XRP Price Prediction 2026: As Crypto Markets Bleed, Institutional Money Quietly Floods Into XRP — What Insider Intel Drives This Bet?

While red dominates crypto charts, a stealthy capital migration tells a different story. Major funds aren't just holding XRP—they're accumulating. This divergence between public panic and private positioning raises the ultimate market question: what do they see that the crowd doesn't?

The Quiet Accumulation

Forget retail sentiment. The real narrative unfolds in over-the-counter desks and private ledger entries. While social media echoes with fear, transaction volumes and wallet analytics reveal a consistent, sizable inflow into XRP from entities moving sums that dwarf average trades. This isn't day-trading; it's strategic positioning.

Decoding the Institutional Thesis

The smart money rarely chases hype—it anticipates resolution. The institutional bet on XRP likely hinges on regulatory clarity becoming a tailwind, not a headwind. As the broader sector grapples with evolving frameworks, XRP's unique position, forged through its very public legal crucible, transforms from a liability into a potential benchmark for compliance. It’s the ultimate 'buy when there's blood in the streets' play, assuming the street in question is eventually getting paved and regulated.

Market Mechanics & The Coming Squeeze

Sustained accumulation by large holders does two things: it steadily reduces available sell-side liquidity and sets the stage for a violent move when sentiment eventually flips. If a catalyst emerges—a definitive legal milestone, a major partnership announcement—the buying pressure needed to move the price significantly decreases. The fuel is being stockpiled now, waiting for a spark. It's a classic setup, often spotted in hindsight but ignored in the moment.

A Cynical Footnote on Finance

In finance, 'contrarian indicator' is just a polite term for the wealthy buying what everyone else is desperately selling, often after they've helped create the panic in the first place. The game isn't about being right; it's about being right at the exact moment it becomes profitable.

The bottom line? Market-wide fear often masks targeted greed. While the crowd fixates on short-term charts, the big players are building long-term positions, betting that XRP's unique journey is approaching a destination that justifies the volatility. Their quiet confidence is the loudest signal in the room.

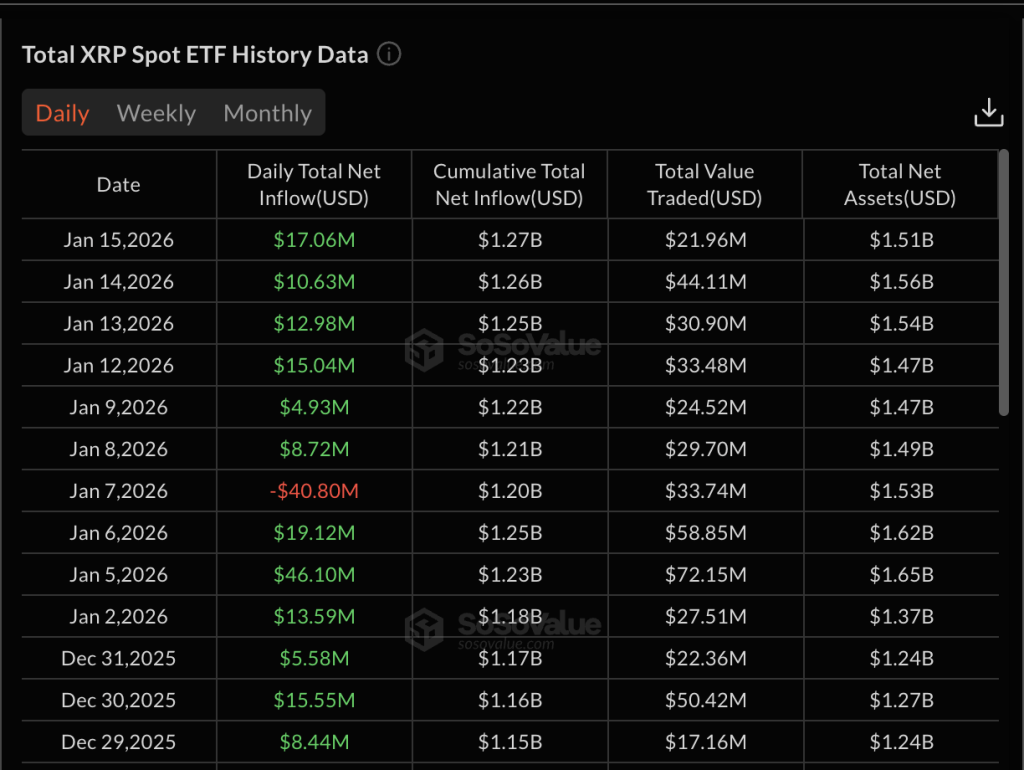

As a result, the total assets held by these funds have skyrocketed to $1.51 billion in just two months, surpassing Solana’s ETF assets by more than $300 million.

In the past 7 days, XRP has booked a 2% drop, although its year-to-date gains currently sit at 12% due to a spike in the price during the first few days of the year.

This streak of positive net inflows indicates that both institutional and retail investors are steadily increasing their holdings, creating a strong floor for the token in case this pullback accelerates.

XRP Price Prediction: Move to $3 Likely If XRP Breaks Out of Descending Triangle Again

The 4-hour chart shows that XRP has formed a descending triangle once again. The last time this happened, the token broke out of this setup and delivered strong gains in the NEAR term.

Now that its bearish structure has been invalidated on higher time frames, another breakout could result in a much more explosive MOVE that pushes XRP back to $3 at least.

The price has now crossed above the 200-period EMA in this lower time frame, favoring a bullish outlook. If the Relative Strength Index (RSI) rises past the mid-line and makes a bullish crossover above the 14-day moving average, that WOULD confirm a buy signal for this altcoin.

As altcoins seem ready to make a loud comeback, top crypto presales like bitcoin Hyper ($HYPER) could benefit from a market-wide recovery. This project leverages Solana’s speed and low transaction costs to kickstart a new era for Bitcoin’s DeFi ecosystem.

Bitcoin Hyper ($HYPER) Will Transform BTC’s DeFi Via Solana’s High Speed and Low Fees

Bitcoin Hyper ($HYPER) is a fast-moving presale that connects Solana’s high-speed blockchain with the Bitcoin network, giving investors a brand-new way to earn passive income on BTC.

With the, users can stake, lend, and earn yield on their Bitcoin while enjoying low fees and faster transactions that help maximize gains instead of losing them to costs.

In just a few months, the project has raised over $30 million. Its ambitious roadmap is what has investors all excited, as developers will now be able to launch highly efficient Bitcoin-native applications that BTC holders will love.

As top wallets and exchanges increasingly adopt the Hyper L2, demand for its native token, $HYPER, will likely explode.

Early buyers who take advantage of the token’s presale price right now will get to reap the highest returns.

To buy $HYPER, simply head to the official Bitcoin Hyper website and connect your favorite wallet (e.g. Best Wallet).

You can either swap USDT or ETH for this token or use a bank card instead.

Visit the Official Bitcoin Hyper Website Here