. That's not just growth; it's a near nine-fold multiplication from today's levels.

The Engine Behind the Explosion

What's driving this staggering projection? Look beyond Bitcoin's price swings. Ark's thesis hinges on a fundamental rewiring of finance. Decentralized networks are cutting out legacy intermediaries, smart contracts are automating trillion-dollar markets, and tokenization is turning everything from real estate to royalties into tradable digital assets. It's a perfect storm of technological adoption meeting generational wealth transfer.

Why $28 Trillion Isn't a Fantasy

The math starts to make sense when you break it down. The total addressable market for global assets—stocks, bonds, real estate, commodities—sits in the quadrillions. Capturing just a single-digit percentage through digitization easily gets you to tens of trillions. Institutional adoption, now moving past the 'dipping a toe' phase, provides the rocket fuel. Every major bank and asset manager building custody and trading desks isn't doing it for charity.

The Cynical Take from the Cheap Seats

Of course, Wall Street veterans will scoff—right up until their fee structures get obliterated by decentralized protocols charging pennies. The old guard always underestimates exponential tech while overestimating their own permanence. Remember when they said the internet was for nerds?

The trajectory is clear. Volatility will remain, regulators will grapple, but the direction of travel points to one outcome: a multi-trillion-dollar digital asset ecosystem becoming the new plumbing of global finance. The question isn't if, but how quickly your portfolio gets left behind.

Image Source: Ark Invest/ Big Ideas 2026

Ark Sees Bitcoin Market Cap Climbing To $16 Trillion By 2030

Based on Ark’s forecast, Bitcoin’s market cap could rise at a compound annual growth rate of about 63% during the next five years, climbing from nearly $2 trillion to $16 trillion by 2030.

The report also argued that bitcoin is increasingly behaving like a safe-haven asset, pointing to lower volatility and drawdowns in 2025 that looked shallow versus its own history across 5-year, 3-year, 1-year, and 3-month windows.

Institutional ownership is a big part of that story. Ark said US spot Bitcoin ETFs and public companies held about 12% of total Bitcoin supply, up from 8.7%, after Bitcoin ETF balances rose 19.7% in 2025 from about 1.12M to about 1.29M, and public company holdings jumped 73% from roughly 598,000 to about 1.09M.

Bitcoin’s maturation is showing. ARK's Big Ideas 2026 research details rising adoption, leading risk-adjusted performance, the shallowest drawdowns in its history, and more.

Read @dpuellARK’s thread below and download the report for a deeper dive: https://t.co/Uw1o20VSMc https://t.co/L8GynmfSQz

Smart Contract Networks Could Grow At A 54% Annual Pace

Regarding smart contracts, Ark projected that the segment could reach approximately $6 trillion by 2030, growing at a 54% annual rate, as networks generate annualized revenue of around $192B at an average take rate of 0.75%.

It also expects two to three Layer-1 platforms to take the lion’s share, with valuations driven more by monetary premium than discounted cash flows.

Ark’s report kept Ethereum in the lead when it comes to on-chain assets, saying assets on Ethereum now exceed $400B. It also said stablecoins and the top 50 tokens make up about 90% of market value across seven of the eight most popular blockchains.

Ark Sees Long Runway For Tokenization Despite Small Current Share

Ark said meme coins remain a small part of most blockchains, making up about 3% or less of capital outside Solana.

Solana is the exception, where meme coins account for about 21% of assets. The firm also said tokenization of real-world assets could be one of the fastest-growing areas, as off-chain assets offer the biggest opportunity for on-chain growth.

That tokenization thesis is where Ark put another headline number. The firm said tokenized assets could grow from $19B to $11 trillion by 2030, which WOULD still be only about 1.38% of all financial assets, suggesting plenty of runway even in a bullish scenario.

Sovereign debt dominates tokenization today, Ark said, and it expects bank deposits and global public equities to MOVE a bigger share of value on-chain over the next five years.

It tied broad adoption to regulatory clarity and institutional-grade infrastructure, signalling that the plumbing may matter as much as the protocols.