Caroline Ellison Walks Free 10 Months Early After FTX Testimony – What Happens Next?

Caroline Ellison just cut 10 months off her sentence. The former Alameda Research CEO walked free after cooperating with prosecutors in the FTX collapse case—and the crypto world is watching her next move.

The Deal That Unlocked the Door

Ellison’s testimony against Sam Bankman-Fried proved more valuable than any trading algorithm. Prosecutors called her cooperation “substantial” and “timely”—legal speak for handing over the keys to the kingdom. The judge agreed, slashing her sentence from a potential 110 years down to time served plus supervised release.

Where Does a Fallen Crypto Star Go?

Not back to trading, that’s certain. Her plea agreement bars involvement in financial services—a lifetime ban from the industry she helped implode. She’ll spend three years under supervision, her finances monitored, every transaction scrutinized. Think of it as the most restrictive wallet permissions imaginable.

The Ripple Effect on Crypto Justice

Ellison’s early release sends a clear signal: cooperate early, cooperate completely. It sets a precedent for future cases where insiders hold the evidence needed to convict. The DOJ just demonstrated its willingness to reward those who help dismantle fraudulent operations—even if they helped build them first.

What’s Left of the FTX Empire?

Billions in claims, thousands of creditors, and one massive lesson about centralized control. The bankruptcy proceedings continue without Ellison’s testimony, but her statements already shaped the narrative of greed, negligence, and spectacular failure. The crypto space moved on—decentralized protocols don’t have CEOs who can embezzle customer funds.

Final Take: Redemption Arc or Cautionary Tale?

Ellison walks free while victims still wait for compensation. Her freedom represents the cold calculus of justice: sometimes the person who opens the vault gets a better deal than those locked inside. In traditional finance, they call this “cooperating with authorities.” In crypto, we call it the ultimate exit strategy—from prison.

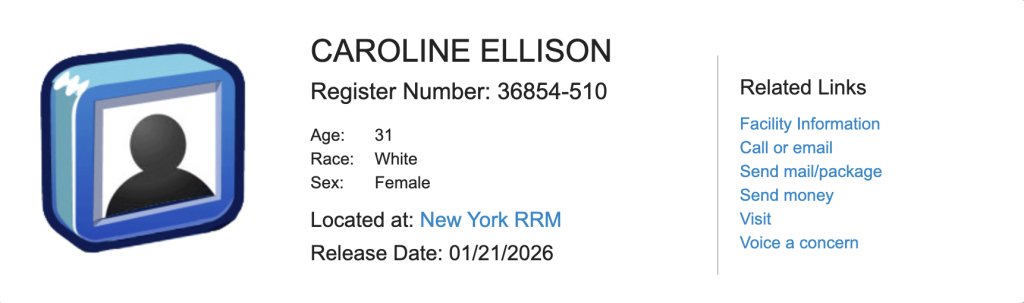

Source: Federal Bureau of Prisons

Source: Federal Bureau of Prisons

Following the collapse of FTX in November 2022, amidst a liquidity crunch and claims of all-around misappropriation of customer funds, Ellison admitted the next month to seven felony counts.

The indictments are for such things as wire fraud, securities fraud, commodities fraud, and money laundering conspiracy.

Ellison’s Testimony Exposed the Inner Workings of the FTX Fraud

Her prosecutors claimed that under her tenure, Alameda Research had an open line of credit with FTX that had allowed the transfer of billions of dollars of customer deposits into the trading company without any obstruction.

Such funds were subsequently found to have been spent on covering the losses incurred by Alameda, on high-risk investments, political donations, and a range of other expenses, all the time letting customers think that their money was safely held by the exchange.

Ellison confessed in court that these were done under orders of Sam Bankman-Fried, the founder of both FTX and Alameda, and her evidence became the keystone of the government case.

Prosecutors described Ellison as a “remarkable” and “exemplary” witness who met with investigators roughly 20 times and helped decode the inner mechanics of the fraud.

During Bankman-Fried’s 2023 trial, she spent three days on the stand detailing how customer funds were misused and how Alameda was shielded from normal risk controls.

Bankman-Fried was ultimately convicted and sentenced in March to nearly 25 years in prison, along with an order to repay up to $11 billion in losses.

He has since filed an appeal and has publicly explored the possibility of a presidential pardon, which President TRUMP said was denied.

FTX's Sam Bankman-Fried files appeal to reduce 25-year sentence with November 4 oral arguments as 3AC plans October deposition.#FTX #SBFhttps://t.co/4ZRoQG88ck

— Cryptonews.com (@cryptonews) September 12, 2025Ellison, by contrast, received a sharply reduced sentence.

In September 2024, she was sentenced by Judge Lewis Kaplan to serve 2 years in jail, declining the request of her lawyers to have no jail time but noting that her cooperation made her unlike other defendants.

In November 2024, she started her sentence in a low-security prison in Danbury, Connecticut, and was transferred to community confinement, sometimes known as a halfway house, in October 2025.

FTX Cooperators Exit Custody as Legal Penalties Remain

Residential reentry centers are constructed to assist inmates in integrating back into society under federal oversight.

Residents are kept under close supervision, restricted from movement unless under permit for approved activities, subject to frequent drug and alcohol testing, and required to meet financial requirements, such as paying a given percentage of income as part of living expenses.

The Bureau of Prisons typically uses these facilities in the final months of a sentence, and inmates housed there are still considered to be in federal custody.

The projected release date of Ellison was later changed to January 2026 based on time, good conduct, and the credit she enjoys due to providing substantial help to prosecutors.

Her discharge technically brings to an end the custodial period of the key cooperating witnesses in the FTX matter.

Former FTX Chief Technology Officer Gary Wang and former co-lead engineer Nishad Singh also cooperated and received no prison time, while former executive Ryan Salame, who did not cooperate, was sentenced to more than seven years in prison.

![]() SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.#SEC #FTXhttps://t.co/IsjAs2o0fE

SEC seeks 10-year officer ban for Caroline Ellison and eight-year prohibitions for Gary Wang and Nishad Singh following FTX fraud cooperation and permanent injunctions.#SEC #FTXhttps://t.co/IsjAs2o0fE

Although Ellison is leaving custody, her legal consequences are far from over.

She remains subject to supervision and has been ordered to forfeit $11 billion as part of the case.

In recent months, the Securities and Exchange Commission has also moved to bar Ellison, Wang, and Singh from serving as officers or directors of any public company for several years.