Crypto Investment Products Defy Late-Week Pullback with $2.17B Inflows: CoinShares Report

Institutional money barrels into crypto—despite a Friday wobble.

The Big Picture

CoinShares data reveals a massive $2.17 billion surge into crypto investment products last week. That's serious capital moving off the traditional sidelines, folks. The figure underscores a building institutional conviction that's becoming harder for Wall Street to ignore—or dismiss as mere speculation.

Late-Week Jitters? What Late-Week Jitters?

The report notes a 'late-week reversal' in flows. Typical. The old-guard finance playbook: test the waters, get spooked by a headline, pull back. Yet, the net result remains overwhelmingly positive. It suggests the dip was bought, not a signal of fleeing capital. The smart money looks past daily noise toward longer-term structural shifts.

Reading Between the Lines

This isn't retail FOMO. These are regulated products—ETPs, trusts, funds—catering to professional investors. A $2.17 billion weekly inflow at this scale signals allocation, not dabbling. It's capital seeking exposure to an asset class proving its resilience, even as traditional portfolios get whiplash from central bank whims and geopolitical tantrums.

The Takeaway

The flow of institutional funds acts as a powerful counter-narrative to crypto's volatility stigma. While some traders still panic-sell on a rumor, the big players are methodically building positions. They're not betting on a meme; they're hedging against a system where 'risk-free' returns often mean watching your capital erode to inflation—the ultimate cynical finance jab. The trend is your friend, and right now, it's pointing toward digital assets.

Bitcoin Dominates While Ethereum and Solana Show Resilience

At the asset level bitcoin continued to dominate attracting $1.55 billion in inflows reinforcing its role as the primary institutional gateway into digital assets during periods of uncertainty. CoinShares notes that Bitcoin inflows remained robust despite macro-driven volatility and regulatory noise.

Ethereum and Solana also demonstrated resilience. ethereum products recorded $496M in inflows, while Solana attracted $45.5M even as lawmakers in the US Senate Banking Committee floated proposals under the CLARITY Act that could restrict yield-bearing stablecoins.

The continued inflows suggest investors remain confident in the long-term utility of smart contract platforms despite evolving regulatory risks.

Broad-Based Altcoin Demand Persists

Beyond the major assets, a wide range of altcoins posted positive flows, highlighting improving risk appetite earlier in the week. XRP led altcoin inflows with $69.5M, followed by Sui ($5.7M), Lido ($3.7M) and Hedera ($2.6M).

CoinShares data indicates that while altcoin allocations remain modest compared to Bitcoin and Ethereum, investors are selectively re-engaging with the broader market, favouring assets with established liquidity, infrastructure, or clear network narratives.

Regional Strength and Blockchain Equities Stand Out

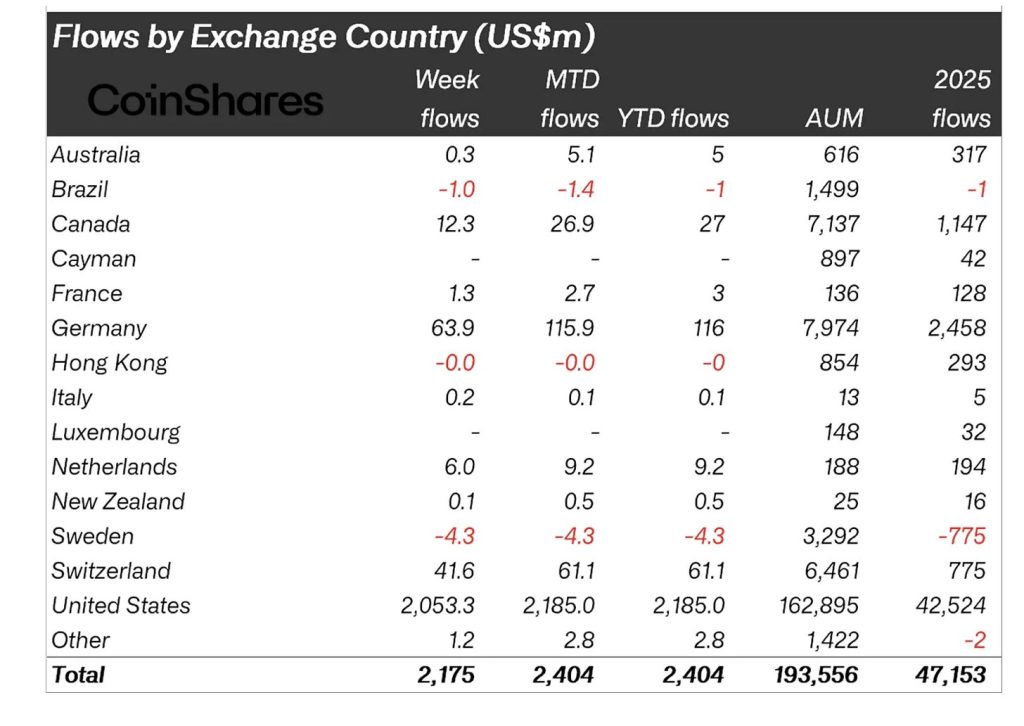

Regionally, flows were overwhelmingly positive. The US led with $2.05 billion in inflows, while Germany ($63.9M), Switzerland ($41.6M), Canada ($12.3M) and the Netherlands ($6.0M) also saw notable demand.

Blockchain equities also delivered a strong performance, attracting $72.6M in inflows during the week. According to CoinShares the strength in equity-linked products underscores sustained investor interest across the wider digital asset ecosystem, extending beyond tokens into publicly listed companies tied to blockchain infrastructure and services.

While late-week sentiment weakened CoinShares’ data suggests institutional demand for digital asset exposure remains resilient, with investors continuing to allocate capital despite macroeconomic and geopolitical uncertainty.