Ethereum ETFs Dominate December Inflows: ETFGI Report Reveals Crypto’s Institutional Shift

Institutional money isn't just dipping a toe in crypto—it's diving headfirst into Ethereum. Forget the cautious whispers; the latest ETFGI data shows a clear December pivot. Capital flooded toward Ethereum exchange-traded funds, leaving other digital asset products in the dust.

The Smart Money's New Playbook

This isn't retail FOMO. The flow pattern screams institutional reallocation. TradFi portfolios, once allergic to anything beyond Bitcoin, are now building dedicated Ethereum exposure. They're not buying the rumor; they're buying the infrastructure—staking yields, layer-2 ecosystems, the whole decentralized stack.

Why ETFs, Why Now?

Regulatory clarity—or the market's perception of it—finally cut through the noise. The cumbersome process of direct custody, key management, and compliance reporting gets bypassed with a single ticker. It's the ultimate financialization hack: all the upside, none of the operational headache. A classic Wall Street move—pay a fee to avoid doing the actual work.

The trend signals a maturation beyond the speculative phase. Capital is voting for Ethereum's utility as a programmable settlement layer, not just its scarcity as digital gold. This inflow surge likely foreshadows heavier rotation into the ecosystem's core assets and applications throughout Q1.

So, while traditional finance veterans might still call it a 'risky asset class,' their own quarterly reports are starting to tell a very different, and very bullish, story. The cynic might say it's just another fee-generating wrapper for the same old product—but sometimes, the wrapper is exactly what unlocks the vault.

Fidelity and Grayscale Lead Crypto ETF Inflows

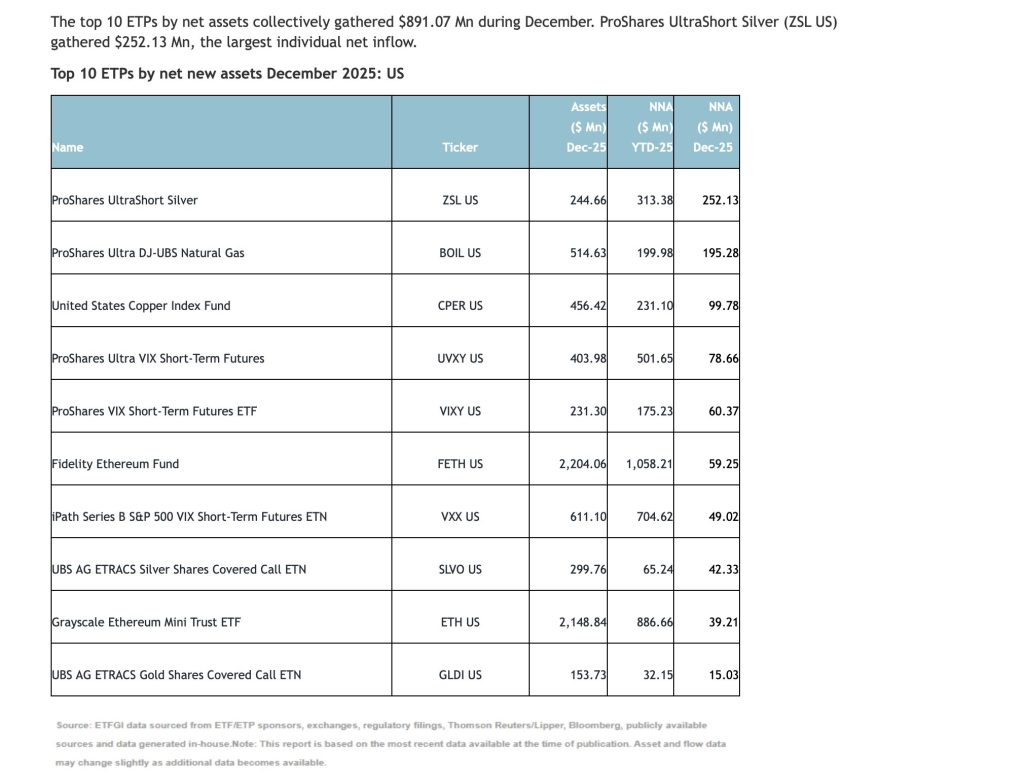

The Fidelity ethereum Fund (FETH US) recorded $59.25 million in net inflows in December making it the largest crypto-related gainer on the list.

The fund now manages approximately $2.2 billion in assets with year-to-date net inflows reaching $1.06 billion reflecting steady institutional accumulation throughout 2025.

The Grayscale Ethereum Mini Trust ETF (ETH US) attracted $39.21 million in net new assets during December. Total assets under management stand at roughly $2.15 billion with nearly $887 million added over the course of the year.

Although Ethereum ETFs did not match the scale of inflows seen in Leveraged commodity or volatility-linked products their presence among the top inflow leaders underscores Ethereum’s growing role in institutional portfolios.

Investors Prefer Spot Crypto Exposure Over Leverage

December’s largest inflows overall were concentrated in leveraged and volatility-based ETPs including inverse silver and VIX-linked products reflecting heightened uncertainty across macro markets.

In contrast Ethereum ETFs offer unleveraged, spot-linked exposure, making them more suitable for longer-term positioning rather than short-term tactical trades.

Market participants increasingly view regulated Ethereum ETFs as a way to gain exposure to blockchain infrastructure themes—such as tokenization, stablecoins, and decentralized finance—without direct custody or operational complexity.

Bitcoin ETFs Absent From December’s Top List

Notably spot bitcoin ETFs did not appear among December’s top 10 products by net new assets. This absence suggests a possible pause in Bitcoin allocations following strong earlier inflows or a relative shift in investor interest toward Ethereum as a complementary digital asset exposure.

Latest data from CoinShares reports a recovery in January – digital asset investment products recorded $2.17 billion in inflows last week marking their strongest weekly inflows since October 2025. At the asset level Bitcoin continued to dominate attracting $1.55 billion in inflows reinforcing its role as the primary institutional gateway into digital assets during periods of uncertainty.

Crypto ETFs Hold Their Ground Amid Macro Volatility

While commodities and volatility products dominated December flows, Ethereum ETFs demonstrated resilience, maintaining consistent asset growth into year-end. According to ETFGI data, crypto ETPs remain a small but increasingly durable segment of the U.S. ETF market.

The December figures reinforce Ethereum’s position as the leading alternative to Bitcoin in regulated investment products showing continued institutional confidence in the asset’s long-term role within digital finance.