Ethereum Price Prediction: Nearly 30% of ETH Just Vanished From Circulation – Is $10,000 Just Weeks Away?

Supply shock incoming. A staggering chunk of Ethereum's circulating supply—nearly 30%—just went poof. Vanished. Taken out of the game. That's not a typo; it's a fundamental shift that's sending shockwaves through crypto markets and has analysts scrambling to update their models.

The Great ETH Burn

Forget gradual sell pressure. This is a sudden, massive reduction in available ETH. The mechanics are complex, but the effect is brutally simple: fewer coins chasing the same—or growing—demand. It's Econ 101, but with blockchain-grade volatility. This isn't just about daily transaction burns anymore; this is a structural deletion that redefines the asset's scarcity profile overnight.

Price Targets Get a Reality Check

Suddenly, those conservative price forecasts look… quaint. With nearly a third of the liquid supply erased, the math on Ethereum's valuation does a hard pivot. The $10,000 mark—once a distant moon-shot for many—now sits squarely in the crosshairs as a near-term technical possibility. It's not guaranteed, but the probability curve just bent sharply upward. Traders are watching the order books thin out in real-time, anticipating a squeeze that could make previous rallies look like warm-up acts.

A New Scarcity Playbook

This moves Ethereum into uncharted territory, a realm previously reserved for assets with hard-capped supplies. The 'ultra-sound money' narrative gets a jetpack. Network activity continues, fees get burned, but the base layer of tradable tokens is now permanently smaller. It forces a rethink of everything from DeFi collateral ratios to institutional allocation models. The game changed while most were watching the price ticker.

The Verdict: Speculation Meets Scarcity

Buckle up. The collision of rampant speculation and genuine, engineered scarcity creates a potent mix. Will it lead to a parabolic move toward five figures in weeks? The charts are hinting 'yes.' Could it also lead to epic volatility and a reality check from traditional finance skeptics? Absolutely—get ready for the usual chorus of 'tulip' comparisons from bankers who still think a ledger should be made of paper. One thing's clear: the Ethereum you thought you knew just got a lot rarer.

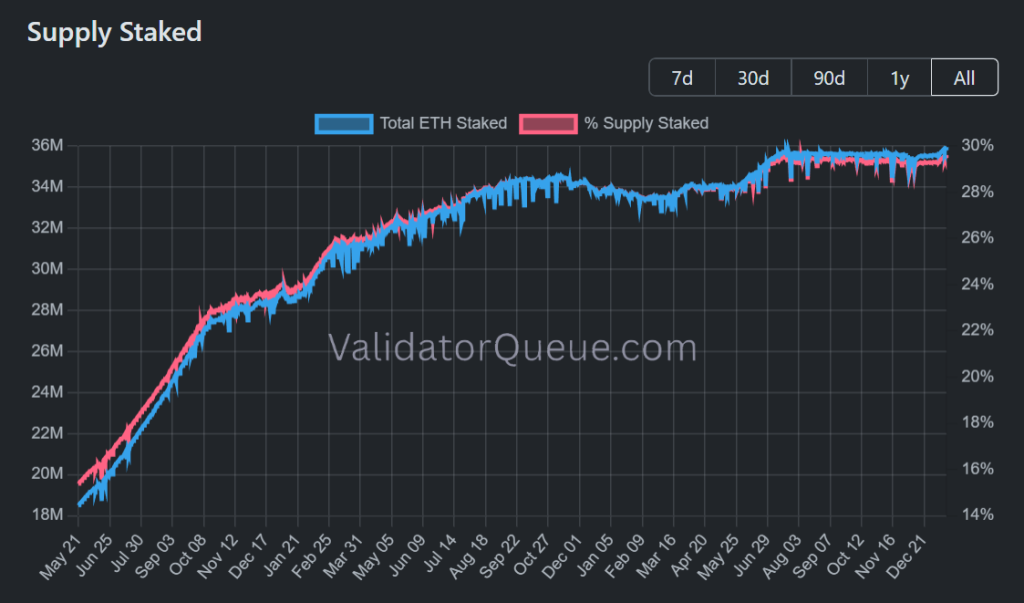

Ethereum tokens staked (ETH) and percentage of circulating supply staked (%). Source: ValidatorQueue.

Ethereum tokens staked (ETH) and percentage of circulating supply staked (%). Source: ValidatorQueue.

This marks a fundamental shift in investor behavior, favoring long-term positioning and yield generation through staking over short-term speculative trading.

Much of this appears recent, with validator entry queue wait time increasing significantly with a mass onboarding of stakers this month.

At the same time, the validator exit queue wait time has hit historic lows with a limited backlog. Already staked ETH is in no rush to become liquid.

This is in large part due to greater institutional participation, as TradFi players seek regulated exposure to staking yields through ETFs and treasury vehicles like BitMine.

As a larger share of supply becomes illiquid, staking can tighten sell-side availability during demand spikes, reinforcing bullish momentum.

That effect could accelerate further with exposure from mainstream traditional asset managers like Morgan Stanley, moving to launch its own spot ethereum staking ETFs.

Ethereum Price Prediction: $10,000 Now in Focus?

Eased liquidity and anchor demand could finally give the ethereum price the traction it needs to realise a two-and-a-half-year ascending channel.

The past year of it has formed a bullish head-and-shoulders pattern that sets up its breakout, and a local bottom at $2,750 confirms its final push – the setup that stakers may be positioning on.

Momentum indicators add validity to the trend. The RSI is compressing against the 50 neutral line after several higher lows, suggesting strength beneath the surface.

The MACD has also reversed towards the signal line in a potential golden cross setup, a sign that buyers may soon control the prevailing trend.

A fully realized right shoulder targets the key breakoutthreshold of the channel, past all-time highs around $4,950. This WOULD kickstart a potentialpush to.

But much like the pattern, its breakout will likely unfold over years.

For 2026, ato themilestone could be within reach as deeper regulatory clarity through bills like the Clarity Act reinforces mainstream adoption of Ethereum infrastructure and investment products like staking ETFs.

Bitcoin Hyper: New Presale Brings Solana Technology to Bitcoin’s Blockchain

While the broader market trend is capital rotation into altcoins, bitcoin shouldn’t be sidelined just yet, as its ecosystem finally tackles its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security with Solana tech, creating a new Layer-2 network that unlocks scalable, efficient use cases Bitcoin couldn’t support on its own.

Just like the Ondo Layer-2 did for Ethereum, Bitcoin Hyper could bring Bitcoin deeper into mainstream narratives like DeFi and RWAs.

The project has already raised over $30 million in presale, and post-launch, even a small fraction of Bitcoin’s massive trading volume could send its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have long capped Bitcoin’s potential – just as the market turns bullish.

Visit the Official Bitcoin Hyper Website Here